Understanding Jumbo Loans: When Do You Want One?

Associated Articles

- Dwelling Mortgage Pre-Approval: Your Ticket To A Easy Homebuying Journey

- Navigating The Mortgage Maze: Greatest Lenders For First-Time Homebuyers In 2023

- Unlocking Your House’s Potential: Prime Causes To Refinance Your Mortgage

- Standard Vs. FHA Loans: Which Is Finest?

- The Affect Of Your Credit score Rating On Your House Mortgage: A Complete Information

Introduction

Uncover every little thing you must learn about Understanding Jumbo Loans: When Do You Want One?

Video about Understanding Jumbo Loans: When Do You Want One?

Understanding Jumbo Loans: When Do You Want One?

The dream of proudly owning a house is a robust motivator for a lot of, however navigating the complexities of mortgages could be daunting. Whereas typical loans are the usual, there are conditions the place a jumbo mortgage could be the suitable selection. This text will discover the world of jumbo loans, explaining their distinctive options, eligibility necessities, and after they could be the proper answer in your dwelling shopping for journey.

What are Jumbo Loans?

Jumbo loans are mortgages that exceed the conforming mortgage limits set by the Federal Housing Finance Company (FHFA) for typical loans. These limits fluctuate by county and are adjusted yearly. In 2023, the conforming mortgage restrict is $726,200 for many of the nation, however it may be increased in sure high-cost areas. For instance, in areas like California and New York, the restrict could be as excessive as $1,089,300.

Why are Jumbo Loans Completely different?

In contrast to typical loans, jumbo mortgages usually are not eligible for buy by Fannie Mae or Freddie Mac. This implies they’re sometimes held by personal lenders, who’ve their very own underwriting pointers and will require stricter qualification standards.

Key Options of Jumbo Loans:

- Greater Mortgage Quantities: The obvious distinction is the flexibility to borrow bigger sums, exceeding the conforming mortgage limits.

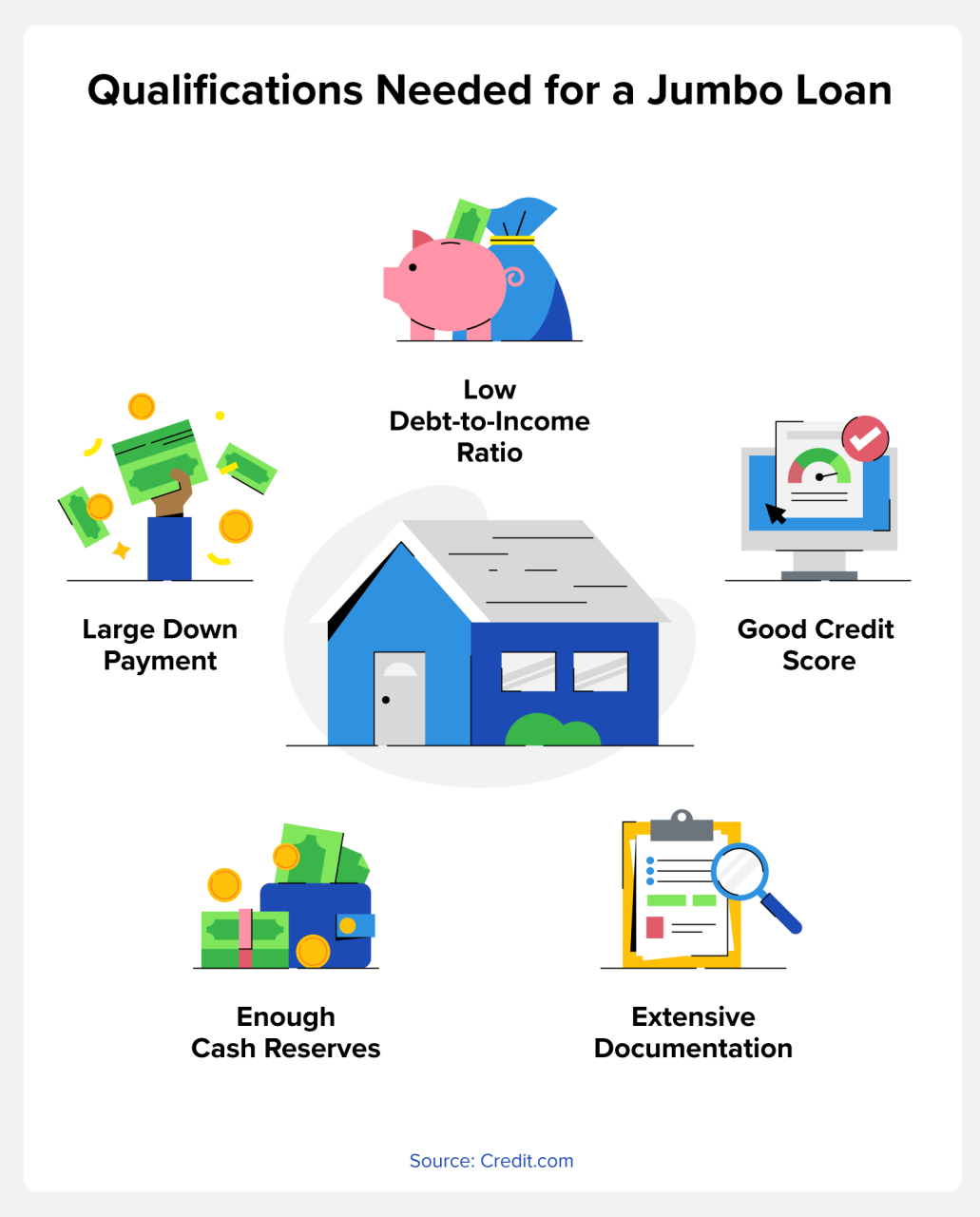

- Stricter Qualification Necessities: Lenders usually demand increased credit score scores, bigger down funds, and stronger debt-to-income ratios for jumbo debtors.

- Greater Curiosity Charges: Jumbo loans typically carry increased rates of interest than typical loans, reflecting the elevated danger for lenders.

- Extra Intensive Documentation: Anticipate to offer extra intensive monetary documentation to show your revenue, property, and creditworthiness.

- Potential for Personal Mortgage Insurance coverage (PMI): Whereas typical loans usually require PMI for down funds under 20%, jumbo loans could require it even with bigger down funds, relying on the lender and loan-to-value ratio.

When Do You Want a Jumbo Mortgage?

Jumbo loans turn out to be a necessity whenever you’re seeking to buy a house that exceeds the conforming mortgage restrict in your space. Listed below are some widespread eventualities the place a jumbo mortgage could be the suitable selection:

- Excessive-Value Housing Markets: In areas with excessive property values, resembling main metropolitan cities or coastal areas, jumbo loans are sometimes the one possibility for financing a house buy.

- Luxurious Properties: When you’re in search of a big, upscale dwelling with premium facilities, a jumbo mortgage will doubtless be wanted to safe the required financing.

- Second Properties or Funding Properties: Jumbo loans can be utilized to finance second houses or funding properties, however lenders could have stricter necessities for these kind of purchases.

- Massive Down Funds: Even if you happen to’re placing down a big down fee, you may nonetheless want a jumbo mortgage if the acquisition value exceeds the conforming restrict.

Benefits of Jumbo Loans:

- Entry to Greater Mortgage Quantities: This lets you buy costlier houses and probably spend money on areas with larger appreciation potential.

- Potential for Decrease Month-to-month Funds: Whereas jumbo loans could have increased rates of interest, the bigger mortgage quantity can translate to decrease month-to-month funds in comparison with a standard mortgage with a smaller quantity borrowed.

- Better Flexibility: Jumbo loans can supply extra flexibility by way of mortgage phrases, resembling adjustable charges, interest-only choices, and longer amortization durations.

Disadvantages of Jumbo Loans:

- Greater Curiosity Charges: Jumbo loans sometimes carry increased rates of interest than typical loans, which might improve the general value of borrowing.

- Stricter Qualification Necessities: Assembly the eligibility standards for a jumbo mortgage could be tougher, requiring a robust monetary profile and wonderful credit score.

- Restricted Availability: Jumbo loans usually are not supplied by all lenders, and a few could have stricter lending standards than others.

- Potential for Greater Closing Prices: Jumbo loans can include increased closing prices as a result of elevated complexity of the underwriting course of.

Suggestions for Getting Authorised for a Jumbo Mortgage:

- Construct a Sturdy Credit score Historical past: Purpose for a credit score rating of a minimum of 740, ideally increased, to enhance your probabilities of approval.

- Save for a Bigger Down Fee: Lenders sometimes require bigger down funds for jumbo loans, usually 20% or extra.

- Keep a Low Debt-to-Revenue Ratio: Hold your debt-to-income ratio under 43% to exhibit your potential to deal with the mortgage funds.

- Present Intensive Monetary Documentation: Be ready to offer detailed documentation of your revenue, property, and liabilities.

- Store Round for the Greatest Charges: Examine gives from a number of lenders to safe essentially the most aggressive rate of interest.

Alternate options to Jumbo Loans:

If a jumbo mortgage looks like a frightening prospect, contemplate these alternate options:

- Standard Loans with a Bigger Down Fee: When you can afford a bigger down fee, you might be able to buy a higher-priced dwelling inside the conforming mortgage limits.

- Mixture of Loans: Think about using a mix of typical and jumbo loans to finance your buy.

- Residence Fairness Loans or Strains of Credit score: These choices can present further financing for a down fee or renovations, however they arrive with their very own dangers and concerns.

Conclusion:

Jumbo loans supply a singular answer for debtors in search of to finance houses that exceed conforming mortgage limits. Whereas they arrive with stricter necessities and probably increased rates of interest, they will open doorways to bigger and extra luxurious properties. Fastidiously weigh the benefits and downsides earlier than deciding if a jumbo mortgage is best for you. By understanding the intricacies of jumbo mortgages, you can also make knowledgeable selections and navigate the trail to homeownership with confidence.

Closure

Thanks for studying! Stick with us for extra insights on Understanding Jumbo Loans: When Do You Want One?.

Ensure to comply with us for extra thrilling information and opinions.

Be happy to share your expertise with Understanding Jumbo Loans: When Do You Want One? within the remark part.

Keep knowledgeable with our subsequent updates on Understanding Jumbo Loans: When Do You Want One? and different thrilling subjects.