The Federal Reserve and Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels

Associated Articles

- Unlocking The Energy Of Auto Mortgage Calculators: How To Evaluate Lenders And Get The Finest Deal

- Cracking The Code: How To Qualify For 0% APR Auto Loans In 2024

- Auto Mortgage Vs. Private Mortgage: Which Is Finest For Automotive Financing?

- Denied Auto Mortgage? Do not Panic! This is What To Do Subsequent

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

Introduction

On this article, we dive into The Federal Reserve and Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels, supplying you with a full overview of what’s to return

Video about

The Federal Reserve and Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels

Shopping for a automotive is an enormous choice, each financially and emotionally. From selecting the right mannequin to navigating the often-intimidating financing course of, there’s quite a bit to think about. One essential issue that may make or break your automotive shopping for expertise is the rate of interest in your auto mortgage. And guess what? The Federal Reserve, that seemingly distant entity accountable for managing the nation’s cash provide, performs a major position in shaping these charges.

This text delves into the advanced relationship between the Federal Reserve and auto mortgage rates of interest, explaining how their actions straight impression your month-to-month funds and general mortgage value. We’ll break down the important thing ideas, discover the historic tendencies, and supply sensible tricks to navigate this intricate panorama.

The Federal Reserve: The Maestro of Curiosity Charges

The Federal Reserve, also known as the Fed, acts because the central financial institution of the US. It is a highly effective establishment with a variety of duties, together with controlling the cash provide, setting rates of interest, and overseeing the banking system. One of many Fed’s main instruments for managing the economic system is the federal funds fee. This fee represents the curiosity that banks cost one another for in a single day loans.

How the Fed’s Actions Ripple By the Auto Mortgage Market

The Fed’s actions on the federal funds fee have a ripple impact that reaches far past the banking sector. When the Fed raises the federal funds fee, it turns into dearer for banks to borrow cash. This enhance in borrowing prices naturally results in greater rates of interest on numerous loans, together with auto loans. Conversely, when the Fed lowers the federal funds fee, banks can borrow cash extra cheaply, resulting in decrease rates of interest on loans.

The Mechanics of Curiosity Fee Transmission

Understanding how the Fed’s actions translate into modifications in auto mortgage rates of interest requires delving into the advanced mechanisms of economic markets. This is a simplified rationalization:

- The Fed’s Sign: The Fed’s choices on the federal funds fee ship a transparent sign to the monetary markets in regards to the course of financial coverage.

- Affect on Financial institution Lending: When the Fed raises charges, banks grow to be extra cautious about lending, as they anticipate greater borrowing prices sooner or later. This results in a tightening of credit score circumstances, making it tougher for debtors to acquire loans.

- Auto Mortgage Charges Observe Go well with: As banks grow to be extra selective of their lending practices, additionally they alter their rates of interest on auto loans. Greater borrowing prices for banks translate into greater rates of interest for customers.

Historic Developments: How the Fed’s Actions Have Formed Auto Mortgage Charges

Through the years, the Fed’s financial coverage has considerably impacted auto mortgage rates of interest. Listed here are some key historic examples:

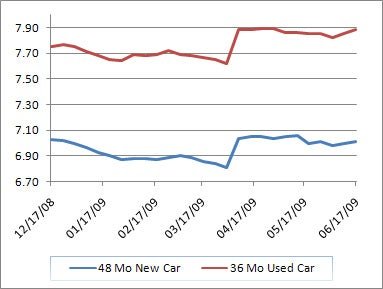

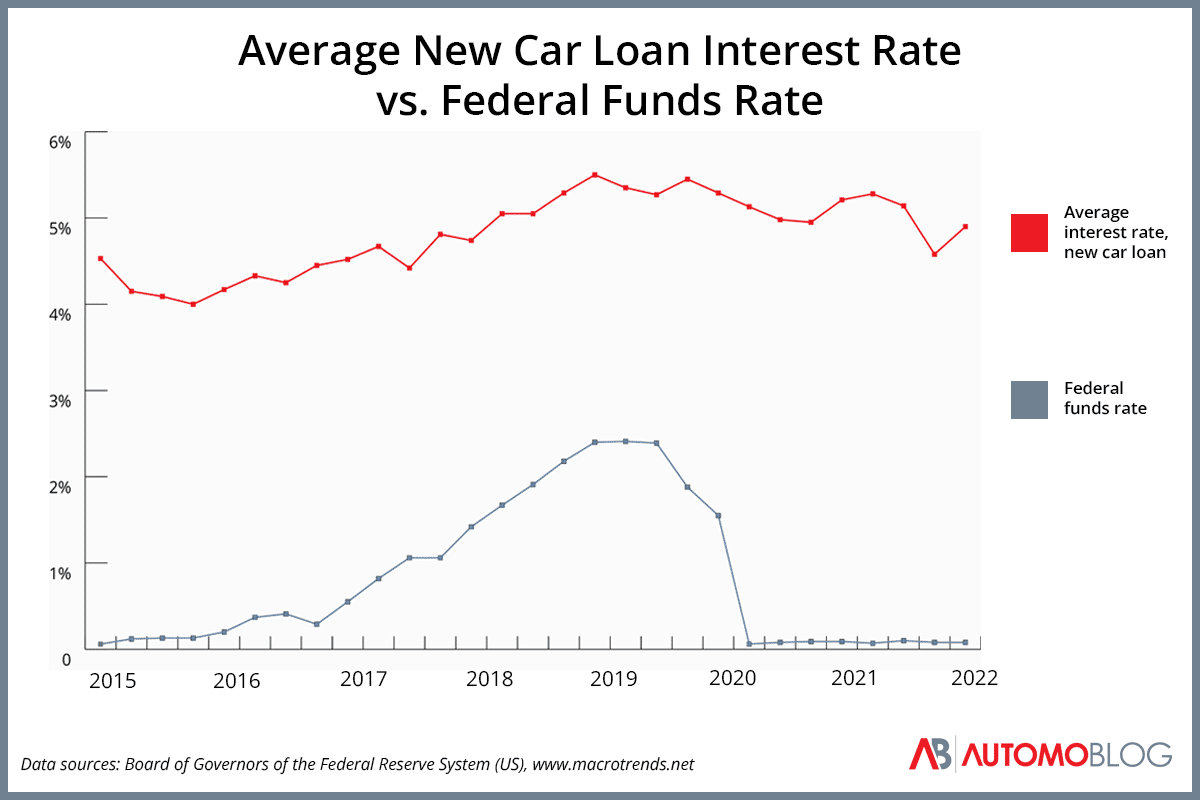

- The Nice Recession (2008-2009): Throughout this era, the Fed aggressively lowered rates of interest to stimulate the economic system. This resulted in record-low auto mortgage rates of interest, making automotive financing extra reasonably priced and boosting automotive gross sales.

- The Publish-Recession Restoration: Because the economic system recovered, the Fed step by step raised rates of interest, resulting in a gradual enhance in auto mortgage charges. This made automotive financing dearer, nevertheless it additionally helped management inflation and forestall a possible financial bubble.

- The COVID-19 Pandemic (2020-Current): The pandemic led to a pointy financial downturn, prompting the Fed to chop rates of interest to close zero. This once more resulted in extraordinarily low auto mortgage charges, making automotive purchases extra accessible. Nonetheless, because the economic system recovers, the Fed is predicted to step by step elevate rates of interest, which might result in greater auto mortgage charges sooner or later.

The Affect on Customers: How Rising Charges Have an effect on Your Pockets

Rising rates of interest on auto loans can have a major impression in your funds. This is how:

- Greater Month-to-month Funds: A better rate of interest means you may pay extra every month to your automotive mortgage. This will pressure your price range, particularly in case you’re already struggling to handle different bills.

- Elevated Whole Mortgage Value: Over the lifetime of your mortgage, a better rate of interest will end in considerably greater whole curiosity funds, which means you may find yourself paying extra to your automotive than you initially anticipated.

- Decreased Affordability: Greater rates of interest could make automotive possession much less reasonably priced for some people and households, notably these with restricted earnings or poor credit score scores.

Navigating the Altering Panorama: Ideas for Savvy Debtors

When you cannot management the Fed’s actions, you may take steps to mitigate the impression of rising rates of interest in your auto mortgage:

- Store Round for the Greatest Charges: Do not accept the primary mortgage give you obtain. Examine charges from a number of lenders, together with banks, credit score unions, and on-line lenders.

- Enhance Your Credit score Rating: A better credit score rating will qualify you for decrease rates of interest. Work on bettering your credit score by paying your payments on time, holding your credit score utilization low, and avoiding pointless credit score functions.

- Contemplate a Shorter Mortgage Time period: A shorter mortgage time period means you may repay your mortgage sooner and accumulate much less curiosity. Nonetheless, this will even end in greater month-to-month funds.

- Negotiate the Curiosity Fee: Do not be afraid to barter the rate of interest with the lender. Be ready to buy round and be keen to stroll away in case you’re not happy with the provide.

- Discover Pre-Approval: Getting pre-approved for a mortgage earlier than you begin purchasing for a automotive may give you a greater thought of your financing choices and enable you negotiate a greater deal.

The Way forward for Auto Mortgage Curiosity Charges: What to Count on

Predicting the way forward for rates of interest is a fancy process, however a number of components recommend that charges might rise within the coming years:

- Inflation: The present excessive inflation fee is prompting the Fed to boost rates of interest to chill down the economic system. This can doubtless result in greater auto mortgage rates of interest.

- Financial Progress: Because the economic system recovers from the pandemic, the Fed may have to boost rates of interest to stop overheating. This might additionally push auto mortgage charges greater.

- Provide Chain Points: Ongoing provide chain disruptions are contributing to greater automotive costs, which might result in elevated demand for financing and doubtlessly greater rates of interest.

Conclusion: The Fed’s Affect on Your Wheels

The Federal Reserve’s actions on rates of interest have a profound impression on the auto mortgage market, straight affecting the price of financing your subsequent automotive. By understanding how the Fed’s choices translate into modifications in auto mortgage charges, you can also make knowledgeable choices about financing your automobile and shield your monetary well-being. Staying knowledgeable in regards to the financial panorama and taking proactive steps to safe the absolute best financing phrases might help you navigate the ever-changing world of auto mortgage rates of interest.

Key phrases:

- Federal Reserve

- Auto Mortgage Curiosity Charges

- Federal Funds Fee

- Financial Coverage

- Curiosity Fee Transmission

- Inflation

- Financial Progress

- Provide Chain Points

- Credit score Rating

- Mortgage Time period

- Pre-Approval

- Automotive Financing

- Automotive Loans

- Auto Loans

- Curiosity Charges

- Mortgage Charges

- Monetary Markets

- Banking System

- Central Financial institution

- Cash Provide

- Financial Circumstances

- Credit score Utilization

- Mortgage Value

- Month-to-month Funds

- Affordability

- Negotiation

- Buying Round

- Monetary Properly-being

- Financial Panorama

- Financial Outlook

- Monetary Choices

- Client Finance

- Client Spending

- Automotive Trade

- Automotive Market

- Automotive Gross sales

- Automotive Costs

- Automobile Financing

- Mortgage Choices

- Lending Practices

- Debtors

- Lenders

- Banks

- Credit score Unions

- On-line Lenders

- Monetary Establishments

- Client Safety

- Monetary Literacy

- Monetary Training

- Financial Training

- Monetary Accountability

- Monetary Planning

- Monetary Administration

- Budgeting

- Debt Administration

- Private Finance

- Cash Administration

- Monetary Safety

- Monetary Stability

- Monetary Independence

Closure

We hope this text has helped you perceive the whole lot about The Federal Reserve and Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels. Keep tuned for extra updates!

Ensure that to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about The Federal Reserve and Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels—go away your feedback under!

Hold visiting our web site for the newest tendencies and opinions.