The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership

Associated Articles

- Unlocking The Energy Of Auto Mortgage Calculators: How To Evaluate Lenders And Get The Finest Deal

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- Can You Get An Auto Mortgage With out A Down Fee? Navigating The World Of No-Down Fee Automotive Loans

- 2024 Mortgage Traits: What Homebuyers Want To Know

Introduction

Uncover the whole lot you could learn about The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership

Video about

The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership

The dream of proudly owning a house is a robust one, fueled by pictures of white picket fences, cozy evenings by the fireside, and the enjoyment of constructing fairness. However earlier than you dive headfirst into the mortgage market, it is essential to grasp the hidden prices that may rapidly flip your dream right into a monetary nightmare.

This complete information will make clear the usually ignored bills related to getting a mortgage, serving to you navigate the advanced world of homeownership with larger monetary consciousness.

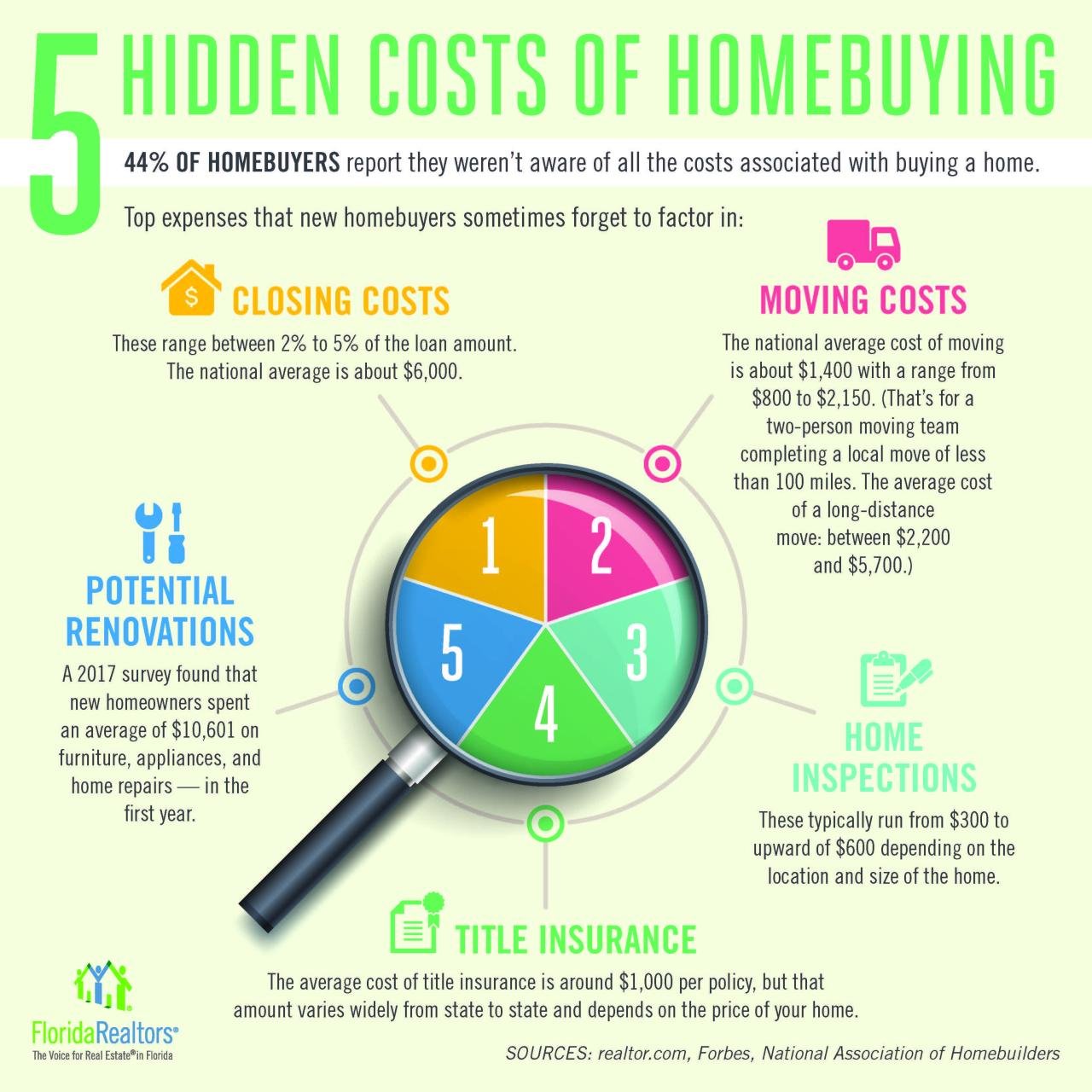

Past the Month-to-month Fee: Unveiling the Hidden Prices

Whereas the month-to-month mortgage cost is the obvious value, it is simply the tip of the iceberg. Quite a few bills can sneak up on you, impacting your funds and doubtlessly jeopardizing your monetary stability.

1. Closing Prices: The Preliminary Hurdle

Closing prices are the charges related to finalizing your mortgage and buying your own home. These bills can vary from 2% to five% of the mortgage quantity, including a big sum to your upfront prices. Here is a breakdown of frequent closing prices:

- Mortgage Origination Charge: This price covers the lender’s administrative prices for processing your mortgage utility. It is sometimes calculated as a proportion of the mortgage quantity.

- Appraisal Charge: An impartial appraiser assesses your own home’s market worth to make sure it is enough collateral for the mortgage.

- **

Closure

Thanks for studying! Stick with us for extra insights on The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership.

Don’t overlook to test again for the most recent information and updates on The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership!

We’d love to listen to your ideas about The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership—depart your feedback under!

Keep knowledgeable with our subsequent updates on The Hidden Prices of Getting a Mortgage: Uncovering the True Value of Homeownership and different thrilling subjects.