Understanding Fastened vs. Variable Curiosity Charges on Private Loans

Associated Articles

- Can You Use A Private Mortgage To Pay Off Medical Payments? A Complete Information

- Personal Loan Debt Consolidation: Is It Right For You?

- Personal Loans Vs. Credit Cards: Which Is Better For You?

- Demystifying Personal Loans: Understanding APRs And Fees

- The Top 10 Personal Loan Apps You Need To Know About: Your Guide To Quick And Easy Cash

Introduction

On this article, we dive into Understanding Fastened vs. Variable Curiosity Charges on Private Loans, supplying you with a full overview of what’s to come back

Video about

Navigating the Mortgage Panorama: Understanding Fastened vs. Variable Curiosity Charges on Private Loans

Taking out a private mortgage could be an effective way to attain monetary targets, whether or not it is consolidating debt, protecting surprising bills, or funding a dream venture. However earlier than you dive into the mortgage software course of, it is essential to know the several types of rates of interest obtainable and the way they will influence your funds. This information will delve into the world of fastened and variable rates of interest on private loans, empowering you to make knowledgeable selections that align together with your monetary technique.

Decoding the Curiosity Charge Enigma: Fastened vs. Variable

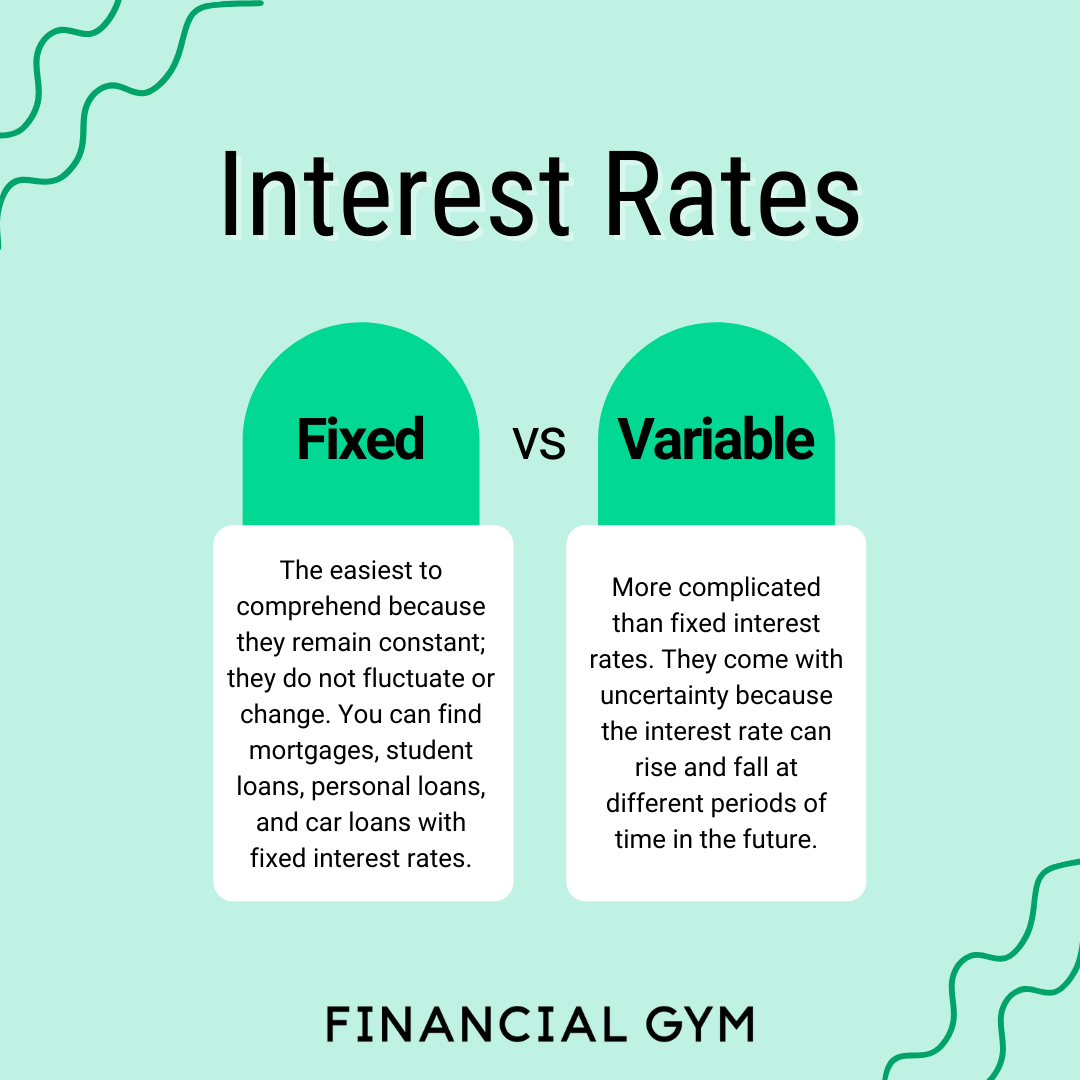

Rates of interest are the price of borrowing cash. They’re expressed as a proportion of the mortgage quantity and decide how a lot you will pay again in curiosity over the mortgage time period. There are two foremost kinds of rates of interest: fastened and variable.

Fastened Curiosity Charges: Predictability and Stability

A set rate of interest, because the identify suggests, stays fixed all through all the mortgage time period. Because of this your month-to-month funds will keep the identical, no matter fluctuations in market rates of interest.

Advantages of Fastened Curiosity Charges:

- Predictability: You already know precisely how a lot you will be paying every month, making it simpler to price range and plan for the long run.

- Stability: You are shielded from rising rates of interest, making certain that your month-to-month funds will not enhance unexpectedly.

- Peace of Thoughts: The knowledge of a set fee can scale back monetary stress and supply a way of safety.

.png?format=1500w)

When Fastened Curiosity Charges Make Sense:

- Lengthy-term loans: If you happen to’re taking out a mortgage for a big period of time, similar to a mortgage or a house fairness mortgage, a set rate of interest can present stability and defend you from surprising will increase.

- Finances-conscious debtors: Fastened charges supply predictable month-to-month funds, making it simpler to stay to a price range and keep away from surprises.

- Threat-averse people: If you happen to favor certainty and do not wish to be uncovered to market volatility, a set fee is a protected alternative.

Variable Curiosity Charges: Flexibility and Potential Financial savings

Variable rates of interest fluctuate primarily based on modifications in a benchmark rate of interest, such because the prime fee or the federal funds fee. Because of this your month-to-month funds can go up or down relying on the route of market rates of interest.

Advantages of Variable Curiosity Charges:

- Potential for decrease preliminary charges: Variable charges are sometimes decrease than fastened charges initially, which can lead to decrease month-to-month funds and financial savings within the early phases of the mortgage time period.

- Flexibility: If rates of interest fall, you possibly can profit from decrease month-to-month funds.

- Quick-term loans: For brief-term loans, the potential for decrease preliminary charges and the opportunity of falling rates of interest could be engaging.

When Variable Curiosity Charges Make Sense:

- Quick-term loans: If you happen to plan to repay your mortgage rapidly, the chance of rising rates of interest is minimal.

- Excessive-risk tolerance: If you happen to’re comfy with the opportunity of fluctuating funds and are prepared to tackle some threat for the potential of decrease preliminary charges, a variable fee is likely to be appropriate.

- Market optimism: If you happen to consider that rates of interest are more likely to fall or stay steady, a variable fee could be a good possibility.

Understanding the Fantastic Print: Key Concerns

Whereas fastened and variable rates of interest supply distinct benefits, it is important to think about the next elements earlier than making a call:

- Mortgage time period: The size of your mortgage time period performs a vital position. Fastened charges are usually extra advantageous for longer mortgage phrases, whereas variable charges could also be extra appropriate for shorter phrases.

- Market outlook: Your evaluation of future rate of interest traits can affect your alternative. If you happen to consider rates of interest will rise, a set fee could also be preferable.

- Private threat tolerance: Contemplate your consolation degree with uncertainty and the potential for fluctuating funds.

- Monetary targets: Your monetary targets and priorities ought to information your resolution. If stability and predictability are paramount, a set fee could be the better option.

Navigating the Curiosity Charge Maze: Discovering the Proper Match

Choosing the proper sort of rate of interest to your private mortgage requires cautious consideration of your particular person circumstances and monetary targets. Here is a breakdown that will help you navigate the decision-making course of:

For Debtors Searching for Stability and Predictability:

- Fastened rates of interest: Provide peace of thoughts and predictable month-to-month funds, making them best for long-term loans, budget-conscious debtors, and people searching for certainty.

For Debtors Open to Potential Financial savings and Flexibility:

- Variable rates of interest: Can present decrease preliminary charges and the potential for decrease month-to-month funds if rates of interest fall. They’re appropriate for short-term loans, debtors with excessive threat tolerance, and those that consider rates of interest will stay steady or decline.

The Backside Line: Making an Knowledgeable Selection

Finally, the choice between fastened and variable rates of interest is a private one. There isn’t a one-size-fits-all reply. By rigorously contemplating your particular person circumstances, monetary targets, and threat tolerance, you can also make an knowledgeable resolution that aligns together with your monetary technique and units you on a path in direction of attaining your monetary goals.

Past the Fundamentals: Exploring Extra Concerns

- APR (Annual Share Charge): The APR represents the whole price of borrowing, together with curiosity and different charges. Evaluate APRs from totally different lenders to seek out probably the most aggressive charges.

- Mortgage origination charges: These are upfront charges charged by lenders for processing your mortgage software. Contemplate these charges when evaluating mortgage affords.

- Prepayment penalties: Some loans might have prepayment penalties, which may discourage you from paying off the mortgage early. You’ll want to examine the mortgage phrases for prepayment penalties.

- Credit score rating: Your credit score rating considerably impacts the rate of interest you qualify for. Bettering your credit score rating may help you safe decrease charges.

- Mortgage goal: The aim of your mortgage may affect the rate of interest you obtain. Some lenders might supply particular charges for particular mortgage functions, similar to debt consolidation or dwelling enhancements.

Empowering Your Monetary Journey: Suggestions for Success

- Store round: Evaluate mortgage affords from a number of lenders to seek out probably the most favorable phrases and rates of interest.

- Negotiate: Do not be afraid to barter with lenders to attempt to safe a decrease rate of interest.

- Learn the effective print: Rigorously assessment the mortgage phrases and situations earlier than signing any paperwork.

- Perceive your compensation choices: Discover totally different compensation choices, similar to fastened funds or versatile fee schedules, to seek out one of the best match to your monetary state of affairs.

- Keep knowledgeable: Preserve monitor of market rate of interest traits and think about refinancing your mortgage if charges fall considerably.

Conclusion: Your Path to Monetary Empowerment

Understanding fastened and variable rates of interest on private loans is essential for making knowledgeable monetary selections. By weighing your particular person circumstances, monetary targets, and threat tolerance, you possibly can select the precise sort of rate of interest that empowers you to attain your monetary goals. Keep in mind to buy round, examine affords, and browse the effective print rigorously. With a transparent understanding of the choices obtainable, you possibly can navigate the mortgage panorama confidently and make selections that assist your monetary well-being.

Closure

We hope this text has helped you perceive every thing about Understanding Fastened vs. Variable Curiosity Charges on Private Loans. Keep tuned for extra updates!

Ensure to comply with us for extra thrilling information and evaluations.

Be at liberty to share your expertise with Understanding Fastened vs. Variable Curiosity Charges on Private Loans within the remark part.

Keep knowledgeable with our subsequent updates on Understanding Fastened vs. Variable Curiosity Charges on Private Loans and different thrilling subjects.