Unlocking Your Monetary Potential: How To Get A Private Mortgage With No Credit score Historical past

Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past

Associated Articles

- Unlock Your Financial Potential: The Best Personal Loans For Excellent Credit Scores

- Navigating The Mortgage Panorama: A Complete Information To Evaluating Private Mortgage Gives

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

Introduction

Be a part of us as we discover Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past, filled with thrilling updates

Video about

Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past

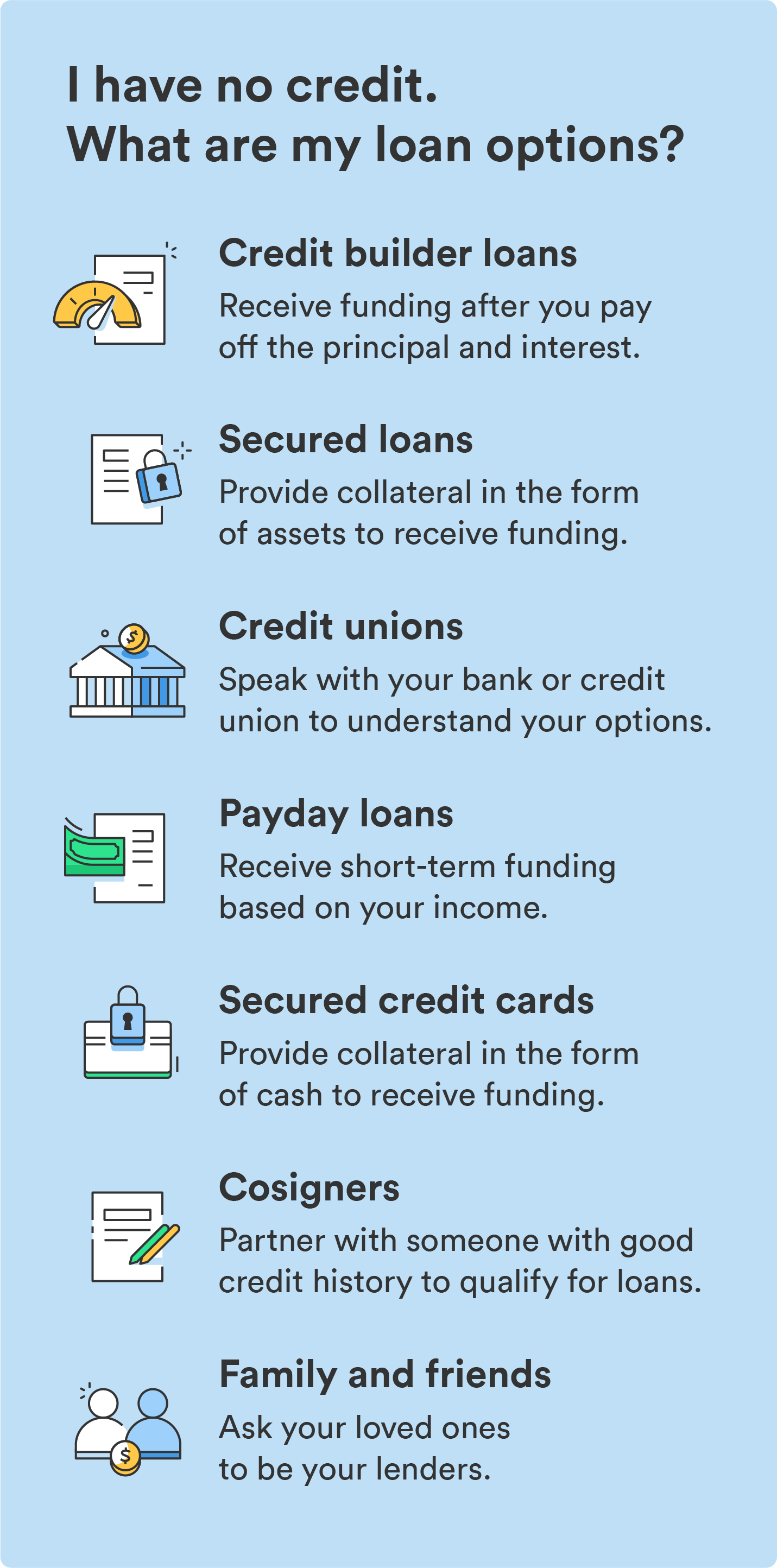

Life occurs. Sudden bills come up. Perhaps you must consolidate debt, cowl a medical emergency, or lastly make that dream house enchancment a actuality. However what in the event you’re simply beginning out and haven’t got an extended credit score historical past? It could really feel such as you’re caught in a monetary catch-22: you want a mortgage to construct credit score, however you want credit score to get a mortgage.

Don’t be concerned! It isn’t unimaginable to get a private mortgage with no credit score historical past. Whereas it would require a bit extra effort and analysis, it is positively achievable. This complete information will equip you with the data and methods to navigate the world of non-public loans and safe the monetary assist you want.

Understanding Credit score Historical past and Its Significance

Earlier than diving into the specifics of getting a mortgage with no credit score historical past, let’s first make clear what credit score historical past is and why it issues.

Your credit score historical past is a document of your monetary conduct, particularly your means to borrow cash and repay it responsibly. Lenders use this data to evaluate your creditworthiness – your chance of repaying a mortgage on time. A robust credit score historical past, mirrored in an excellent credit score rating, makes you a extra enticing borrower, resulting in probably decrease rates of interest and extra favorable mortgage phrases.

The Challenges of No Credit score Historical past

For people with no credit score historical past, lenders face a better diploma of uncertainty. And not using a observe document of accountable borrowing, it is tougher for them to find out your monetary reliability. This could result in:

- Increased rates of interest: To compensate for the elevated threat, lenders could cost increased rates of interest on loans for debtors with no credit score historical past.

- Restricted mortgage choices: Some lenders is perhaps hesitant to supply loans to these with no credit score historical past, limiting your decisions.

- Smaller mortgage quantities: Even in the event you qualify for a mortgage, you is perhaps provided a smaller mortgage quantity than somebody with established credit score.

Constructing a Credit score Basis: The First Steps

The excellent news is that you could construct a constructive credit score historical past from scratch. Listed below are some key methods to get began:

1. Grow to be an Licensed Consumer on a Credit score Card:

One of many quickest methods to determine credit score is to grow to be a licensed consumer on a bank card account belonging to somebody with good credit score historical past. This lets you profit from their constructive credit score exercise, although you are not the first cardholder.

- Advantages:

- Builds credit score historical past with out requiring a bank card utility.

- Can enhance your credit score rating, particularly if the cardholder has a excessive credit score utilization ratio (the quantity of credit score used in comparison with the overall credit score accessible).

- Concerns:

- Make sure the cardholder has an excellent credit score historical past and is accountable with their funds.

- Bear in mind that licensed customers are accountable for any fees made on the cardboard.

2. Safe a Secured Credit score Card:

Secured bank cards require a safety deposit, which acts as collateral in case you default on funds. They seem to be a widespread alternative for people with restricted or no credit score historical past as a result of they’re usually simpler to get permitted for.

- Advantages:

- Gives a protected and managed option to construct credit score.

- The safety deposit mitigates threat for the lender, probably resulting in decrease rates of interest.

- Concerns:

- You will want to offer a safety deposit, sometimes equal to the credit score restrict.

- Rates of interest could be increased than conventional unsecured bank cards.

3. Get a Credit score Builder Mortgage:

Credit score builder loans are particularly designed to assist people set up credit score. They sometimes contain making common funds right into a financial savings account, which you’ll then entry as soon as the mortgage time period is full.

- Advantages:

- Studies constructive fee historical past to credit score bureaus, constructing your credit score rating.

- Supplies a protected and managed option to borrow cash.

- You are basically saving cash whereas constructing credit score.

- Concerns:

- Could have increased rates of interest than conventional loans.

- The mortgage quantity is usually small.

4. Apply for a Mortgage from a Credit score Union:

Credit score unions are sometimes extra keen to work with debtors with restricted or no credit score historical past. They prioritize neighborhood involvement and should supply extra versatile mortgage choices.

- Advantages:

- Could have decrease rates of interest than conventional banks.

- Extra more likely to approve loans based mostly on elements past credit score rating, comparable to revenue and employment historical past.

- Concerns:

- Membership necessities could apply.

- Mortgage quantities and phrases could range relying on the credit score union.

5. Contemplate a Small Private Mortgage from an On-line Lender:

Some on-line lenders specialise in offering loans to people with no credit score historical past. They usually use various knowledge, comparable to financial institution statements and employment historical past, to evaluate your creditworthiness.

- Advantages:

- Fast and handy utility course of.

- Could supply extra versatile mortgage phrases than conventional lenders.

- Concerns:

- Rates of interest could be excessive.

- Completely analysis the lender and browse the phrases and circumstances rigorously.

6. Discover Mortgage Choices with a Cosigner:

You probably have a pal or member of the family with good credit score, they will cosign in your mortgage. This implies they’re going to share duty for repaying the mortgage, probably rising your probabilities of approval and securing a decrease rate of interest.

- Advantages:

- Will increase your probabilities of getting permitted.

- Could result in a decrease rate of interest.

- Concerns:

- You will be legally obligated to repay the mortgage, even when the cosigner defaults.

- It could pressure relationships in the event you’re unable to repay the mortgage.

7. Make the most of a Credit score Reporting Company:

Credit score reporting businesses like Experian, Equifax, and TransUnion play an important function in accumulating and reporting your credit score data. You may entry your free credit score report from every company yearly by way of AnnualCreditReport.com.

- Advantages:

- Helps you determine any errors or inaccuracies in your credit score report, which may negatively affect your credit score rating.

- Supplies perception into your credit score historical past and areas for enchancment.

- Concerns:

- Be sure to verify your credit score report from all three businesses, as they might not at all times be an identical.

Suggestions for Rising Your Possibilities of Approval

Even with no credit score historical past, there are steps you possibly can take to enhance your probabilities of getting a private mortgage:

- Reveal a Secure Revenue: Lenders need to see that you’ve got a dependable supply of revenue to repay the mortgage. Present documentation like pay stubs, tax returns, and financial institution statements.

- Keep a Low Debt-to-Revenue Ratio: Your debt-to-income ratio (DTI) is the proportion of your month-to-month revenue that goes in the direction of debt funds. A decrease DTI signifies that you’ve got extra monetary flexibility and are much less more likely to default on a mortgage.

- Save for a Down Fee: Having a down fee demonstrates your dedication to repaying the mortgage and reduces the lender’s threat.

- Store Round for the Finest Charges: Examine gives from completely different lenders to seek out essentially the most aggressive rates of interest and mortgage phrases.

- Contemplate a Secured Mortgage: Secured loans, comparable to these backed by a automobile or a financial savings account, could be simpler to acquire with no credit score historical past.

Navigating the Mortgage Software Course of

As soon as you’ve got gathered the required data and chosen a lender, you may must submit a mortgage utility. This is what to anticipate:

- Pre-Approval: Some lenders supply pre-approval, which provides you an estimate of the mortgage quantity and rate of interest you are more likely to qualify for.

- Credit score Test: The lender will carry out a tough inquiry in your credit score report, which may briefly decrease your credit score rating.

- Revenue Verification: Lenders will confirm your revenue to make sure you can afford the month-to-month funds.

- Mortgage Approval: If permitted, you may obtain a mortgage settlement outlining the phrases and circumstances.

Understanding the Significance of Mortgage Phrases

When evaluating mortgage gives, pay shut consideration to the next key phrases:

- Curiosity Price: The rate of interest determines the price of borrowing cash. A decrease rate of interest means you may pay much less in curiosity over the lifetime of the mortgage.

- Mortgage Time period: The mortgage time period is the size of time it’s a must to repay the mortgage. An extended mortgage time period can result in decrease month-to-month funds however will lead to paying extra curiosity general.

- Charges: Lenders could cost charges for processing your utility, originating the mortgage, or late funds.

- APR (Annual Share Price): The APR represents the overall value of borrowing cash, together with the rate of interest and any charges.

Constructing a Sturdy Credit score Historical past: The Lengthy Recreation

Getting a private mortgage with no credit score historical past is simply step one. As soon as you’ve got secured a mortgage, it is essential to make use of it responsibly to construct a constructive credit score historical past. This is how:

- Make Funds on Time: Constant on-time funds are an important consider constructing credit score. Arrange reminders and think about computerized funds to make sure well timed funds.

- Preserve Credit score Utilization Low: Your credit score utilization ratio is the quantity of credit score you are utilizing in comparison with your whole credit score restrict. Intention to maintain it under 30% to keep away from negatively impacting your credit score rating.

- Monitor Your Credit score Report: Recurrently verify your credit score report for errors or inaccuracies. You may entry your free credit score report yearly from AnnualCreditReport.com.

- Diversify Your Credit score: Having a mixture of completely different credit score accounts, comparable to bank cards, loans, and installment loans, can enhance your credit score rating.

Conclusion: Embracing Monetary Empowerment

Getting a private mortgage with no credit score historical past could be difficult, however it’s not unimaginable. By understanding the method, taking proactive steps to construct credit score, and demonstrating monetary duty, you possibly can unlock your monetary potential and obtain your monetary targets. Bear in mind, constructing credit score is a journey, not a vacation spot. With persistence, persistence, and a dedication to accountable monetary practices, you possibly can set up a robust credit score basis that can serve you effectively for years to return.

Key phrases:

- Private Mortgage

- No Credit score Historical past

- Construct Credit score

- Credit score Rating

- Credit score Historical past

- Mortgage Software

- Curiosity Charges

- Mortgage Phrases

- Credit score Reporting Companies

- Credit score Builder Mortgage

- Secured Credit score Card

- Licensed Consumer

- Debt-to-Revenue Ratio

- Credit score Utilization

- Monetary Empowerment

- Mortgage Approval

- Cosigner

- On-line Lender

- Credit score Union

- Monetary Duty

- Accountable Borrowing

- Mortgage Choices

- Monetary Administration

- Creditworthiness

- Monetary Planning

- Monetary Objectives

- Cash Administration

- Monetary Literacy

- Monetary Merchandise

- Monetary Providers

- Private Finance

- Monetary Safety

- Monetary Stability

- Monetary Freedom

Closure

We hope this text has helped you perceive the whole lot about Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past. Keep tuned for extra updates!

Don’t overlook to verify again for the newest information and updates on Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past!

We’d love to listen to your ideas about Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past—depart your feedback under!

Keep knowledgeable with our subsequent updates on Unlocking Your Monetary Potential: Learn how to Get a Private Mortgage with No Credit score Historical past and different thrilling matters.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…