Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage

Associated Articles

- Understanding Jumbo Loans: When Do You Want One?

- Ditch The PMI: A Complete Information To Avoiding Mortgage Insurance coverage

- Refinance Your Dwelling Mortgage: Prime Methods For 2024

- Every little thing You Want To Know About Adjustable-Fee Mortgages (ARMs): Your Information To Navigating The Shifting Curiosity Panorama

- Navigating The Path To Homeownership: Your Information To VA Residence Loans

Introduction

Be a part of us as we discover Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage, full of thrilling updates

Video about Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage

Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage

For a lot of seniors, their dwelling represents a good portion of their wealth. However accessing that fairness might be difficult, particularly if they do not wish to promote their beloved dwelling. That is the place a reverse mortgage is available in.

A reverse mortgage is a novel mortgage that permits householders aged 62 and older to entry the fairness of their properties with out having to make month-to-month funds. As a substitute of paying down the mortgage, the mortgage steadiness grows over time, and the home-owner receives funds in varied kinds.

Reverse mortgages are usually not for everybody, however they could be a invaluable monetary software for many who meet sure standards and perceive the dangers concerned.

This text will delve into the multifaceted world of reverse mortgages, exploring the advantages, drawbacks, and concerns that go into making an knowledgeable determination.

Understanding the Fundamentals of a Reverse Mortgage

Earlier than diving into the advantages, it is essential to know the elemental mechanics of a reverse mortgage. Here is a simplified breakdown:

- Residence Fairness as Collateral: The mortgage makes use of your property as collateral, which means the lender has the suitable to say your property in the event you fail to fulfill the phrases of the mortgage.

- No Month-to-month Funds: In contrast to conventional mortgages, you do not make month-to-month funds on a reverse mortgage. As a substitute, you obtain funds from the lender, both as a lump sum, a line of credit score, or month-to-month funds.

- Rising Mortgage Stability: The mortgage steadiness will increase over time, accruing curiosity and costs. The mortgage turns into due while you promote your property, transfer out completely, or cross away.

- Mortgage Limits: There are limits on the quantity you’ll be able to borrow primarily based on your property’s worth, your age, and prevailing rates of interest.

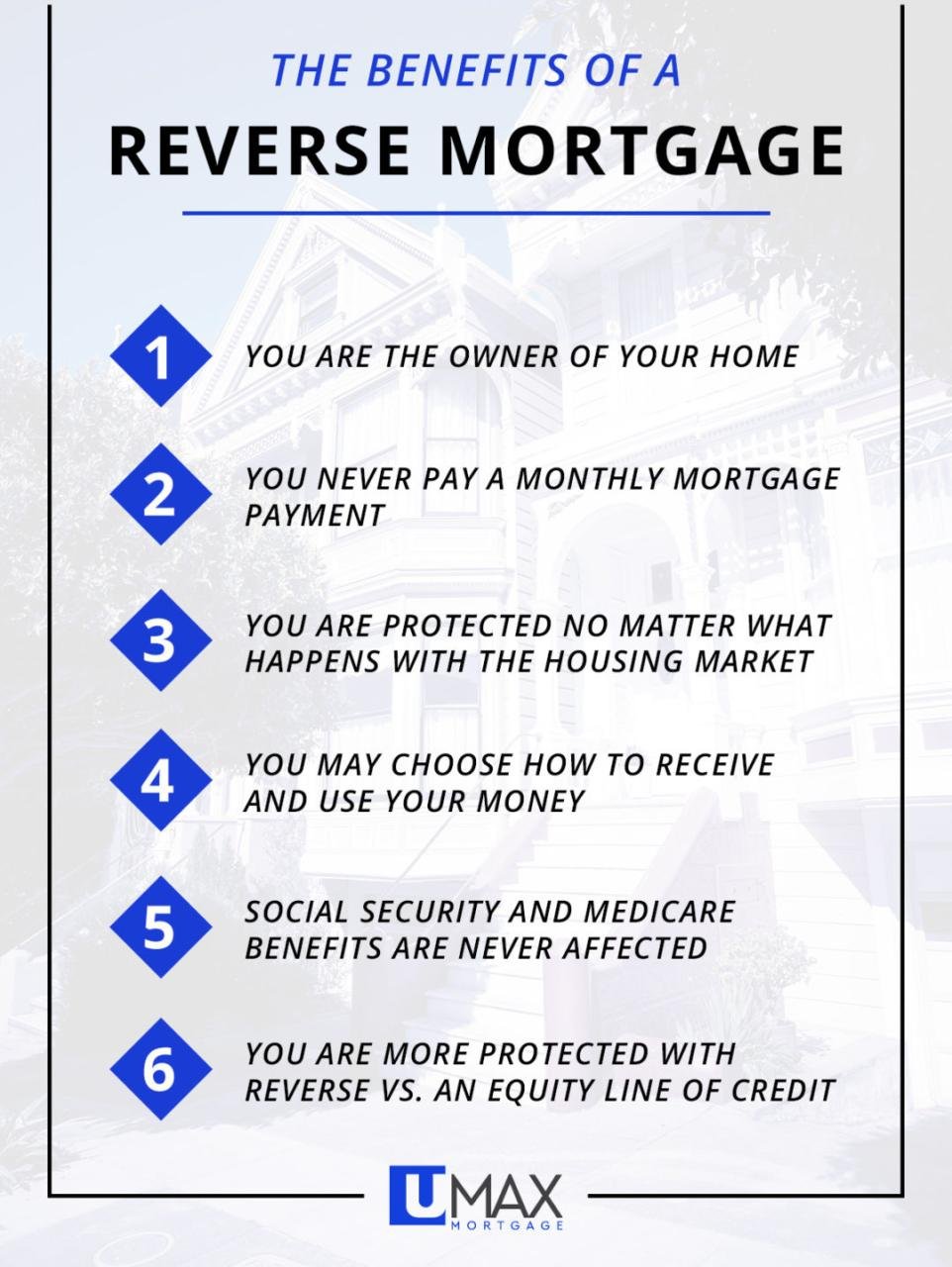

The Many Benefits of a Reverse Mortgage

Whereas reverse mortgages aren’t with out their complexities, they provide a spread of potential advantages for householders in particular conditions. Here is an in depth exploration of the important thing benefits:

1. Monetary Flexibility and Safety:

- Supplementing Retirement Earnings: A reverse mortgage can present a gradual stream of revenue to complement retirement financial savings, serving to to cowl important bills like healthcare, groceries, and utilities.

- Eliminating Month-to-month Mortgage Funds: Should you’re nonetheless paying off a conventional mortgage, a reverse mortgage will help you remove these funds, liberating up money movement and enhancing your month-to-month funds.

- Paying Off Money owed: You should utilize the funds to repay present money owed, like bank card balances or medical payments, decreasing your total monetary burden.

- Residence Repairs and Upkeep: A reverse mortgage can present the funds for important dwelling repairs or renovations, guaranteeing your property stays comfy and secure so that you can dwell in.

- Emergency Funds: Getting access to a line of credit score can present a monetary security web in case of sudden emergencies, like medical payments or automobile repairs.

2. Sustaining Residence Possession:

- Staying in Your Residence: One of the vital vital advantages of a reverse mortgage is that it lets you stay in your house, which might be essential for sustaining your independence and sense of neighborhood.

- No Compelled Sale: In contrast to a conventional mortgage, you will not be pressured to promote your property in the event you fall behind on funds. You’ll be able to proceed to dwell in your house for so long as you select.

- Passing Your Residence to Heirs: You’ll be able to cross your property on to your heirs after your demise, although they might need to repay the excellent mortgage steadiness or promote the house to take action.

3. Tax Benefits:

- Tax-Free Proceeds: The funds you obtain from a reverse mortgage are usually tax-free, as they’re thought of a mortgage in opposition to your property fairness, not taxable revenue.

- No Influence on Social Safety Advantages: Receiving funds from a reverse mortgage doesn’t have an effect on your eligibility for Social Safety advantages or Medicare.

4. Different Potential Advantages:

- Improved Credit score Rating: Whereas not at all times a direct profit, a reverse mortgage can truly enhance your credit score rating by decreasing your debt-to-income ratio.

- Peace of Thoughts: Understanding you might have entry to funds for sudden bills can present a way of safety and peace of thoughts, particularly in retirement.

Weighing the Potential Drawbacks and Issues

Whereas reverse mortgages provide vital benefits, it is essential to know the potential drawbacks and concerns earlier than making a choice.

1. Elevated Mortgage Stability:

- Curiosity and Charges: The mortgage steadiness grows over time, accruing curiosity and costs, which might considerably improve the general price of the mortgage.

- Doable Residence Fairness Loss: If the mortgage steadiness grows bigger than your property’s worth, you could lose fairness in your house, probably leaving your heirs with a debt they need to repay.

- Potential for Foreclosures: Should you fail to fulfill the phrases of the mortgage, akin to paying property taxes and householders insurance coverage, you would face foreclosures.

2. Eligibility and Restrictions:

- Age Requirement: You have to be at the least 62 years previous to qualify for a reverse mortgage.

- Credit score Rating and Earnings Necessities: You have to have a great credit score rating and meet sure revenue necessities to qualify for a mortgage.

- Homeownership Necessities: Your private home should meet sure standards, akin to being your main residence and being in good situation.

3. Monetary and Authorized Implications:

- Influence on Property Planning: A reverse mortgage can affect your property planning, because the mortgage steadiness shall be deducted from the worth of your property while you cross away.

- Potential for Scams: Be cautious of scams and predatory lenders who could attempt to reap the benefits of seniors. It is essential to work with a good lender and search skilled recommendation.

4. Various Choices:

- Residence Fairness Line of Credit score (HELOC): A HELOC is a conventional mortgage that lets you borrow in opposition to your property fairness, however you may must make month-to-month funds.

- Promoting Your Residence: Should you’re in search of a lump sum of money, promoting your property could also be a extra easy choice, however you may need to relocate.

Making an Knowledgeable Determination: Issues for Seniors

Deciding whether or not a reverse mortgage is best for you requires cautious consideration and a radical understanding of your monetary scenario and objectives. Listed here are some key inquiries to ask your self:

- What are your monetary objectives? Are you seeking to complement your retirement revenue, repay money owed, or cowl dwelling repairs?

- What are your long-term plans? Do you propose to remain in your house for the remainder of your life, or do you envision transferring sooner or later?

- What’s your present monetary scenario? What are your revenue, bills, and property?

- What are your heirs’ wants and expectations? How will a reverse mortgage affect your property and your heirs’ inheritance?

Looking for Skilled Recommendation

It is important to seek the advice of with a professional monetary advisor and a good mortgage lender to debate your particular scenario and discover all of your choices. They will help you perceive the complexities of reverse mortgages and decide if it is the suitable alternative for you.

Conclusion: A Highly effective Instrument for Seniors

Reverse mortgages is usually a highly effective software for seniors who wish to entry the fairness of their properties. Nevertheless, they aren’t a one-size-fits-all resolution. It is essential to rigorously weigh the advantages and downsides, perceive the dangers concerned, and make an knowledgeable determination that aligns along with your particular person monetary objectives and circumstances.

By understanding the intricacies of reverse mortgages, seniors can unlock the potential of their dwelling fairness and improve their monetary safety in retirement.

Key phrases: reverse mortgage, dwelling fairness, retirement revenue, seniors, monetary safety, monetary flexibility, dwelling possession, tax benefits, property planning, HELOC, monetary advisor, mortgage lender, knowledgeable determination, advantages, drawbacks, concerns, mortgage steadiness, rates of interest, charges, foreclosures, eligibility, restrictions, different choices, scams, predatory lenders, monetary objectives, long-term plans, monetary scenario, heirs, inheritance, peace of thoughts, monetary freedom, housing affordability, housing choices, growing older in place, dwelling renovation, dwelling repairs, medical bills, debt consolidation, credit score rating, debt-to-income ratio.

Closure

We hope this text has helped you perceive every thing about Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage. Keep tuned for extra updates!

Make certain to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage—go away your feedback under!

Keep knowledgeable with our subsequent updates on Unlocking Your Residence’s Fairness: The Advantages of a Reverse Mortgage and different thrilling subjects.