Unlocking The Greatest Curiosity Charges On Your Auto Mortgage: A Complete Information

Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information

Associated Articles

- Electrifying Financial savings: Your Information To The Finest Auto Mortgage Charges For Electrical Autos

- Slash Your Automotive Fee: A Information To Decreasing Your Auto Mortgage Prices

- Navigating The Street To Auto Possession: Avoiding Widespread Auto Mortgage Scams

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

- Can You Get An Auto Mortgage With out A Down Fee? Navigating The World Of No-Down Fee Automotive Loans

Introduction

Welcome to our in-depth have a look at Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information

Video about

Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information

Shopping for a brand new or used automobile is a big monetary choice, and securing a good auto mortgage rate of interest is essential to minimizing your general value. A decrease rate of interest interprets to decrease month-to-month funds and fewer cash spent on curiosity over the lifetime of the mortgage. This information will equip you with the data and techniques to navigate the auto mortgage panorama and procure the very best rate of interest.

Understanding the Fundamentals of Auto Mortgage Curiosity Charges

Earlier than diving into methods, let’s make clear what influences your auto mortgage rate of interest:

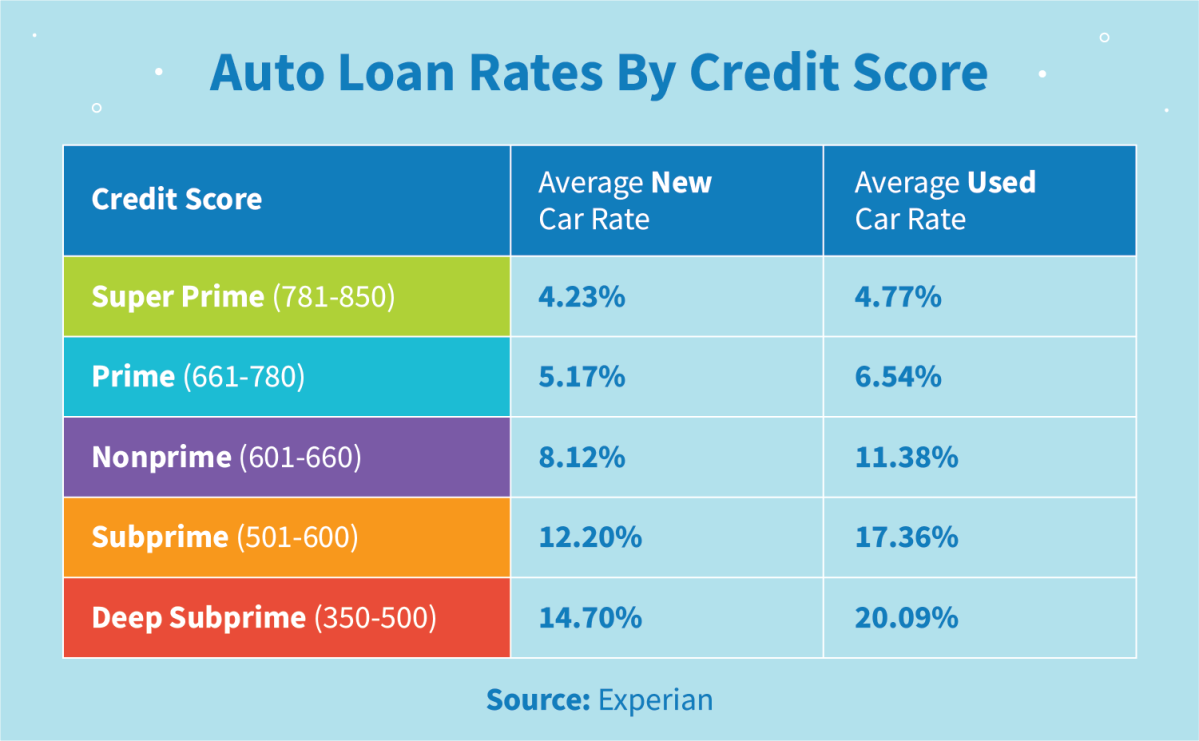

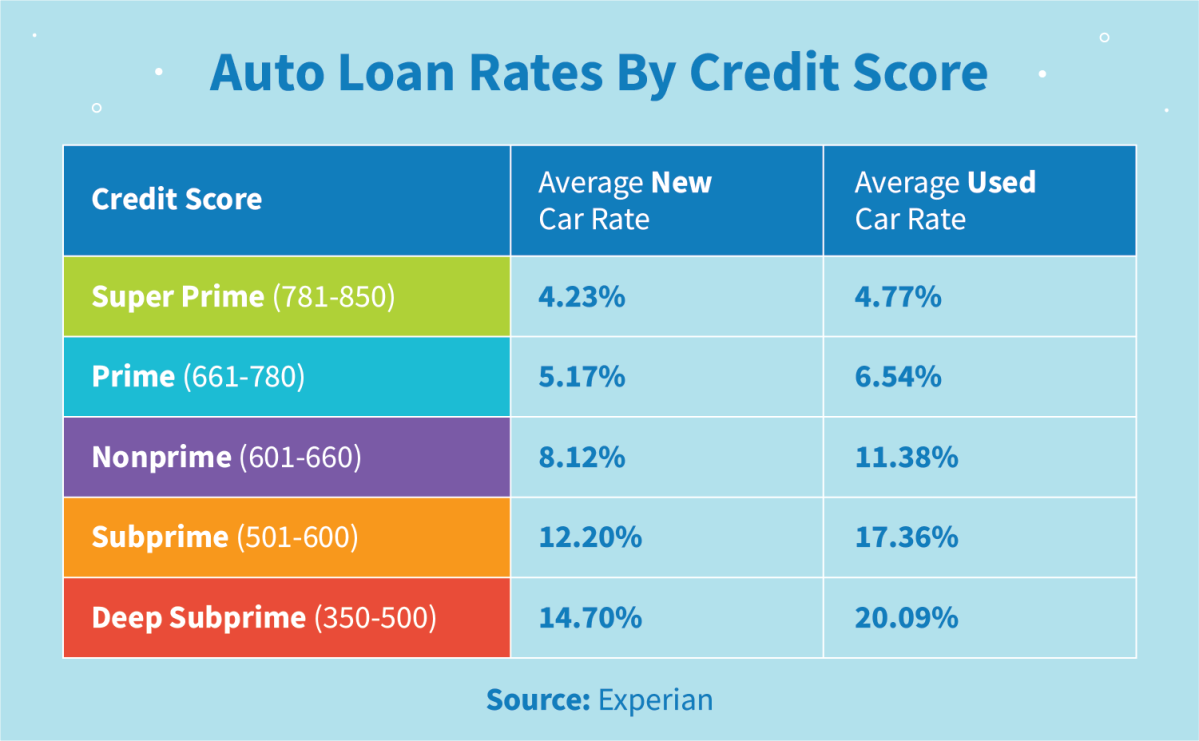

- Credit score Rating: Your credit score rating is the cornerstone of your monetary well being. Lenders use it to evaluate your creditworthiness and decide the chance they take by lending you cash. A better credit score rating usually interprets to decrease rates of interest.

- Mortgage Time period: The size of your mortgage (the time period) impacts your rate of interest. Longer phrases usually imply decrease month-to-month funds however larger general curiosity prices. Conversely, shorter phrases lead to larger month-to-month funds however decrease whole curiosity.

- Mortgage Quantity: The quantity you borrow instantly influences the rate of interest. Bigger mortgage quantities could result in larger rates of interest.

- Car Sort: The kind of automobile you are financing can affect the rate of interest. Newer automobiles with larger resale worth could entice decrease rates of interest in comparison with older or much less fascinating fashions.

- Lender: Completely different lenders have various rate of interest insurance policies. Credit score unions, on-line lenders, and banks all supply completely different charges primarily based on their lending standards.

Key Methods to Safe the Greatest Auto Mortgage Charges

Now that you just perceive the components at play, let’s discover efficient methods to maximise your possibilities of securing a good rate of interest:

1. Construct a Sturdy Credit score Basis:

- Test Your Credit score Report: Begin by acquiring your credit score report from the three main credit score bureaus (Equifax, Experian, and TransUnion). Assessment it for any errors and dispute them promptly.

- Pay Payments On Time: Constant on-time funds show accountable monetary habits and positively affect your credit score rating.

- Cut back Credit score Utilization: Intention to maintain your credit score utilization ratio (the quantity of credit score you employ in comparison with your whole credit score restrict) under 30%.

- Keep away from Opening New Accounts: Opening a number of new credit score accounts inside a brief timeframe can negatively have an effect on your rating.

2. Store Round for the Greatest Charges:

- Evaluate Gives: Do not accept the primary give you obtain. Contact a number of lenders, together with banks, credit score unions, and on-line lenders, to check rates of interest and phrases.

- Use On-line Instruments: Web sites like Bankrate, NerdWallet, and LendingTree mean you can examine mortgage gives from numerous lenders in a single place.

- Negotiate: After you have a number of gives, do not hesitate to barter with lenders to attempt to safe a greater charge.

3. Contemplate Pre-Approval:

- Pre-Approval vs. Pre-Qualification: Pre-approval is a extra formal course of the place a lender evaluations your credit score and earnings and offers a conditional mortgage approval. Pre-qualification is a much less formal estimate that does not contain a tough credit score inquiry.

- Advantages of Pre-Approval: Pre-approval offers you an thought of your borrowing energy and makes you a extra enticing purchaser to dealerships.

- Pre-Approval Course of: Contact lenders instantly or use on-line platforms to use for pre-approval. Present the required documentation, and the lender will consider your creditworthiness.

4. Select the Proper Mortgage Time period:

- Stability Month-to-month Funds and Curiosity Prices: A shorter mortgage time period means larger month-to-month funds however decrease whole curiosity prices. A long run results in decrease month-to-month funds however larger general curiosity.

- Contemplate Your Monetary State of affairs: Select a mortgage time period that aligns together with your finances and monetary targets.

- Do not Overextend Your self: Keep away from stretching your funds too skinny with a mortgage time period that makes your month-to-month funds troublesome to handle.

5. Discover Financing Choices:

- Seller Financing: Dealerships usually supply financing by their affiliated lenders. Nonetheless, these charges could not at all times be essentially the most aggressive.

- Credit score Unions: Credit score unions sometimes supply aggressive charges and personalised service.

- On-line Lenders: On-line lenders usually present handy and streamlined mortgage purposes.

- Banks: Conventional banks supply a variety of mortgage merchandise, however their charges could fluctuate.

- Contemplate a Co-Signer: In case your credit score rating is low, a co-signer with good credit score will help you qualify for a decrease rate of interest.

6. Optimize Your Mortgage Utility:

- Present Correct Data: Be certain that your utility comprises correct and up-to-date info. Any discrepancies can delay the method or lead to the next rate of interest.

- Doc Your Revenue and Bills: Be ready to supply proof of earnings, equivalent to pay stubs or tax returns, and documentation of your month-to-month bills.

- Preserve a Secure Monetary Historical past: Keep away from making any main monetary adjustments, equivalent to opening new credit score accounts or taking over new debt, earlier than making use of for a mortgage.

7. Contemplate a Securement Mortgage:

- Securement Loans: These loans use an asset, equivalent to a automobile or property, as collateral. Lenders could supply decrease rates of interest on secured loans as a result of they’ve much less danger.

- Advantages of Securement Loans: You probably have credit score rating, you possibly can usually safe a decrease rate of interest with a secured mortgage.

8. Discover Refinancing Choices:

- Refinancing: In case your credit score rating has improved or rates of interest have dropped because you took out your mortgage, you might be able to refinance your auto mortgage for a decrease charge.

- Refinancing Course of: Contact your present lender or store round for brand new lenders to see in case you qualify for a decrease charge.

9. Keep away from Pointless Extras:

- Prolonged Warranties: Dealerships usually attempt to promote prolonged warranties, however these could be costly and pointless.

- Hole Insurance coverage: Hole insurance coverage covers the distinction between your automobile’s worth and your mortgage steadiness in case your automobile is totaled. It may be useful, nevertheless it’s not at all times needed.

- Give attention to the Mortgage: Prioritize securing a good rate of interest in your auto mortgage fairly than getting caught up in optionally available extras.

10. Keep Knowledgeable:

- Monitor Curiosity Charges: Keep watch over present rate of interest traits and think about refinancing if charges drop considerably.

- Analysis Lenders: Keep knowledgeable about completely different lenders and their choices.

- Learn the Positive Print: Rigorously assessment the phrases and circumstances of your mortgage settlement earlier than signing.

Conclusion: Unlocking Your Greatest Auto Mortgage Fee

Acquiring the very best rate of interest in your auto mortgage requires a proactive method and knowledgeable decision-making. By constructing a powerful credit score basis, purchasing round for aggressive charges, and understanding the varied mortgage choices accessible, you possibly can considerably cut back your general borrowing prices and maximize your monetary well-being. Keep in mind that this can be a long-term funding, and a bit effort upfront can repay massive in the long term.

Closure

Thanks for studying! Stick with us for extra insights on Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information.

Don’t overlook to test again for the newest information and updates on Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information!

Be happy to share your expertise with Unlocking the Greatest Curiosity Charges on Your Auto Mortgage: A Complete Information within the remark part.

Hold visiting our web site for the newest traits and evaluations.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…