Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal

Associated Articles

- The Shifting Gears: How Rising Curiosity Charges Are Impacting Auto Mortgage Choices

- Complete Information to Auto Insurance coverage Quotes: Save Cash and Get the Finest Protection

- High 5 On-line Auto Mortgage Lenders To Take into account This Yr: Your Information To Inexpensive Financing

- Cracking The Code: How To Qualify For 0% APR Auto Loans In 2024

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

Introduction

Welcome to our in-depth have a look at Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal

Video about

Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal

Shopping for a automotive is a giant resolution, and financing it may be a frightening course of. Navigating the world of auto loans, rates of interest, and mortgage phrases can really feel overwhelming, particularly if you happen to’re a first-time purchaser. Nevertheless, with slightly information and preparation, you’ll be able to confidently safe the very best mortgage to your new journey. One of the crucial essential steps on this course of is getting pre-approved for an auto mortgage.

What’s Auto Mortgage Pre-Approval?

Auto mortgage pre-approval is a preliminary evaluation of your creditworthiness by a lender. It basically tells you ways a lot cash you are prone to be accepted for and at what rate of interest. Consider it as a "pre-qualification" for a mortgage, however with extra weight and dedication from the lender.

Why is Auto Mortgage Pre-Approval Essential?

Pre-approval provides a number of vital benefits for each you and the automotive dealership:

- Confidence in Your Price range: Understanding how a lot you’ll be able to borrow earlier than stepping foot in a dealership empowers you to give attention to vehicles inside your monetary attain. You may keep away from losing time and power on autos which are outdoors your funds.

- Stronger Negotiating Place: A pre-approval letter from a good lender provides you a robust instrument to barter with automotive dealerships. It demonstrates your monetary seriousness and talent to buy, making you a extra enticing purchaser.

- Sooner Approval Course of: As soon as you have discovered the proper automotive, the dealership already has a pre-approved mortgage in place, streamlining the financing course of. You may typically drive off the lot together with your new automotive in a matter of hours.

- Potential for Decrease Curiosity Charges: Some lenders supply pre-approved charges which are locked in for a selected interval. This can assist you safe a decrease rate of interest in comparison with making use of for a mortgage on the dealership.

- Avoids Final-Minute Surprises: Pre-approval lets you discover your mortgage choices and evaluate charges from completely different lenders earlier than making a closing resolution. This prevents surprises on the dealership, the place you may really feel pressured into accepting much less favorable phrases.

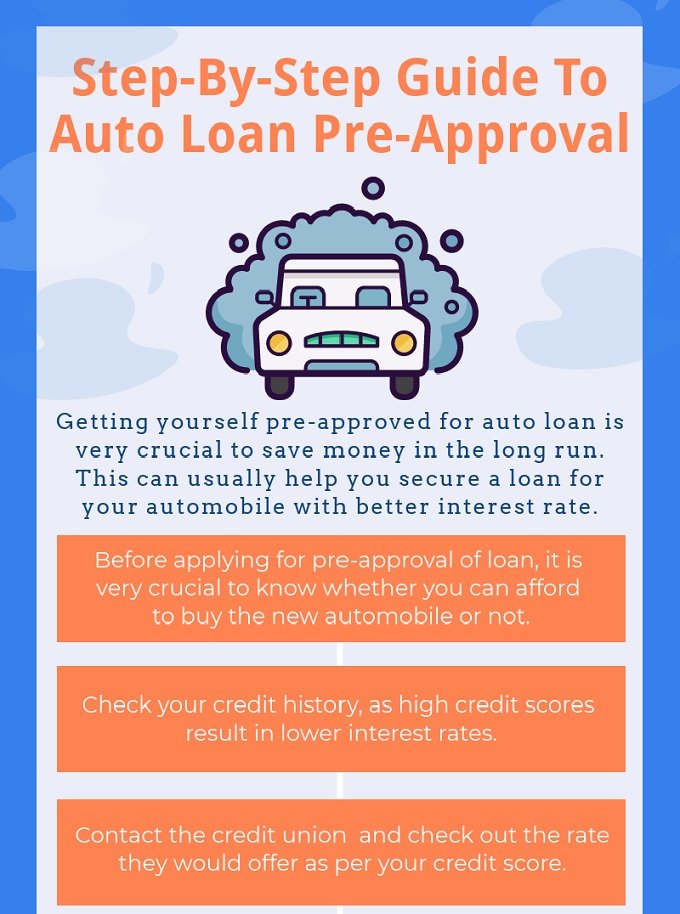

How one can Get Pre-Accepted for an Auto Mortgage:

The pre-approval course of is mostly easy and may be accomplished on-line, over the cellphone, or in individual at a lender’s department. Here is a step-by-step information:

1. Collect Your Monetary Data:

- Social Safety Quantity: That is important for verifying your id and accessing your credit score report.

- Earnings Data: Present particulars about your earnings sources, together with pay stubs, tax returns, or financial institution statements.

- Credit score Historical past: Lenders will assessment your credit score report back to assess your creditworthiness. You may entry your credit score report without cost from the three main credit score bureaus: Experian, Equifax, and TransUnion.

- Current Debt: Record any excellent loans, bank cards, or different monetary obligations.

- Down Cost Quantity: Decide how a lot you’ll be able to afford to place down upfront. A bigger down fee sometimes leads to a decrease mortgage quantity and decrease month-to-month funds.

2. Select a Lender:

- Banks and Credit score Unions: Conventional lenders typically supply aggressive charges and personalised service.

- On-line Lenders: These lenders typically have extra versatile necessities and may supply quicker approval occasions.

- Dealership Financing: Whereas dealerships could supply financing choices, their charges will not be all the time essentially the most aggressive.

3. Apply for Pre-Approval:

- On-line Purposes: Most lenders supply handy on-line utility portals.

- Cellphone Calls: You may contact lenders on to provoke the pre-approval course of over the cellphone.

- In-Particular person Visits: Some lenders favor to deal with pre-approval purposes in individual.

4. Assessment Your Pre-Approval Supply:

- Mortgage Quantity: Verify the utmost quantity you are pre-approved for.

- Curiosity Charge: Examine the rate of interest to different provides you have obtained.

- Mortgage Time period: Perceive the size of the mortgage and the way it impacts your month-to-month funds.

- Charges and Prices: Concentrate on any further charges related to the mortgage.

5. Negotiate with the Dealership:

- Use Your Pre-Approval Letter: Current the pre-approval letter to the dealership as a bargaining chip.

- Examine Gives: If the dealership provides financing, evaluate their charges and phrases to your pre-approval.

- Do not Be Afraid to Stroll Away: In case you’re not happy with the dealership’s supply, you’ll be able to all the time stroll away and discover different choices.

Suggestions for Getting the Finest Auto Mortgage Pre-Approval:

- Verify Your Credit score Rating: Earlier than making use of for pre-approval, verify your credit score rating to see the place you stand. The next credit score rating sometimes results in decrease rates of interest.

- Store Round: Examine pre-approval provides from a number of lenders to search out one of the best charges and phrases.

- Take into account a Co-Signer: In case your credit score rating is low, a co-signer with good credit score can assist you qualify for a mortgage.

- Do not Overextend Your self: Calculate your month-to-month funds and guarantee they match comfortably inside your funds.

- Learn the Wonderful Print: Rigorously assessment the mortgage phrases and situations earlier than signing any paperwork.

Frequent Auto Mortgage Phrases:

- Curiosity Charge: The annual share price (APR) charged in your mortgage.

- Mortgage Time period: The size of time you must repay the mortgage.

- Principal: The unique amount of cash borrowed.

- Month-to-month Cost: The mounted quantity you pay every month to repay the mortgage.

- Down Cost: The upfront fee you make in direction of the acquisition value of the automobile.

- Charges and Prices: Extra prices related to the mortgage, reminiscent of origination charges, processing charges, and shutting prices.

Understanding Credit score Scores and Their Influence on Auto Mortgage Charges:

Your credit score rating is a numerical illustration of your creditworthiness, primarily based in your credit score historical past. It performs an important position in figuring out the rate of interest you will obtain on an auto mortgage. Lenders use credit score scores to evaluate your danger of defaulting on a mortgage. The next credit score rating signifies a decrease danger and due to this fact qualifies you for decrease rates of interest.

Components that Affect Your Credit score Rating:

- Cost Historical past: That is essentially the most vital issue, accounting for 35% of your rating. Making funds on time and avoiding late funds is crucial.

- Quantities Owed: This issue represents 30% of your rating. It considers your credit score utilization ratio, which is the quantity of credit score you are utilizing in comparison with your accessible credit score.

- Size of Credit score Historical past: This issue accounts for 15% of your rating. An extended credit score historical past usually leads to a better rating.

- New Credit score: This issue represents 10% of your rating. Opening new credit score accounts can briefly decrease your rating.

- Credit score Combine: This issue accounts for 10% of your rating. Having a mixture of various kinds of credit score, reminiscent of bank cards, installment loans, and mortgages, can enhance your rating.

Suggestions for Bettering Your Credit score Rating:

- Pay Payments on Time: Make all funds on time to keep away from late charges and unfavourable marks in your credit score report.

- Hold Credit score Utilization Low: Attempt to preserve your credit score utilization ratio beneath 30%. This implies utilizing lower than 30% of your accessible credit score.

- Keep away from Opening Too Many New Accounts: Opening too many new accounts can negatively impression your credit score rating.

- Verify Your Credit score Report: Assessment your credit score report often for any errors or inaccuracies.

- Pay Down Debt: Deal with paying down high-interest debt, reminiscent of bank card balances.

Selecting the Proper Auto Mortgage:

As soon as you have been pre-approved for an auto mortgage, you could resolve which lender and mortgage phrases are best for you. Listed here are some elements to contemplate:

- Curiosity Charge: Purpose for the bottom rate of interest attainable. Store round and evaluate provides from completely different lenders.

- Mortgage Time period: A shorter mortgage time period usually leads to greater month-to-month funds however decrease general curiosity prices. An extended mortgage time period sometimes has decrease month-to-month funds however greater general curiosity prices.

- Charges and Prices: Concentrate on any further charges related to the mortgage, reminiscent of origination charges, processing charges, and shutting prices.

- Mortgage Sort: There are various kinds of auto loans accessible, reminiscent of standard loans, secured loans, and subprime loans. Select the mortgage kind that most closely fits your wants and monetary scenario.

- Lender Repute: Select a good lender with an excellent observe document. Learn on-line opinions and verify the lender’s ranking with the Higher Enterprise Bureau.

Conclusion:

Getting pre-approved for an auto mortgage is an important step within the automotive shopping for course of. It empowers you with monetary information, strengthens your negotiating place, and streamlines the financing course of. By understanding the pre-approval course of, your credit score rating, and the completely different mortgage phrases accessible, you’ll be able to confidently safe the very best auto mortgage to your wants. Keep in mind to buy round, evaluate provides, and select a lender and mortgage phrases that suit your monetary scenario. With cautious planning and preparation, you’ll be able to drive off the lot together with your new automotive, understanding you have made a sensible and knowledgeable monetary resolution.

Closure

Thanks for studying! Stick with us for extra insights on Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal.

Don’t overlook to verify again for the most recent information and updates on Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal!

Be at liberty to share your expertise with Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal within the remark part.

Keep knowledgeable with our subsequent updates on Understanding Auto Mortgage Pre-Approval: A Step-by-Step Information to Securing the Finest Deal and different thrilling matters.