What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information

Associated Articles

- Navigating The Claims Course of: A Information To Submitting A Profitable Enterprise Insurance coverage Declare

- Defending Your Enterprise On The Street: A Complete Information To Industrial Auto Insurance coverage

- Navigating the Complexities of Insurance coverage Claims with a Lawyer

- Navigating The Maze: How To Select The Proper Enterprise Insurance coverage Coverage

- The Significance of Environmental Attorneys in Company Compliance

Introduction

Uncover every part that you must learn about What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information

Video about

What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information

On this planet of enterprise, errors occur. Typically they’re minor, a easy typo on an bill or a missed deadline. Different occasions, they are often vital, resulting in monetary losses, broken reputations, and even lawsuits. That is the place Errors and Omissions (E&O) insurance coverage is available in.

E&O insurance coverage is a sort of legal responsibility insurance coverage that protects professionals from monetary losses arising from claims of negligence, errors, or omissions of their work. It acts as a security internet, offering monetary safety and peace of thoughts for companies and people who present skilled companies.

However who precisely wants E&O insurance coverage? The reply is surprisingly broad, encompassing a variety of execs throughout varied industries. This text will delve into the specifics of E&O insurance coverage, discover its advantages, and determine the important thing professions that ought to take into account this important protection.

Understanding the Fundamentals: What’s E&O Insurance coverage?

Think about you are a monetary advisor. You give a shopper funding recommendation that seems to be unsuitable, resulting in monetary losses for the shopper. They may sue you, claiming negligence or malpractice. E&O insurance coverage would step in to cowl your authorized protection prices and any monetary settlements or judgments in opposition to you.

Here is a breakdown of key facets of E&O insurance coverage:

- Protection: E&O insurance coverage usually covers claims alleging:

- Negligence: Failure to train the usual of care anticipated of an expert in your area.

- Errors: Errors made in your work, corresponding to miscalculations, incorrect recommendation, or defective designs.

- Omissions: Failing to carry out a crucial activity or offering incomplete info.

- Advantages:

- Monetary Safety: Covers authorized protection prices, settlements, and judgments.

- Peace of Thoughts: Offers reassurance that you just’re shielded from monetary wreck as a result of skilled errors.

- Enhanced Fame: Demonstrates professionalism and dedication to shopper satisfaction.

- Coverage Limits: Much like different insurance coverage insurance policies, E&O insurance coverage has limits on the quantity of protection supplied.

- Exclusions: Insurance policies usually have exclusions, corresponding to intentional acts or prison conduct.

Who Wants E&O Insurance coverage?

Whereas not necessary in all conditions, E&O insurance coverage is very beneficial for professionals who:

- Present skilled recommendation or companies: This consists of a variety of professions, from monetary advisors and accountants to attorneys, architects, engineers, and consultants.

- Deal with delicate info: Professionals who work with confidential info, corresponding to medical data, monetary information, or authorized paperwork, are significantly weak to claims of negligence or breach of privateness.

- Take care of high-value transactions: Professionals concerned in actual property transactions, insurance coverage claims, or large-scale tasks are at the next threat of economic losses as a result of errors.

- Work with shoppers instantly: Any occupation that instantly interacts with shoppers and offers companies primarily based on their experience wants E&O insurance coverage to guard themselves from potential claims.

Particular Professions That Ought to Think about E&O Insurance coverage:

1. Monetary Professionals:

- Monetary Advisors: Offering funding recommendation, managing portfolios, and recommending monetary merchandise.

- Accountants: Making ready tax returns, auditing monetary statements, and offering monetary consulting companies.

- Insurance coverage Brokers: Promoting and advising on insurance coverage insurance policies.

- Mortgage Brokers: Arranging mortgages and different mortgage merchandise.

2. Healthcare Professionals:

- Medical doctors: Offering medical prognosis and therapy.

- Nurses: Offering affected person care and helping with medical procedures.

- Therapists: Offering psychological well being counseling and therapy.

- Pharmacists: Allotting medicine and offering drug info.

3. Authorized Professionals:

- Attorneys: Offering authorized recommendation, representing shoppers in courtroom, and drafting authorized paperwork.

- Paralegals: Aiding attorneys with authorized analysis, doc preparation, and shopper communication.

- Notaries: Witnessing signatures and verifying paperwork.

4. Actual Property Professionals:

- Actual Property Brokers: Facilitating actual property transactions, offering property valuations, and advertising properties.

- Actual Property Appraisers: Estimating the worth of properties.

- Property Managers: Managing rental properties and overseeing upkeep.

5. Design and Development Professionals:

- Architects: Designing buildings and different buildings.

- Engineers: Designing and overseeing development tasks.

- Contractors: Constructing and renovating buildings.

- Inside Designers: Designing and adorning inside areas.

6. Enterprise Professionals:

- Consultants: Offering recommendation and experience on a wide range of enterprise issues.

- Advertising Professionals: Creating and executing advertising campaigns.

- Human Sources Professionals: Managing worker relations, recruitment, and coaching.

- IT Professionals: Offering laptop and community help, software program improvement, and cybersecurity companies.

7. Different Professions:

- Academics: Offering schooling and instruction to college students.

- Writers: Creating written content material for varied functions.

- Photographers: Capturing photographs for business or private use.

- Occasion Planners: Organizing and coordinating occasions.

- Journey Brokers: Reserving journey preparations and offering journey recommendation.

Advantages of E&O Insurance coverage:

- Monetary Safety: E&O insurance coverage protects you from monetary wreck within the occasion of a profitable declare. It covers authorized protection prices, settlements, and judgments, guaranteeing that you do not have to personally bear the monetary burden of a lawsuit.

- Peace of Thoughts: Having E&O insurance coverage offers peace of thoughts figuring out that you just’re shielded from potential claims. It lets you focus in your work with out the fixed fear of economic threat.

- Enhanced Fame: E&O insurance coverage demonstrates a dedication to professionalism and shopper satisfaction. It reveals that you are taking steps to guard your shoppers and mitigate potential dangers.

- Improved Shopper Relationships: Purchasers usually tend to belief professionals who’ve E&O insurance coverage. They really feel assured figuring out that their pursuits are protected in case of errors or omissions.

- Elevated Enterprise Alternatives: Some shoppers require professionals to have E&O insurance coverage as a situation of doing enterprise. Having this protection can open doorways to new alternatives and partnerships.

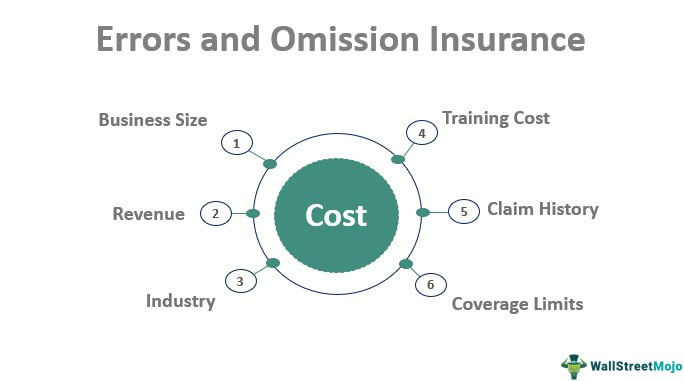

Elements to Think about When Selecting E&O Insurance coverage:

- Protection Limits: The quantity of protection you want will rely upon the character of your work and the potential monetary dangers concerned.

- Deductible: The deductible is the quantity you pay out of pocket earlier than the insurance coverage coverage kicks in.

- Exclusions: Pay attention to any exclusions within the coverage, corresponding to intentional acts or prison conduct.

- Claims Historical past: Your previous claims historical past can have an effect on your premium charges.

- Fame of the Insurer: Select a good insurer with a robust observe file of dealing with claims pretty.

Conclusion: E&O Insurance coverage – A Very important Funding for Professionals

E&O insurance coverage is an important funding for professionals who present companies or recommendation to shoppers. It offers monetary safety, peace of thoughts, and enhances your fame. Whether or not you are a monetary advisor, healthcare skilled, lawyer, or every other skilled who works instantly with shoppers, take into account acquiring E&O insurance coverage to mitigate potential dangers and safeguard your enterprise.

By understanding the advantages and choosing the proper coverage, you may be certain that you are adequately shielded from the monetary penalties {of professional} errors and omissions.

Closure

We hope this text has helped you perceive every part about What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information. Keep tuned for extra updates!

Don’t overlook to verify again for the most recent information and updates on What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information!

We’d love to listen to your ideas about What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information—go away your feedback under!

Keep knowledgeable with our subsequent updates on What Is Errors and Omissions Insurance coverage and Who Wants It? A Complete Information and different thrilling subjects.