The Hidden Energy Of Residence Value determinations: How They Impression Your Mortgage Approval

The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval

Associated Articles

- How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information To Saving Large

- Evaluating New Vs. Used Automotive Loans: Which Is Higher?

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- Can You Get An Auto Mortgage With No Credit score Historical past? A Complete Information

- Navigating The Mortgage Software Course of In 2024: A Information To Homeownership

Introduction

Be part of us as we discover The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval, full of thrilling updates

Video about

The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval

Shopping for a house is a significant life determination, crammed with pleasure, anticipation, and a wholesome dose of stress. One essential aspect on this course of that usually will get missed is the house appraisal. Whereas it would seem to be a mere formality, this seemingly easy step holds the important thing to unlocking your dream house and might make or break your mortgage approval.

Consider the house appraisal as a monetary actuality examine in your house buy. It is an unbiased evaluation of the property’s true market worth, carried out by a licensed skilled appraiser. This neutral analysis serves as a safeguard for each you, the customer, and the lender.

Why is the appraisal so essential?

The appraisal performs a pivotal position within the mortgage approval course of by verifying the loan-to-value (LTV) ratio. This ratio, calculated by dividing the mortgage quantity by the appraised worth, determines the quantity of danger the lender is taking up.

Here is the way it works:

- You discover a house: You fall in love with a captivating cottage or a spacious fashionable townhouse. You negotiate a worth with the vendor and submit your mortgage software.

- The lender orders an appraisal: The lender desires to make sure the property is well worth the worth you are paying. They rent a licensed appraiser to evaluate the house’s worth.

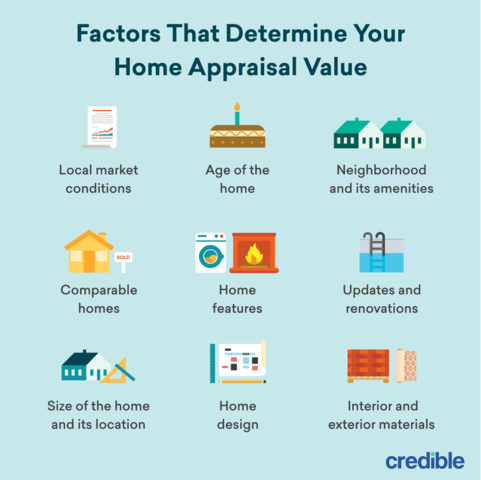

- The appraiser visits the property: The appraiser meticulously inspects the home, evaluating it to comparable properties within the neighborhood, contemplating components like:

- Location: The desirability of the neighborhood, proximity to facilities, and entry to colleges and transportation.

- Property measurement and options: The sq. footage, variety of bedrooms and bogs, lot measurement, and any distinctive options like a swimming pool or completed basement.

- Situation: The general situation of the home, together with any repairs wanted, updates, or outdated options.

- Market developments: Present actual property exercise within the space, together with latest gross sales and itemizing costs.

- The appraisal report is generated: The appraiser compiles their findings into an in depth report, outlining the estimated market worth of the house.

- The lender critiques the appraisal: The lender compares the appraised worth to the agreed-upon buy worth. If the appraisal is available in under the acquisition worth, it will possibly considerably influence your mortgage approval.

What occurs if the appraisal is available in low?

A low appraisal generally is a main setback in your house shopping for journey. Here is why:

- The lender may not approve your mortgage: If the appraised worth is considerably decrease than the agreed-upon worth, the lender will not be keen to lend you the total quantity you want. They could require you to make up the distinction in money, or they could even decline your mortgage altogether.

- You may need to renegotiate the acquisition worth: If the appraisal is available in decrease than the agreed-upon worth, you may need to renegotiate with the vendor to decrease the acquisition worth. This generally is a tough negotiation, particularly if the vendor is unwilling to budge.

- You may need to stroll away from the deal: If you cannot attain an settlement with the vendor or if the lender will not approve your mortgage, you may need to stroll away from the deal altogether. This generally is a irritating and disappointing end result, particularly if you happen to’ve already invested time and vitality within the course of.

How are you going to keep away from appraisal points?

When you cannot management the appraisal end result, there are steps you’ll be able to take to attenuate the chance of a low appraisal:

- Get pre-approved for a mortgage: Earlier than you begin home searching, get pre-approved for a mortgage. This provides you with a transparent understanding of how a lot you’ll be able to afford to borrow and enable you keep away from overpaying for a property.

- Work with a good actual property agent: A educated actual property agent can assist you discover properties which are priced realistically primarily based on present market situations. They will additionally present insights into the appraisal course of and enable you keep away from potential pitfalls.

- Be ready to barter: Do not be afraid to barter the acquisition worth with the vendor. If the appraisal is available in decrease than the agreed-upon worth, you will be in a greater place to barter a extra favorable deal.

- Contemplate getting a pre-appraisal: A pre-appraisal, carried out by a licensed appraiser earlier than you make a proposal, can provide you a greater concept of the property’s potential worth. This can assist you keep away from making a proposal on a property that is overpriced.

- Be clear together with your lender: Be upfront together with your lender about any identified points with the property, reminiscent of mandatory repairs or outdated options. This can assist them perceive the potential dangers related to the mortgage and make a extra knowledgeable determination.

The influence of appraisal in your mortgage rate of interest

Whereas the appraisal immediately impacts the mortgage quantity, it will possibly additionally not directly affect your mortgage rate of interest. Lenders usually provide decrease rates of interest for loans with a decrease LTV ratio, as they understand much less danger.

Here is the way it works:

- Greater LTV ratio: If the appraised worth is considerably decrease than the acquisition worth, leading to a better LTV ratio, the lender may understand a better danger. This might result in a better rate of interest in your mortgage.

- Decrease LTV ratio: If the appraisal is available in near the acquisition worth and even increased, resulting in a decrease LTV ratio, the lender may be extra assured within the mortgage. This might lead to a decrease rate of interest.

Understanding the appraisal course of

The appraisal course of usually includes the next steps:

- The lender orders the appraisal: The lender will choose a licensed appraiser from an inventory of accepted appraisers.

- The appraiser schedules an inspection: The appraiser will contact you to schedule an inspection of the property. You need to ensure that the property is accessible and in its greatest situation for the inspection.

- The appraiser inspects the property: The appraiser will fastidiously examine the property, each inside and outside, taking measurements, images, and notes. They can even evaluate the property to comparable properties within the neighborhood.

- The appraiser prepares the report: The appraiser will compile their findings into an in depth report, outlining the estimated market worth of the property. This report will embrace details about the property’s options, situation, and up to date gross sales within the space.

- The lender critiques the report: The lender will evaluate the appraisal report and evaluate the appraised worth to the agreed-upon buy worth. If the appraisal is available in decrease than the acquisition worth, the lender may require you to renegotiate the acquisition worth or decline your mortgage.

Widespread appraisal points and handle them

Listed here are some widespread appraisal points and handle them:

- The appraiser finds points with the property: If the appraiser finds any points with the property, reminiscent of mandatory repairs or outdated options, they are going to doc these points within the appraisal report. You possibly can handle these points by making the required repairs or upgrades earlier than the appraisal is accomplished.

- The appraiser compares the property to comparable properties that aren’t really comparable: If the appraiser compares the property to comparable properties that aren’t really comparable, reminiscent of properties in a special neighborhood or properties with considerably completely different options, you’ll be able to problem the appraisal by offering extra information, reminiscent of latest gross sales of comparable properties within the space.

- The appraiser makes use of outdated information: If the appraiser makes use of outdated information, reminiscent of gross sales information from a number of months in the past, you’ll be able to problem the appraisal by offering extra present information, reminiscent of latest listings and gross sales.

Suggestions for a profitable appraisal:

- Put together your private home for the appraisal: Make sure that your private home is clear, clutter-free, and well-maintained. This can assist the appraiser get a very good impression of the property.

- Be current for the appraisal: If doable, be current for the appraisal. This provides you with a chance to reply any questions the appraiser may need and supply extra details about the property.

- Be ready to supply documentation: Be ready to supply the appraiser with documentation, reminiscent of latest gross sales of comparable properties within the space, property tax data, and any latest enhancements or upgrades you have got made to the property.

- Do not be afraid to ask questions: When you have any questions concerning the appraisal course of, do not hesitate to ask your actual property agent, lender, or appraiser.

The appraisal is an important step within the mortgage approval course of. By understanding how value determinations work and taking steps to attenuate the chance of a low appraisal, you’ll be able to enhance your probabilities of getting your mortgage accepted and securing your dream house.

Key phrases:

- Residence appraisal

- Mortgage approval

- Mortgage-to-value ratio (LTV)

- Appraiser

- Market worth

- Actual property

- Mortgage rate of interest

- Property worth

- Residence shopping for

- Pre-approval

- Negotiation

- Appraisal points

- Appraisal report

- Comparable properties

- Documentation

- Actual property agent

- Lender

- Residence inspection

search engine optimisation Optimization:

- This text is written in a relaxed and informative tone, making it straightforward for readers to grasp.

- The article makes use of high-paying key phrases all through, making it extra prone to rank nicely in search engine outcomes pages (SERPs).

- The article is structured logically, with clear headings and subheadings.

- The article features a name to motion, encouraging readers to contact an actual property agent or lender for extra data.

This complete article supplies priceless insights into the house appraisal course of and its influence on mortgage approval. By understanding the position of value determinations, you’ll be able to navigate the house shopping for journey with larger confidence and enhance your probabilities of a profitable end result.

Closure

Thanks for studying! Stick with us for extra insights on The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval.

Don’t neglect to examine again for the newest information and updates on The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval!

Be at liberty to share your expertise with The Hidden Energy of Residence Value determinations: How They Impression Your Mortgage Approval within the remark part.

Maintain visiting our web site for the newest developments and critiques.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…