Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024

Associated Articles

- Can You Get An Auto Mortgage With out A Down Fee? Navigating The World Of No-Down Fee Automotive Loans

- Are On-line Auto Loans Higher Than Dealership Financing? Navigating The Street To Your Subsequent Trip

- High 5 Errors To Keep away from When Making use of For An Auto Mortgage: Unlocking The Keys To A Easy Trip

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

- Unlocking The Greatest Curiosity Charges On Your Auto Mortgage: A Complete Information

Introduction

Uncover every thing it’s essential to learn about Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024

Video about

Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024

The joys of shopping for a brand new automobile is plain, however the actuality of month-to-month automobile funds can rapidly dampen the joy. For those who’re feeling the pinch of a excessive rate of interest in your auto mortgage, auto mortgage refinancing might be the monetary aid you want.

However how do you navigate the refinancing course of and safe the very best deal in 2024? This complete information will equip you with the information and methods to make knowledgeable selections and doubtlessly save hundreds of {dollars}.

What’s Auto Mortgage Refinancing?

Merely put, auto mortgage refinancing is the method of changing your current automobile mortgage with a brand new one, usually from a special lender. This may be useful in the event you’ve skilled:

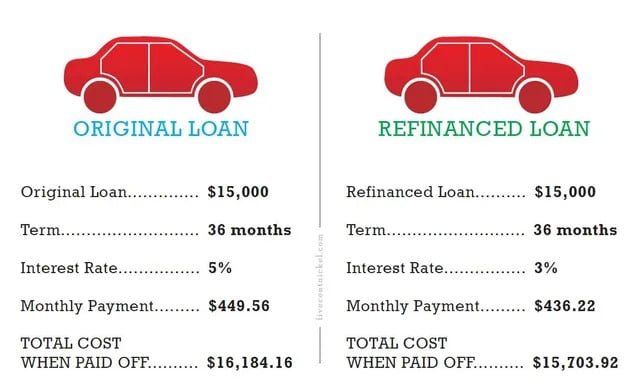

- A decline in rates of interest: If rates of interest have dropped because you took out your unique mortgage, refinancing can decrease your month-to-month funds and cut back the whole quantity of curiosity you pay over the lifetime of the mortgage.

- Improved credit score rating: A better credit score rating can qualify you for decrease rates of interest, making refinancing a wise transfer.

- Want for a shorter mortgage time period: Whereas a shorter time period means greater month-to-month funds, you may pay much less curiosity total.

- Have to consolidate debt: Refinancing can assist you mix a number of loans into one, simplifying your funds and doubtlessly reducing your total curiosity burden.

The Potential Advantages of Refinancing:

- Decrease month-to-month funds: This may unlock money stream for different monetary objectives or present much-needed respiration room in your funds.

- Diminished whole curiosity paid: By securing a decrease rate of interest, you may pay much less in curiosity fees over the lifetime of the mortgage, saving you substantial cash in the long term.

- Shorter mortgage time period: A shorter time period can assist you repay your mortgage quicker, lowering the general curiosity burden.

- Improved credit score rating: For those who’re capable of safe a decrease rate of interest as a consequence of an improved credit score rating, your credit score rating can proceed to enhance as you make well timed funds on the refinanced mortgage.

- Simplified funds: Consolidating a number of loans into one can simplify your funds and make managing your debt simpler.

Who Ought to Think about Auto Mortgage Refinancing?

Whereas the potential advantages of refinancing are interesting, it is not all the time the appropriate alternative for everybody. Listed here are some elements to think about:

- Your present rate of interest: In case your present rate of interest is already low, you could not see important financial savings by refinancing.

- Your credit score rating: A better credit score rating will usually qualify you for decrease rates of interest, making refinancing extra advantageous.

- The remaining time period of your mortgage: In case you have a brief period of time left in your mortgage, the financial savings from refinancing may not be substantial sufficient to justify the method.

- Your monetary scenario: Be sure to can comfortably afford the brand new month-to-month funds earlier than you refinance.

Key Components to Think about Earlier than Refinancing:

Earlier than diving into the refinancing course of, contemplate these essential elements:

- Your credit score rating: Your credit score rating performs a major position in figuring out the rate of interest you may be provided. Examine your credit score report for errors and work on enhancing your rating if mandatory.

- Your debt-to-income ratio: Lenders consider your debt-to-income ratio (DTI), which is the share of your gross month-to-month earnings that goes in direction of debt funds. A decrease DTI usually will increase your possibilities of approval and secures a greater rate of interest.

- The remaining time period of your mortgage: The longer your remaining time period, the extra potential financial savings you’ll be able to obtain by way of refinancing.

- Present rates of interest: Analysis present rates of interest provided by totally different lenders to match provides and discover the very best deal.

- Refinancing charges: Lenders could cost charges for refinancing, akin to origination charges or appraisal charges. Issue these charges into your total price evaluation.

Easy methods to Discover the Finest Auto Mortgage Refinancing Charges:

Securing the very best refinancing fee requires analysis and comparability. Here is a step-by-step information:

1. Examine Your Credit score Rating: A great credit score rating is crucial for securing a positive rate of interest. You possibly can receive your credit score rating at no cost from web sites like Credit score Karma, Experian, Equifax, and TransUnion.

2. Analysis Lenders: Discover a wide range of lenders, together with banks, credit score unions, and on-line lenders. Evaluate their rates of interest, charges, and phrases to search out probably the most aggressive supply.

3. Collect Your Monetary Info: To use for refinancing, you may want to supply details about your earnings, debt, and property. Have this info available to streamline the appliance course of.

4. Get Pre-Authorised: Pre-approval lets you see the rates of interest you qualify for with out impacting your credit score rating. This provides you a superb understanding of your potential financial savings earlier than you decide to refinancing.

5. Evaluate Provides and Negotiate: After getting a number of pre-approval provides, evaluate the rates of interest, charges, and phrases fastidiously. Do not hesitate to barter with lenders to safe the absolute best deal.

6. Select a Lender and Finalize the Refinancing: As soon as you have chosen the lender that gives probably the most favorable phrases, finalize the refinancing course of by signing the mortgage paperwork.

Ideas for Negotiating a Higher Curiosity Fee:

- Store round: Get quotes from a number of lenders to match charges and discover the very best deal.

- Enhance your credit score rating: A better credit score rating will qualify you for decrease rates of interest.

- Negotiate along with your present lender: Your present lender could also be prepared to give you a decrease rate of interest to maintain your online business.

- Think about a shorter mortgage time period: A shorter time period can generally end in a decrease rate of interest.

- Supply a bigger down fee: A bigger down fee may also make you a extra engaging borrower to lenders.

Understanding the Refinancing Course of:

The refinancing course of usually entails these steps:

1. Software: Submit a refinancing utility with the lender of your alternative, offering your private and monetary info.

2. Credit score Examine: The lender will pull your credit score report and rating to evaluate your creditworthiness.

3. Car Appraisal: The lender could require an appraisal of your car to find out its present market worth.

4. Mortgage Approval: Based mostly in your credit score rating, debt-to-income ratio, and car appraisal, the lender will resolve whether or not to approve your refinancing request.

5. Mortgage Closing: As soon as your mortgage is permitted, you may signal the mortgage paperwork and obtain the funds to repay your current mortgage.

What to Watch Out For When Refinancing:

- Excessive charges: Concentrate on any charges related to refinancing, akin to origination charges, appraisal charges, or closing prices.

- Prepayment penalties: Some lenders could cost a penalty in the event you repay the mortgage early.

- Adverse fairness: For those who owe extra in your automobile than it is price, you might have destructive fairness. This may make it troublesome to refinance, as lenders could require you to repay the distinction.

Options to Refinancing:

If refinancing is not the appropriate choice for you, contemplate these options:

- Negotiating a decrease rate of interest along with your present lender: Your present lender could also be prepared to decrease your rate of interest in the event you’ve improved your credit score rating or have a protracted historical past of on-time funds.

- Making further funds in your mortgage: Making further funds can assist you repay your mortgage quicker and cut back the whole quantity of curiosity you pay.

- Promoting your automobile and shopping for a inexpensive one: This may considerably cut back your month-to-month funds and unlock money stream.

Conclusion:

Auto mortgage refinancing could be a highly effective software to economize and enhance your monetary scenario. By understanding the method, researching lenders, and negotiating successfully, you’ll be able to safe the absolute best deal and doubtlessly save hundreds of {dollars} over the lifetime of your mortgage.

Bear in mind to fastidiously contemplate your monetary scenario, analysis your choices, and make knowledgeable selections to make sure refinancing is the appropriate alternative for you.

Closure

We hope this text has helped you perceive every thing about Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024. Keep tuned for extra updates!

Don’t neglect to verify again for the newest information and updates on Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024!

We’d love to listen to your ideas about Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024—depart your feedback beneath!

Keep knowledgeable with our subsequent updates on Unlocking Financial savings: Your Information to Auto Mortgage Refinancing in 2024 and different thrilling matters.