Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans Of 2024

Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024

Associated Articles

- Fueling Your Startup Desires: The Final Information To Enterprise Mortgage Suppliers For Startups

- Securing The Funding You Need: Your Guide To Qualifying For A Business Loan In 2024

- Securing The Funding You Want: A Complete Information To Boosting Your Enterprise Mortgage Approval Possibilities

- Unlock Your Enterprise Potential: Finest Unsecured Enterprise Loans Of 2024

- Unlocking Growth: How Business Loans Can Supercharge Your Cash Flow

Introduction

Uncover the most recent particulars about Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024 on this complete information.

Video about

Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024

Within the ever-evolving panorama of enterprise financing, peer-to-peer (P2P) lending has emerged as a strong different to conventional financial institution loans. This modern strategy connects debtors immediately with buyers, providing a quicker, extra versatile, and sometimes extra inexpensive approach to safe the capital wanted for enlargement, innovation, and progress.

As we navigate the complexities of 2024, understanding the perfect P2P enterprise mortgage choices out there is essential for entrepreneurs and small enterprise house owners in search of to unlock their potential. This complete information explores the highest P2P platforms, their key options, eligibility necessities, and the benefits they provide over conventional lending establishments.

What are Peer-to-Peer Enterprise Loans?

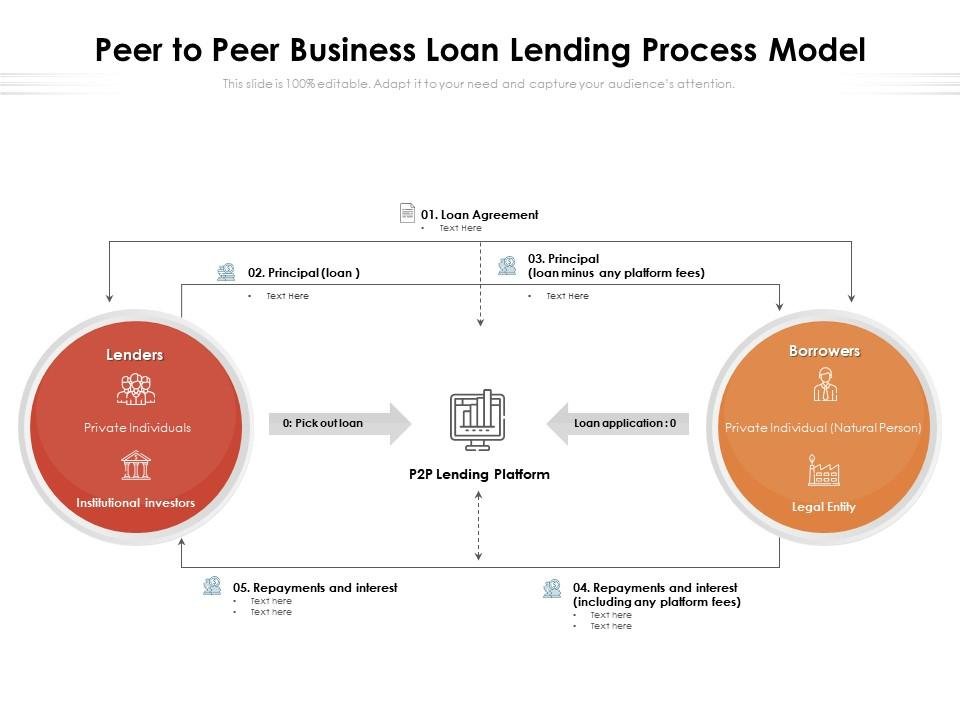

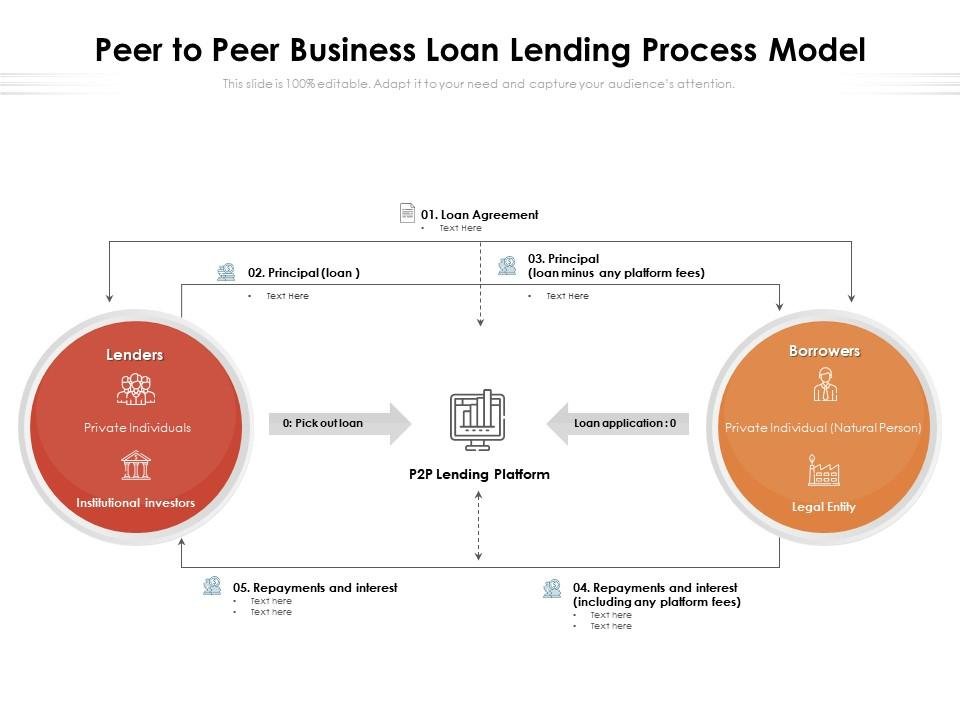

Peer-to-peer enterprise loans, also called on-line enterprise loans, function on a easy precept: connecting debtors with particular person or institutional buyers by a web-based platform. These platforms act as intermediaries, facilitating the mortgage course of from software to reimbursement.

Here is the way it works:

- Borrower Utility: Companies submit mortgage purposes by the P2P platform, outlining their monetary wants and enterprise objectives.

- Mortgage Itemizing: The platform lists the mortgage request, detailing key info just like the mortgage quantity, rate of interest, reimbursement phrases, and enterprise particulars.

- Investor Funding: Buyers browse out there mortgage listings and select to put money into those who align with their danger tolerance and monetary objectives.

- Mortgage Disbursement: As soon as the mortgage is totally funded by buyers, the platform disburses the funds to the borrower.

- Reimbursement: Debtors make month-to-month funds to the platform, which then distributes the funds to the buyers.

The Benefits of P2P Enterprise Loans

P2P enterprise loans supply a compelling different to conventional financial institution loans, boasting a number of key benefits:

- Quicker Approval: P2P platforms usually have streamlined software processes and automatic underwriting methods, resulting in quicker approval instances in comparison with banks.

- Larger Flexibility: P2P loans usually supply extra versatile reimbursement phrases and mortgage quantities, catering to various enterprise wants.

- Aggressive Curiosity Charges: P2P platforms can supply decrease rates of interest than conventional lenders, particularly for companies with good credit score scores.

- Clear Course of: P2P platforms present debtors with clear and clear details about mortgage phrases, rates of interest, and reimbursement schedules.

- Entry to Capital: P2P lending opens doorways for companies that will not qualify for conventional financial institution loans, resembling startups, small companies, and people with less-than-perfect credit score.

Key Issues When Selecting a P2P Enterprise Mortgage Platform

Whereas P2P loans supply quite a few benefits, it is essential to rigorously consider every platform earlier than making a choice. Listed below are some key components to think about:

- Mortgage Quantities and Phrases: Consider the platform’s minimal and most mortgage quantities, reimbursement phrases, and rate of interest vary.

- Eligibility Necessities: Perceive the platform’s eligibility standards, together with credit score rating, enterprise income, and time in enterprise.

- Charges and Costs: Concentrate on any origination charges, late cost charges, or different costs related to the mortgage.

- Buyer Opinions and Fame: Analysis the platform’s status, learn buyer critiques, and assess its monitor file.

- Safety and Privateness: Make sure the platform has sturdy safety measures in place to guard your delicate monetary info.

Prime P2P Enterprise Mortgage Platforms of 2024

Now, let’s delve into the highest P2P enterprise mortgage platforms of 2024, offering detailed insights into their choices, strengths, and goal audiences:

1. LendingClub

LendingClub is a number one P2P lending platform with a powerful monitor file and a variety of mortgage choices.

Key Options:

- Mortgage Quantities: $5,000 to $500,000

- Curiosity Charges: 5.99% to 35.99% APR

- Reimbursement Phrases: 12 to 60 months

- Eligibility Necessities: Minimal credit score rating of 620, minimal enterprise income of $100,000, minimal time in enterprise of two years.

Strengths:

- Massive Community of Buyers: LendingClub has an unlimited community of buyers, enabling fast funding for accredited loans.

- Number of Mortgage Merchandise: Presents a various vary of mortgage merchandise, together with time period loans, strains of credit score, and gear financing.

- Aggressive Curiosity Charges: LendingClub usually offers aggressive rates of interest, particularly for companies with good credit score.

- Consumer-Pleasant Platform: The platform is straightforward to navigate and presents a complete on-line dashboard for managing loans.

Goal Viewers: Established companies with good credit score scores in search of substantial mortgage quantities for enlargement, gear purchases, or working capital wants.

2. OnDeck

OnDeck is a well-established P2P platform recognized for its quick approval course of and concentrate on small companies.

Key Options:

- Mortgage Quantities: $5,000 to $250,000

- Curiosity Charges: 7.99% to 35.99% APR

- Reimbursement Phrases: 6 to 24 months

- Eligibility Necessities: Minimal credit score rating of 600, minimal enterprise income of $50,000, minimal time in enterprise of 1 yr.

Strengths:

- Fast Funding: OnDeck presents quick funding, usually inside a couple of days of approval.

- Versatile Mortgage Choices: Offers a wide range of mortgage merchandise, together with time period loans, strains of credit score, and gear financing.

- Robust Buyer Help: OnDeck has a devoted buyer help workforce out there to help debtors all through the mortgage course of.

- Clear Pricing: Clearly outlines all charges and costs related to its loans.

Goal Viewers: Small companies with good credit score scores in search of fast entry to capital for working capital, stock purchases, or advertising and marketing campaigns.

3. Kabbage

Kabbage is a well-liked P2P platform recognized for its user-friendly software course of and its concentrate on offering funding for startups and small companies.

Key Options:

- Mortgage Quantities: $1,000 to $150,000

- Curiosity Charges: 6.99% to 35.99% APR

- Reimbursement Phrases: 6 to 24 months

- Eligibility Necessities: Minimal credit score rating of 550, minimal enterprise income of $50,000, minimal time in enterprise of 6 months.

Strengths:

- Quick and Straightforward Utility: Kabbage has a streamlined software course of that may be accomplished on-line in minutes.

- Versatile Funding Choices: Presents a wide range of mortgage merchandise, together with time period loans, strains of credit score, and bill financing.

- Actual-Time Mortgage Choices: Offers fast mortgage selections, usually inside a couple of minutes of finishing the appliance.

- Cellular App Entry: Allows debtors to handle their loans and monitor their progress by a handy cellular app.

Goal Viewers: Startups, small companies, and entrepreneurs in search of quick and versatile funding for working capital, stock purchases, or advertising and marketing bills.

4. Fundera

Fundera is a novel P2P platform that connects companies with a community of lenders, providing customized mortgage suggestions and steering.

Key Options:

- Mortgage Quantities: $5,000 to $5 million

- Curiosity Charges: Range relying on the lender

- Reimbursement Phrases: Range relying on the lender

- Eligibility Necessities: Range relying on the lender

Strengths:

- Broad Vary of Mortgage Merchandise: Presents a various vary of mortgage merchandise, together with time period loans, strains of credit score, gear financing, and SBA loans.

- Customized Mortgage Suggestions: Offers custom-made mortgage suggestions based mostly on the borrower’s particular wants and monetary state of affairs.

- Knowledgeable Steering: Presents entry to a workforce of enterprise financing consultants who can present steering and help all through the mortgage course of.

- Free Comparability Software: Permits debtors to check mortgage presents from a number of lenders earlier than making a choice.

Goal Viewers: Companies of all sizes in search of complete mortgage options, tailor-made suggestions, and knowledgeable steering.

5. Can Capital

Can Capital is a P2P platform that focuses on offering funding for companies within the hashish trade.

Key Options:

- Mortgage Quantities: $10,000 to $1 million

- Curiosity Charges: Range relying on the borrower’s creditworthiness

- Reimbursement Phrases: 12 to 60 months

- Eligibility Necessities: Minimal credit score rating of 600, minimal enterprise income of $100,000, minimal time in enterprise of 1 yr.

Strengths:

- Trade Experience: Has a deep understanding of the hashish trade and its distinctive financing wants.

- Versatile Mortgage Choices: Presents a wide range of mortgage merchandise, together with time period loans, strains of credit score, and gear financing.

- Aggressive Curiosity Charges: Offers aggressive rates of interest for hashish companies.

- Robust Buyer Help: Presents devoted buyer help to help hashish companies with their financing wants.

Goal Viewers: Hashish companies in search of funding for enlargement, gear purchases, or working capital wants.

6. PayPal Working Capital

PayPal Working Capital is a novel providing from the favored on-line cost platform that gives companies with fast entry to funding based mostly on their gross sales historical past.

Key Options:

- Mortgage Quantities: As much as $200,000

- Curiosity Charges: Range relying on the borrower’s gross sales quantity

- Reimbursement Phrases: Computerized reimbursement based mostly on a proportion of future gross sales

- Eligibility Necessities: Will need to have a PayPal enterprise account and a minimal gross sales quantity.

Strengths:

- Quick and Straightforward Entry: Offers instantaneous funding based mostly on the borrower’s gross sales historical past.

- Computerized Reimbursement: Reimbursement is routinely deducted from future gross sales, simplifying the reimbursement course of.

- No Credit score Checks: Does not require a credit score test, making it accessible to companies with less-than-perfect credit score.

- Built-in with PayPal: Seamlessly integrates with the PayPal platform, making it handy for companies already utilizing PayPal.

Goal Viewers: Companies with a historical past of robust gross sales in search of fast and versatile funding with out present process a credit score test.

7. Shopify Capital

Shopify Capital is a financing possibility out there to companies utilizing the Shopify e-commerce platform.

Key Options:

- Mortgage Quantities: As much as $200,000

- Curiosity Charges: Range relying on the borrower’s gross sales quantity

- Reimbursement Phrases: Computerized reimbursement based mostly on a proportion of future gross sales

- Eligibility Necessities: Will need to have a Shopify retailer and a minimal gross sales quantity.

Strengths:

- Easy Utility Course of: Presents a streamlined software course of that may be accomplished inside the Shopify platform.

- Quick Funding: Offers fast funding selections and disbursements.

- Computerized Reimbursement: Reimbursement is routinely deducted from future gross sales, simplifying the reimbursement course of.

- No Credit score Checks: Does not require a credit score test, making it accessible to companies with less-than-perfect credit score.

Goal Viewers: Shopify retailers in search of fast and versatile funding based mostly on their gross sales quantity with out present process a credit score test.

8. Sq. Capital

Sq. Capital is a financing possibility out there to companies utilizing the Sq. cost processing platform.

Key Options:

- Mortgage Quantities: As much as $100,000

- Curiosity Charges: Range relying on the borrower’s gross sales quantity

- Reimbursement Phrases: Computerized reimbursement based mostly on a proportion of future gross sales

- Eligibility Necessities: Will need to have a Sq. account and a minimal gross sales quantity.

Strengths:

- Straightforward Utility Course of: Presents a easy software course of that may be accomplished inside the Sq. dashboard.

- Quick Funding: Offers fast funding selections and disbursements.

- Computerized Reimbursement: Reimbursement is routinely deducted from future gross sales, simplifying the reimbursement course of.

- No Credit score Checks: Does not require a credit score test, making it accessible to companies with less-than-perfect credit score.

Goal Viewers: Sq. retailers in search of fast and versatile funding based mostly on their gross sales quantity with out present process a credit score test.

9. Funding Circle

Funding Circle is a world P2P platform that connects companies with buyers worldwide.

Key Options:

- Mortgage Quantities: $25,000 to $5 million

- Curiosity Charges: Range relying on the borrower’s creditworthiness

- Reimbursement Phrases: 12 to 60 months

- Eligibility Necessities: Minimal credit score rating of 640, minimal enterprise income of $100,000, minimal time in enterprise of two years.

Strengths:

- World Attain: Connects companies with buyers from world wide, increasing funding alternatives.

- Number of Mortgage Merchandise: Presents a variety of mortgage merchandise, together with time period loans, strains of credit score, and gear financing.

- Aggressive Curiosity Charges: Offers aggressive rates of interest for companies with good credit score.

- Robust Buyer Help: Presents devoted buyer help to help companies all through the mortgage course of.

Goal Viewers: Companies in search of substantial mortgage quantities for enlargement, gear purchases, or working capital wants.

10. Prosper

Prosper is a P2P platform that gives each private and enterprise loans.

Key Options:

- Mortgage Quantities: $2,000 to $50,000

- Curiosity Charges: Range relying on the borrower’s creditworthiness

- Reimbursement Phrases: 3 to five years

- Eligibility Necessities: Minimal credit score rating of 640, minimal enterprise income of $50,000, minimal time in enterprise of 1 yr.

Strengths:

- Versatile Mortgage Choices: Presents a wide range of mortgage merchandise, together with time period loans, strains of credit score, and gear financing.

- Aggressive Curiosity Charges: Offers aggressive rates of interest for companies with good credit score.

- Robust Buyer Help: Presents devoted buyer help to help companies all through the mortgage course of.

- Consumer-Pleasant Platform: The platform is straightforward to navigate and presents a complete on-line dashboard for managing loans.

Goal Viewers: Companies in search of smaller mortgage quantities for working capital, stock purchases, or advertising and marketing bills.

Navigating the P2P Lending Panorama: Ideas for Success

Selecting the best P2P enterprise mortgage platform could be a vital step in the direction of unlocking what you are promoting’s progress potential. Listed below are some further tricks to navigate the P2P lending panorama successfully:

- Evaluate A number of Platforms: Do not accept the primary platform you encounter. Evaluate mortgage phrases, rates of interest, charges, and eligibility necessities throughout completely different platforms to seek out the perfect match in your wants.

- Perceive Your Credit score Rating: Your credit score rating performs an important function in figuring out your eligibility for P2P loans and the rates of interest you may obtain. Enhance your credit score rating earlier than making use of for a mortgage to safe higher phrases.

- Put together a Enterprise Plan: A well-structured marketing strategy outlining your monetary wants, enterprise objectives, and reimbursement technique can strengthen your mortgage software.

- Learn the Wonderful Print: Earlier than signing any mortgage settlement, rigorously overview the phrases and situations, together with rates of interest, charges, and reimbursement schedules.

- Search Knowledgeable Steering: When you’re uncertain in regards to the P2P lending course of, seek the advice of with a enterprise advisor or monetary guide for knowledgeable recommendation.

Conclusion: Embracing the Energy of P2P Enterprise Loans

Within the dynamic enterprise atmosphere of 2024, P2P lending presents a strong answer for entrepreneurs and small enterprise house owners in search of funding for progress. By understanding the benefits, key concerns, and high platforms out there, companies could make knowledgeable selections to entry the capital wanted to realize their aspirations.

P2P enterprise loans empower companies to unlock their potential, drive innovation, and thrive in a aggressive market. Embrace the pliability, transparency, and accessibility of this modern financing choice to propel what you are promoting in the direction of success.

Closure

We hope this text has helped you perceive every part about Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024. Keep tuned for extra updates!

Be sure that to comply with us for extra thrilling information and critiques.

We’d love to listen to your ideas about Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024—go away your feedback under!

Keep knowledgeable with our subsequent updates on Unlocking Progress: The Finest Peer-to-Peer Enterprise Loans of 2024 and different thrilling matters.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…