Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage

Associated Articles

- The Final Information To Private Damage Legal responsibility Protection: Shield Your self And Your Future

- The Position of Insurance coverage in Defending Your Digital Advertising and marketing Enterprise

- Legal responsibility Insurance coverage For Contractors: Safeguarding Your Enterprise From The Sudden

- Understanding Errors And Omissions (E&O) Legal responsibility Insurance coverage: A Complete Information

- Do not Let A Mishap Destroy Your Huge Day: Occasion Legal responsibility Insurance coverage Defined

Introduction

Welcome to our in-depth take a look at Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage

Video about Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage

Navigating the Maze: Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage

On this planet of enterprise {and professional} life, legal responsibility insurance coverage is a crucial defend towards potential monetary destroy. However amidst the various choices out there, two main varieties of protection usually go away enterprise homeowners and professionals perplexed: claims-made and occurrence-based insurance policies. Understanding the nuances of every will be the distinction between peace of thoughts and a devastating monetary blow. This complete information will delve into the intricacies of those insurance policies, serving to you select the appropriate protection in your distinctive wants.

The Fundamentals: What’s Legal responsibility Insurance coverage?

Legal responsibility insurance coverage, a cornerstone of danger administration, protects people and companies from monetary repercussions stemming from claims of negligence, hurt, or wrongdoing. This protection primarily acts as a monetary security web, must you be held legally accountable for inflicting damage, property harm, or different losses to others.

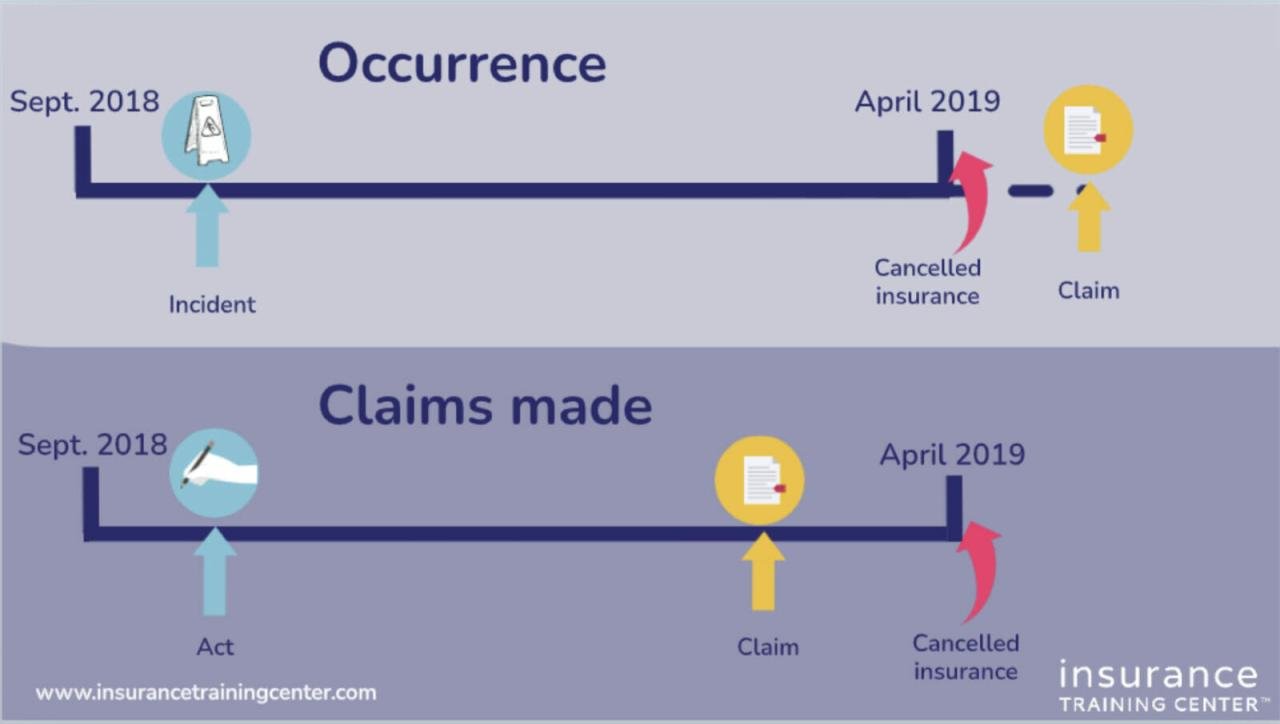

Claims-Made: Protection Tied to the Date of the Declare

Think about a situation the place a consumer sues you for malpractice in 2025, alleging an incident that occurred in 2023. With a claims-made coverage, the date your declare is filed, not the date of the incident, determines whether or not you are lined. This implies:

- Protection is triggered when a declare is made towards you.

- The coverage should be lively on the time the declare is filed. This contains each the coverage interval and any prolonged reporting interval, which lets you report claims after the coverage has expired.

Key Options of Claims-Made Insurance policies:

- Retroactive Date: A vital component of claims-made insurance policies is the "retroactive date," which defines the earliest date an incident can happen and nonetheless be lined. Claims arising from occasions earlier than this date are usually not lined.

- Tail Protection: When your claims-made coverage expires, a "tail" or "prolonged reporting interval" will be bought to supply continued protection for claims arising from incidents that occurred in the course of the coverage interval.

- No Protection for Previous Occasions: Claims-made insurance policies typically do not cowl incidents that occurred earlier than the coverage’s inception.

Prevalence-Primarily based: Protection Primarily based on the Date of the Incident

In distinction to claims-made insurance policies, occurrence-based insurance policies provide protection primarily based on the date the precise incident occurred. This implies:

- Protection is triggered when the occasion that led to the declare occurs.

- The coverage should be lively on the time of the incident.

Key Options of Prevalence-Primarily based Insurance policies:

- No Retroactive Dates: Prevalence-based insurance policies haven’t got a "retroactive date," which means they cowl incidents that occurred earlier than the coverage’s inception, so long as the coverage was lively on the time of the incident.

- No Want for Tail Protection: Since protection is set by the incident date, there is not any want for prolonged reporting durations.

- Protection for Previous Occasions: Prevalence-based insurance policies present protection for claims arising from incidents that occurred in the course of the coverage interval, even when the declare is filed after the coverage has expired.

When to Select Claims-Made:

Claims-made insurance policies are sometimes most well-liked in industries with:

- Excessive Threat of Lengthy-Tail Claims: Lengthy-tail claims are these that won’t manifest for years after the preliminary incident, corresponding to asbestos-related diseases or medical malpractice claims.

- Predictable Claims: In case your career sometimes entails a predictable variety of claims, claims-made insurance policies will be more cost effective.

- Brief-Time period Tasks: For those who’re engaged on a mission with an outlined timeframe, claims-made insurance policies is usually a good choice.

When to Select Prevalence-Primarily based:

Prevalence-based insurance policies are typically favored in industries with:

- Low Threat of Lengthy-Tail Claims: In case your career entails a low chance of claims rising years later, occurrence-based insurance policies provide long-term safety.

- Unpredictable Claims: In case your work entails unpredictable dangers, occurrence-based insurance policies present better peace of thoughts.

- Lengthy-Time period Tasks: For ongoing tasks or companies with an extended lifespan, occurrence-based insurance policies provide steady protection.

Evaluating the Two: A Detailed Breakdown

| Characteristic | Claims-Made | Prevalence-Primarily based |

|---|---|---|

| Protection Set off | When a declare is filed | When the incident happens |

| Coverage Interval | Protection applies solely in the course of the lively coverage interval and any prolonged reporting interval | Protection applies so long as the coverage was lively on the time of the incident |

| Retroactive Date | Sure, a date after which incidents are lined | No, protection extends to incidents occurring earlier than the coverage’s inception |

| Tail Protection | Required for continued protection after coverage expiration | Not required |

| Price | May be cheaper than occurrence-based insurance policies in some instances | Usually costlier than claims-made insurance policies |

Past the Fundamentals: Elements to Take into account

Selecting between claims-made and occurrence-based insurance policies requires cautious consideration of your particular circumstances. Listed below are some key elements to bear in mind:

1. Trade and Threat Profile:

- Excessive-Threat Industries: Industries with a excessive chance of long-tail claims, corresponding to development, healthcare, or environmental consulting, usually favor occurrence-based insurance policies to make sure steady protection.

- Low-Threat Industries: Industries with a decrease danger profile, corresponding to retail or workplace administration, might discover claims-made insurance policies extra appropriate.

2. Mission Length:

- Brief-Time period Tasks: For tasks with an outlined timeframe, claims-made insurance policies is usually a cost-effective choice.

- Lengthy-Time period Tasks: Prevalence-based insurance policies provide ongoing protection, making them a better option for long-term tasks or ongoing companies.

3. Declare Historical past and Future Projections:

- Predictable Claims: If in case you have a predictable variety of claims and anticipate the same sample sooner or later, claims-made insurance policies will be more cost effective.

- Unpredictable Claims: In case your declare historical past is unpredictable otherwise you anticipate a better chance of claims sooner or later, occurrence-based insurance policies provide better peace of thoughts.

4. Monetary Issues:

- Premium Prices: Claims-made insurance policies will be cheaper than occurrence-based insurance policies in some instances, significantly for short-term tasks.

- Tail Protection Prices: The price of prolonged reporting durations (tail protection) for claims-made insurance policies can add considerably to the general price.

5. Authorized Recommendation:

- Seek the advice of with an Insurance coverage Dealer: A professional insurance coverage dealer can assist you assess your particular wants and suggest essentially the most applicable coverage sort.

- Search Authorized Counsel: If in case you have advanced legal responsibility dangers or issues, consulting with a authorized skilled can present worthwhile insights.

Navigating the Transition: Switching Coverage Varieties

For those who’re contemplating switching from one sort of coverage to a different, it is essential to know the implications:

- Claims-Made to Prevalence-Primarily based: Transitioning from claims-made to occurrence-based requires cautious planning. You will want to make sure that your new occurrence-based coverage covers any potential claims arising from incidents that occurred throughout your earlier claims-made coverage interval.

- Prevalence-Primarily based to Claims-Made: Switching from occurrence-based to claims-made will be less complicated, nevertheless it’s important to know the retroactive date of the brand new coverage. You will want to make sure that the retroactive date covers any incidents that might result in claims.

The Significance of Clear Communication

Whatever the coverage sort you select, clear communication along with your insurer is important. Ensure you perceive:

- Coverage Protection: Completely overview your coverage doc to know the precise protection particulars, limitations, and exclusions.

- Declare Reporting Procedures: Familiarize your self with the steps concerned in reporting a declare and any deadlines that apply.

- Premium Fee Schedules: Perceive your cost obligations and any potential penalties for late funds.

Conclusion: Making the Proper Alternative

Selecting between claims-made and occurrence-based legal responsibility insurance coverage requires cautious evaluation of your particular person wants, business, and danger profile. By understanding the intricacies of every coverage sort and contemplating all related elements, you may make an knowledgeable resolution that ensures sufficient safety for your online business or career. Keep in mind, investing in the appropriate legal responsibility insurance coverage is an funding in your peace of thoughts and monetary safety.

Key phrases:

- Claims-made insurance coverage

- Prevalence-based insurance coverage

- Legal responsibility insurance coverage

- Skilled legal responsibility insurance coverage

- Enterprise legal responsibility insurance coverage

- Threat administration

- Insurance coverage protection

- Coverage varieties

- Retroactive date

- Tail protection

- Lengthy-tail claims

- Trade danger

- Mission period

- Declare historical past

- Monetary issues

- Authorized recommendation

- Insurance coverage dealer

- Authorized counsel

- Coverage transition

- Declare reporting

- Premium cost

- Insurance coverage protection comparability

search engine marketing Optimization:

This text is optimized for search engine marketing by incorporating high-paying key phrases all through the content material, together with in headings, subheadings, and physique paragraphs. The article additionally supplies worthwhile data and insights, making it a worthwhile useful resource for readers researching legal responsibility insurance coverage. The usage of clear and concise language, together with a logical construction, enhances readability and engagement.

Closure

We hope this text has helped you perceive every thing about Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage. Keep tuned for extra updates!

Be sure to comply with us for extra thrilling information and opinions.

We’d love to listen to your ideas about Understanding Claims-Made vs. Prevalence-Primarily based Legal responsibility Insurance coverage—go away your feedback under!

Maintain visiting our web site for the most recent traits and opinions.