The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama

Associated Articles

- Unlocking Your Financial Potential: How To Get A Personal Loan With No Credit History

- Unlock Your Financial Potential: The Best Personal Loans For Excellent Credit Scores

- Navigating The Mortgage Panorama: A Complete Information To Evaluating Private Mortgage Gives

- What To Know About Secured Vs. Unsecured Personal Loans

- Demystifying Personal Loans: Understanding APRs And Fees

Introduction

Uncover all the things it is advisable find out about The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama

Video about

The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama

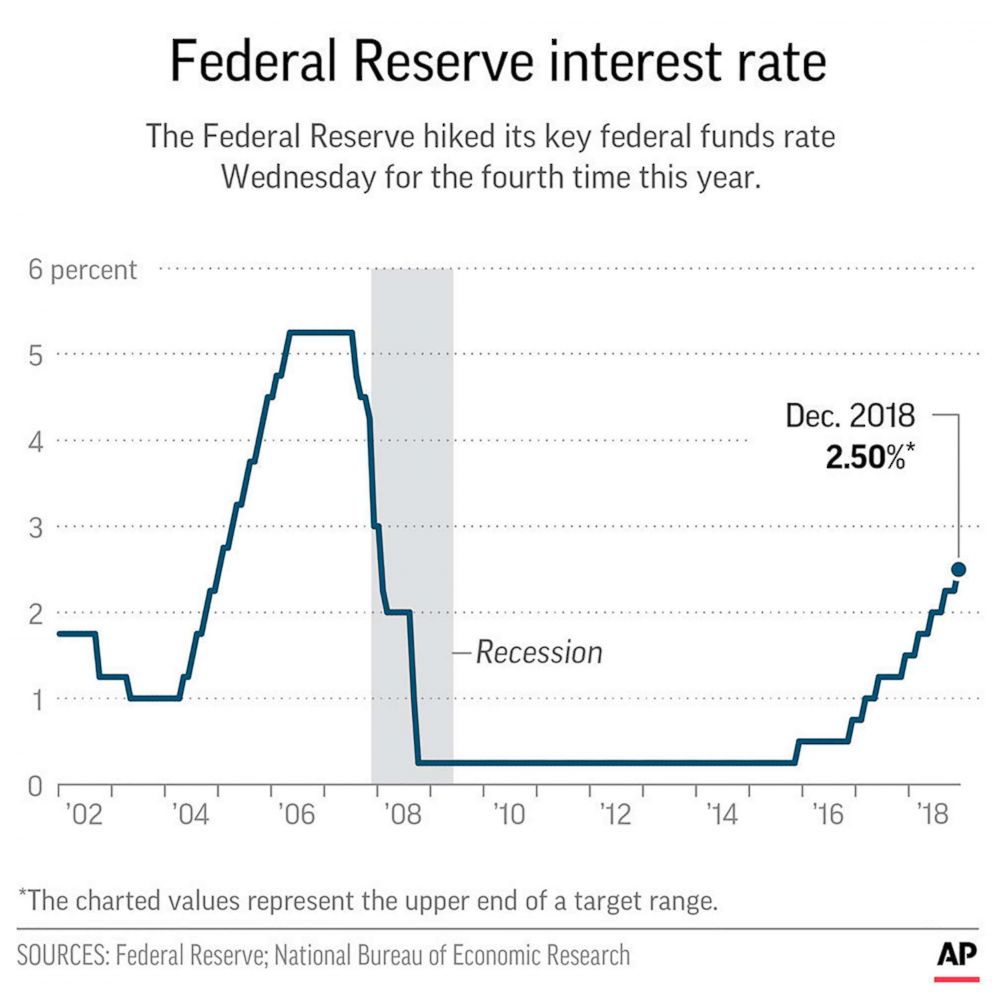

The Federal Reserve, sometimes called the Fed, performs a vital function in shaping the US financial system. One in every of its main instruments is adjusting rates of interest, a transfer that ripples by means of numerous monetary markets, together with the non-public mortgage panorama. Because the Fed raises rates of interest, the price of borrowing cash will increase, influencing the phrases and availability of private loans. This text delves into the complicated relationship between Federal Reserve price hikes and private loans, exploring their influence on debtors, lenders, and the general monetary panorama.

Understanding the Fed’s Function and Fee Hikes

The Federal Reserve acts because the central financial institution of the US, tasked with sustaining a steady and wholesome financial system. One in every of its key obligations is controlling inflation, which is the speed at which costs for items and providers improve over time. When inflation rises too rapidly, it erodes the buying energy of customers and might result in financial instability. To fight inflation, the Fed raises rates of interest, making it dearer for companies and people to borrow cash. This, in flip, slows down financial exercise and helps to curb inflation.

How Fee Hikes Have an effect on Private Loans

The influence of Federal Reserve price hikes on private loans is multifaceted, affecting each debtors and lenders:

1. Greater Curiosity Charges: Essentially the most direct influence of Fed price hikes is a rise in rates of interest for private loans. Because the Fed’s benchmark rate of interest rises, lenders alter their very own charges accordingly. This implies debtors will face larger month-to-month funds and total larger prices for his or her loans.

2. Tightened Lending Requirements: In a rising rate of interest atmosphere, lenders grow to be extra cautious about extending credit score. They might tighten their lending requirements, requiring debtors to have higher credit score scores, larger earnings ranges, and decrease debt-to-income ratios. This could make it harder for some debtors to qualify for private loans or to acquire favorable phrases.

3. Decreased Mortgage Availability: In excessive instances of rising rates of interest, lenders might scale back the general availability of private loans. It is because they might be much less prepared to tackle the danger of lending cash at larger charges, particularly in the event that they anticipate a slowdown within the financial system.

4. Influence on Borrower Affordability: Greater rates of interest make it dearer to borrow cash, impacting a borrower’s potential to afford their mortgage funds. This could result in monetary stress and even delinquency, significantly for debtors with restricted earnings or excessive debt ranges.

5. Influence on Mortgage Merchandise: Lenders might introduce new mortgage merchandise or alter present ones to adapt to the altering rate of interest atmosphere. This might contain providing loans with shorter phrases, decrease mortgage quantities, or extra stringent eligibility necessities.

Navigating the Shifting Panorama: Methods for Debtors

Understanding the influence of Federal Reserve price hikes is essential for debtors searching for private loans. Listed below are some methods to navigate the shifting panorama:

1. Store Round: Examine rates of interest and phrases from a number of lenders earlier than making a choice. This can assist you discover probably the most aggressive supply and doubtlessly get monetary savings on curiosity funds.

2. Enhance Your Credit score Rating: A better credit score rating could make you a extra enticing borrower and qualify you for decrease rates of interest. Deal with paying your payments on time, holding credit score utilization low, and avoiding pointless credit score inquiries.

3. Contemplate Various Lending Choices: In the event you’re struggling to safe a private mortgage on account of tight lending requirements, discover various lending choices like peer-to-peer lending platforms or credit score unions. These establishments might have extra versatile lending standards.

4. Discover Debt Consolidation Choices: In case you have a number of high-interest money owed, think about consolidating them right into a single private mortgage with a decrease rate of interest. This can assist you get monetary savings on curiosity funds and simplify your debt administration.

5. Finances Properly: With larger rates of interest, it is extra vital than ever to handle your funds responsibly. Create a price range, monitor your bills, and prioritize paying down high-interest debt.

The Fed’s Influence on Lenders

Federal Reserve price hikes additionally influence lenders in numerous methods:

1. Elevated Funding Prices: Because the Fed raises charges, lenders face larger borrowing prices, making it dearer for them to fund loans. This could scale back their revenue margins and doubtlessly result in larger rates of interest for debtors.

2. Decreased Mortgage Demand: Greater rates of interest can discourage debtors from taking out loans, resulting in a lower in mortgage demand. This could influence lenders’ income and profitability.

3. Threat Administration Concerns: In a rising rate of interest atmosphere, lenders must be extra cautious about danger administration. They might tighten their lending requirements and give attention to debtors with sturdy credit score profiles.

4. Adapting to the Altering Market: Lenders should adapt to the altering market circumstances by adjusting their mortgage merchandise, rates of interest, and lending standards to stay aggressive and meet the wants of debtors.

The Larger Image: Implications for the Financial system

The Fed’s price hikes have wider implications for the general financial system, impacting numerous sectors and influencing client habits:

1. Financial Progress: Fee hikes can decelerate financial development by making it dearer for companies to take a position and increase. Nevertheless, they will additionally assist to manage inflation and forestall overheating of the financial system.

2. Shopper Spending: Greater rates of interest can discourage customers from making massive purchases like vehicles or houses, as they grow to be dearer to finance. This could influence retail gross sales and total financial exercise.

3. Housing Market: Fee hikes can decelerate the housing market by making mortgages dearer. This could result in decrease dwelling costs and lowered demand for brand spanking new houses.

4. Funding Choices: Fee hikes can influence funding choices, as buyers might shift their focus from riskier property to safer investments with decrease returns.

Conclusion: A Balancing Act

The Federal Reserve’s price hikes are a posh financial software with far-reaching penalties. Whereas they assist to manage inflation and preserve financial stability, additionally they have a big influence on private loans, affecting debtors, lenders, and the general monetary panorama. By understanding the connection between Fed price hikes and private loans, debtors could make knowledgeable choices about their borrowing wants and navigate the altering monetary atmosphere. Because the Fed continues to regulate rates of interest, it is important to remain knowledgeable and adapt your monetary methods accordingly.

Closure

We hope this text has helped you perceive all the things about The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama. Keep tuned for extra updates!

Ensure that to comply with us for extra thrilling information and opinions.

Be at liberty to share your expertise with The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama within the remark part.

Keep knowledgeable with our subsequent updates on The Influence of Federal Reserve Fee Hikes on Private Loans: Navigating the Shifting Panorama and different thrilling matters.