Understanding Mortgage Factors: Are They Price It?

Associated Articles

- The Rising Tide: How Curiosity Charges Are Reshaping The Mortgage Panorama

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- Denied Auto Mortgage? Do not Panic! This is What To Do Subsequent

- Understanding Jumbo Mortgages: Is It Proper For You?

- Evaluating New Vs. Used Automotive Loans: Which Is Higher?

Introduction

Welcome to our in-depth have a look at Understanding Mortgage Factors: Are They Price It?

Video about

Understanding Mortgage Factors: Are They Price It?

Shopping for a house is without doubt one of the greatest monetary selections you will ever make. It is an thrilling time, but it surely additionally comes with loads of complexities, particularly in relation to financing. One of many key selections you will have to make is whether or not or to not purchase mortgage factors.

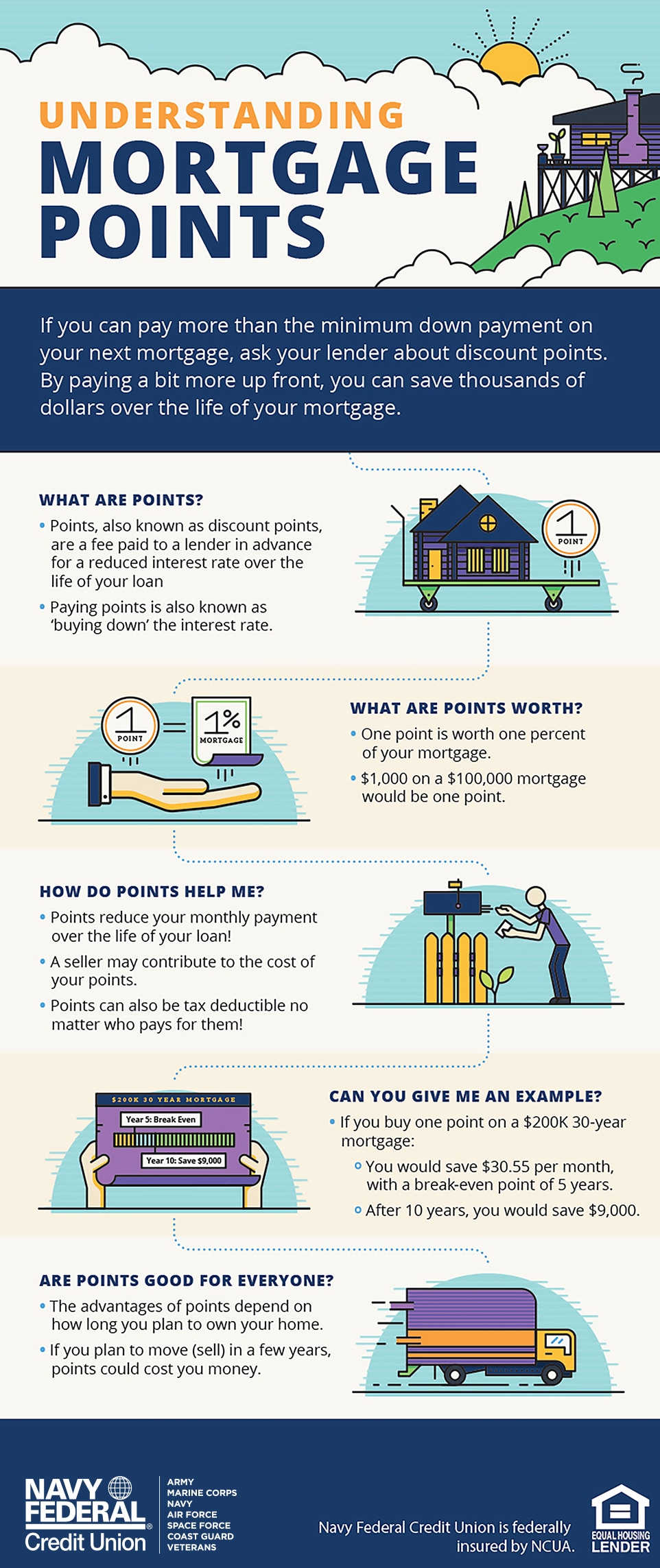

What are Mortgage Factors?

Mortgage factors, also called low cost factors, are primarily pay as you go curiosity in your mortgage mortgage. Whenever you purchase factors, you pay a sure share of your mortgage quantity upfront in trade for a decrease rate of interest for the lifetime of your mortgage.

How do Mortgage Factors Work?

Every level prices 1% of your mortgage quantity. For instance, in the event you’re taking out a $300,000 mortgage and purchase two factors, you’d pay $6,000 upfront (2 x $300,000 x 0.01). In return, your rate of interest will likely be decreased by a specific amount, sometimes 0.25% to 0.5% per level.

Are Mortgage Factors Price It?

The query of whether or not or to not purchase mortgage factors is a fancy one with no simple reply. It is determined by a variety of elements, together with:

- Your monetary state of affairs: Are you able to afford to pay the upfront value of the factors?

- The rate of interest in your mortgage: The upper the rate of interest, the extra you will save by shopping for factors.

- How lengthy you propose to remain in your house: The longer you keep, the extra time it’s important to profit from the decrease rate of interest.

- The present mortgage rate of interest surroundings: If charges are anticipated to rise, shopping for factors could also be a very good technique.

Calculating the Break-Even Level

To find out if shopping for factors is worth it, it is advisable calculate the break-even level. That is the period of time it takes for the financial savings from the decrease rate of interest to offset the price of the factors.

This is a easy instance:

For instance you are taking out a $300,000 mortgage at a 4% rate of interest. You’ve gotten the choice of shopping for two factors at a value of $6,000. This would scale back your rate of interest to three.5%.

To calculate the break-even level, you need to use a mortgage calculator or a spreadsheet program. You will have to enter the next data:

- Authentic mortgage quantity

- Authentic rate of interest

- Lowered rate of interest after shopping for factors

- Value of the factors

The calculator will inform you what number of months it is going to take for the financial savings from the decrease rate of interest to equal the price of the factors.

Elements Affecting the Break-Even Level

The break-even level can differ considerably relying on the next elements:

- The distinction in rates of interest: The bigger the distinction in rates of interest, the quicker the financial savings from shopping for factors will accumulate.

- The mortgage quantity: A bigger mortgage quantity will lead to an extended break-even level.

- The size of your mortgage time period: An extended mortgage time period gives you extra time to learn from the decrease rate of interest, making shopping for factors extra engaging.

When Does Shopping for Factors Make Sense?

Shopping for mortgage factors could be a good technique within the following conditions:

- You’ve gotten a big down cost and might afford the upfront value of the factors.

- You intend to remain in your house for a very long time.

- Rates of interest are anticipated to rise within the close to future.

- You’ve gotten a low credit score rating and are getting the next rate of interest.

- You wish to cut back your month-to-month mortgage funds.

When Ought to You Keep away from Shopping for Factors?

Shopping for factors will not be a good suggestion if:

- You’ve gotten restricted funds and might’t afford the upfront value.

- You intend to maneuver quickly.

- Rates of interest are anticipated to fall.

- You’ve gotten a powerful credit score rating and are getting a low rate of interest.

- You are not comfy with the thought of paying upfront for a decrease rate of interest.

Options to Shopping for Factors

Should you’re undecided about shopping for factors, there are different methods to scale back your mortgage prices:

- Store round for the most effective rate of interest: Get quotes from a number of lenders to search out the bottom price.

- Negotiate your rate of interest: Do not be afraid to ask for a greater price, particularly when you’ve got a powerful credit score rating and a big down cost.

- Contemplate a shorter mortgage time period: A 15-year mortgage could have a decrease rate of interest than a 30-year mortgage, saving you cash in the long term.

- Make further funds in your mortgage: Paying greater than your minimal cost will enable you to repay your mortgage quicker and save on curiosity.

The Backside Line

Shopping for mortgage factors could be a sensible monetary determination, but it surely’s vital to weigh the professionals and cons rigorously. Contemplate your monetary state of affairs, the rate of interest in your mortgage, and the way lengthy you propose to remain in your house. Should you’re undecided whether or not or to not purchase factors, speak to a mortgage lender or a monetary advisor.

Key phrases:

- Mortgage Factors

- Low cost Factors

- Pay as you go Curiosity

- Curiosity Fee

- Break-Even Level

- Mortgage Calculator

- Mortgage Time period

- Monetary Scenario

- Curiosity Fee Atmosphere

- Credit score Rating

- Down Cost

- Mortgage Lender

- Monetary Advisor

search engine optimization Optimization:

Closure

Thanks for studying! Stick with us for extra insights on Understanding Mortgage Factors: Are They Price It?.

Don’t overlook to verify again for the newest information and updates on Understanding Mortgage Factors: Are They Price It?!

Be at liberty to share your expertise with Understanding Mortgage Factors: Are They Price It? within the remark part.

Keep knowledgeable with our subsequent updates on Understanding Mortgage Factors: Are They Price It? and different thrilling subjects.