What You Must Know About FHA Mortgage Limits in 2024: Your Information to Reasonably priced Homeownership

Associated Articles

- Navigating The Mortgage Maze: Professionals And Cons Of Shopping for Throughout A Recession

- Refinancing Your Automobile Mortgage With Dangerous Credit score: A Information To Decrease Funds And Higher Charges

- How Does Leasing A Automotive Have an effect on Your Auto Mortgage Eligibility?

- Can You Get An Auto Mortgage With No Credit score Historical past? A Complete Information

- How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information To Saving Large

Introduction

Uncover the whole lot you might want to find out about What You Must Know About FHA Mortgage Limits in 2024: Your Information to Reasonably priced Homeownership

Video about

What You Must Know About FHA Mortgage Limits in 2024: Your Information to Reasonably priced Homeownership

The dream of proudly owning a house is a robust one, however navigating the world of mortgages can really feel overwhelming. One of many first hurdles you may encounter is knowing mortgage limits, particularly these set by the Federal Housing Administration (FHA). These limits decide the utmost mortgage quantity you’ll be able to qualify for, instantly impacting your means to buy your dream dwelling.

This complete information will break down the whole lot you might want to find out about FHA mortgage limits in 2024, offering you with the data to make knowledgeable selections about your private home shopping for journey.

What are FHA Mortgage Limits?

The FHA, a authorities company, insures mortgages issued by non-public lenders. FHA mortgage limits are the utmost mortgage quantity the FHA will insure in a specific space. These limits differ based mostly on components like location and housing market situations.

Why are FHA Mortgage Limits Essential?

FHA mortgage limits are important for a number of causes:

- Affordability: FHA loans are designed to make homeownership extra accessible, particularly for first-time consumers or these with decrease credit score scores. The bounds be sure that debtors can safe a mortgage that aligns with their monetary capabilities.

- Borrower Safety: By setting limits, the FHA helps shield debtors from taking over extreme debt they could not be capable to handle.

- Market Stability: FHA mortgage limits assist stabilize the housing market by stopping extreme hypothesis and making certain that dwelling costs stay inside an affordable vary.

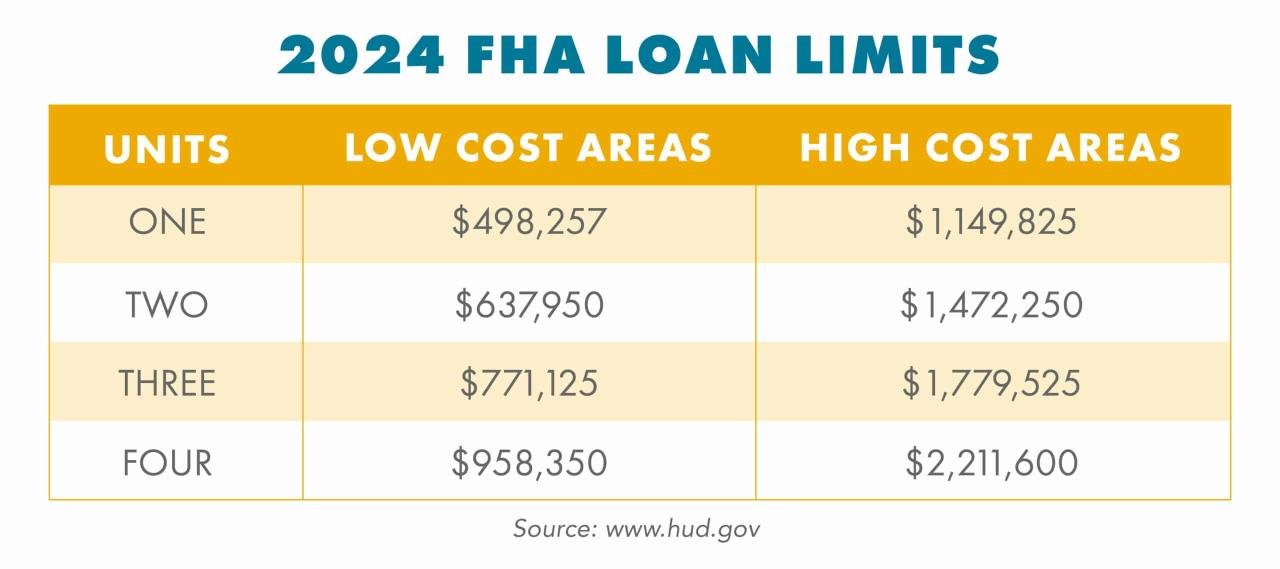

FHA Mortgage Limits in 2024: A Nearer Look

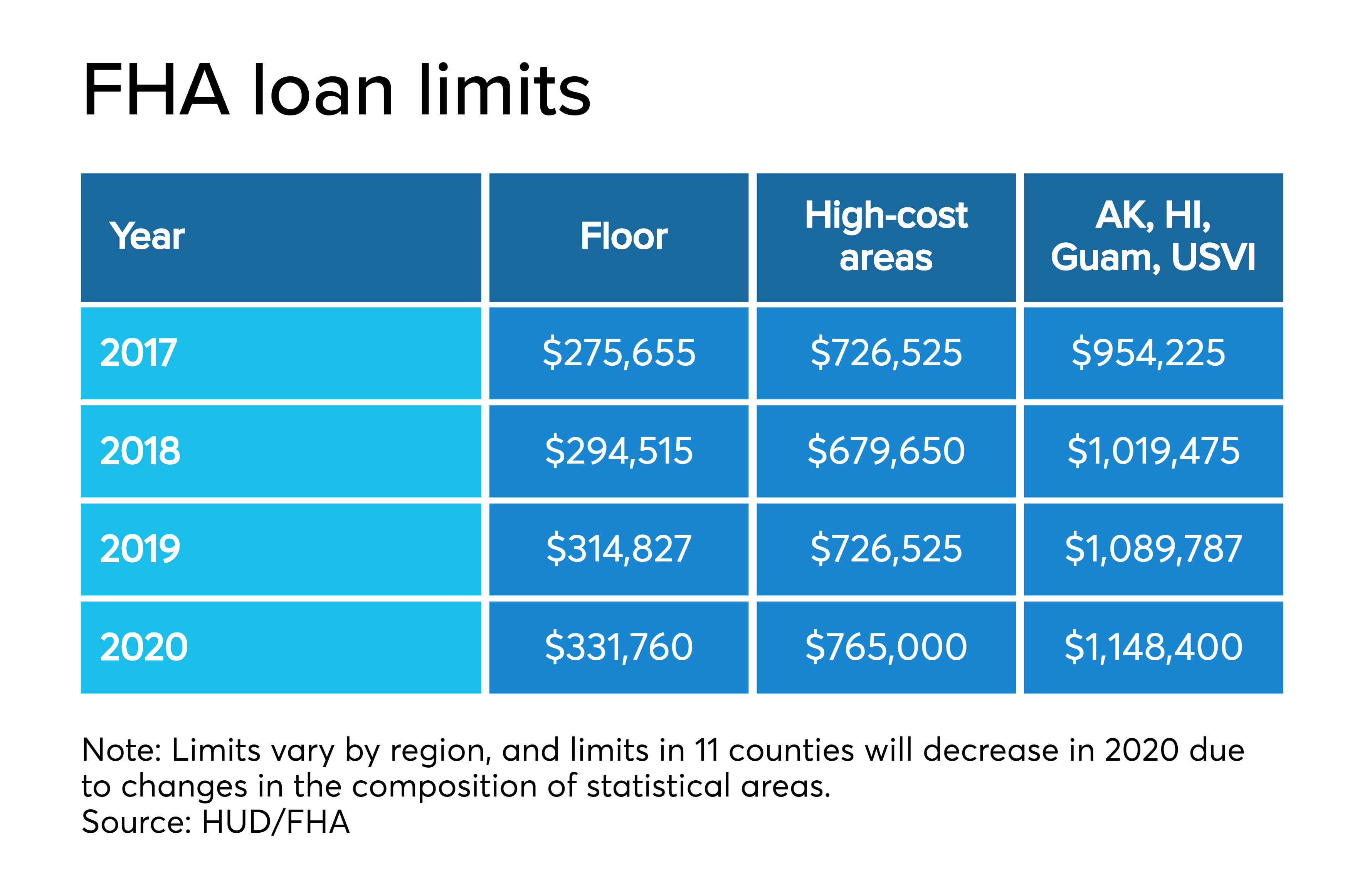

The FHA adjusts mortgage limits yearly to mirror adjustments in native housing markets. For 2024, the bottom mortgage restrict for many areas is $726,200, a big improve from the 2023 restrict. Nevertheless, that is simply the place to begin.

Understanding Space-Particular Limits:

The bottom restrict is barely related in low-cost housing markets. In areas with larger housing prices, the FHA units larger limits, generally known as high-cost areas. These limits are calculated based mostly on a selected formulation and are usually larger than the bottom restrict.

How are Excessive-Price Space Limits Decided?

The FHA makes use of a posh formulation to find out high-cost space limits. This formulation considers components like:

- Median dwelling costs: The upper the median dwelling value in an space, the upper the mortgage restrict.

- Price of residing: Areas with larger prices of residing typically have larger mortgage limits.

- Financial components: Components like employment charges and earnings ranges can even affect mortgage limits.

Discovering Your Particular Space’s Limits:

To search out the precise FHA mortgage limits to your space, you need to use the FHA’s on-line calculator or seek the advice of with a mortgage lender. The FHA’s web site offers a complete listing of mortgage limits for all counties in the US.

FHA Mortgage Limits for Completely different Property Varieties:

FHA mortgage limits apply to various kinds of properties, together with:

- Single-family properties: That is the most typical kind of property financed by FHA loans.

- Condominiums: FHA loans can be found for condominiums, however the particular limits might differ relying on the person condominium venture.

- Multi-family models: FHA loans can be utilized to finance as much as four-unit properties, however the limits could also be decrease than these for single-family properties.

What to Do if You Exceed the FHA Mortgage Restrict:

If the FHA mortgage restrict to your space is decrease than the value of the house you need to buy, you’ve gotten a couple of choices:

- Think about a standard mortgage: Standard loans have larger mortgage limits than FHA loans.

- Improve your down fee: A bigger down fee may also help you qualify for a bigger mortgage quantity.

- Search for a inexpensive dwelling: Should you’re prepared to compromise on measurement or location, you could possibly discover a dwelling that matches inside the FHA mortgage restrict.

Benefits of FHA Loans:

FHA loans provide a number of benefits over typical loans, together with:

- Decrease down fee: FHA loans require a decrease down fee than typical loans, usually 3.5%.

- Extra lenient credit score rating necessities: FHA loans are extra forgiving in terms of credit score scores, making them accessible to debtors with less-than-perfect credit score.

- Decrease closing prices: FHA loans typically have decrease closing prices than typical loans.

- Mortgage insurance coverage: FHA loans require mortgage insurance coverage, which protects the lender in case of default. Nevertheless, this insurance coverage is usually inexpensive than non-public mortgage insurance coverage (PMI) required for typical loans.

FHA Mortgage Limits and Down Funds:

The down fee required for an FHA mortgage is calculated as a proportion of the acquisition value. The minimal down fee is 3.5%, however you might want a bigger down fee if the acquisition value exceeds the FHA mortgage restrict to your space.

Understanding FHA Mortgage Limits and Your Finances:

Understanding FHA mortgage limits is essential when planning your private home buy. Realizing the bounds to your space will aid you:

- Decide the utmost mortgage quantity you’ll be able to qualify for: This provides you with a transparent image of your shopping for energy.

- Slim your private home search: You possibly can focus your search on properties that fall inside your value vary, contemplating the FHA mortgage restrict.

- Negotiate successfully: Having a superb understanding of FHA mortgage limits will empower you to barter a good value with the vendor.

Suggestions for Maximizing Your FHA Mortgage Restrict:

Listed below are some ideas for maximizing your FHA mortgage restrict and getting the very best deal:

- Enhance your credit score rating: A better credit score rating may also help you qualify for a bigger mortgage quantity.

- Scale back your debt: Reducing your debt-to-income ratio can enhance your probabilities of approval and improve your borrowing capability.

- Store round for mortgage lenders: Completely different lenders might have completely different mortgage limits and phrases. Evaluate provides from a number of lenders to search out the perfect deal.

- Think about a co-borrower: Having a co-borrower with good credit score may also help you qualify for a bigger mortgage.

Navigating the FHA Mortgage Course of:

When you perceive FHA mortgage limits and have a transparent image of your monetary state of affairs, you can begin the mortgage software course of. Listed below are the important thing steps concerned:

- Get pre-approved: Pre-approval from a lender provides you with a good suggestion of how a lot you’ll be able to borrow and make the house shopping for course of extra environment friendly.

- Discover a actual property agent: A educated agent may also help you discover the appropriate dwelling inside your value vary.

- Make a suggestion: When you discover a dwelling you like, make a suggestion that is inside your price range.

- Shut on the mortgage: As soon as your provide is accepted, you may must undergo the closing course of, which includes signing paperwork and finalizing the mortgage.

Conclusion: Unlocking Your Dream Residence with FHA Loans

FHA loans are a beneficial device for reaching homeownership. By understanding FHA mortgage limits and the components that affect them, you can also make knowledgeable selections about your private home buy. Keep in mind to do your analysis, store round for lenders, and work with a professional actual property agent to navigate the method easily. With cautious planning and the appropriate assets, you’ll be able to flip your dream of homeownership right into a actuality.

Closure

We hope this text has helped you perceive the whole lot about What You Must Know About FHA Mortgage Limits in 2024: Your Information to Reasonably priced Homeownership. Keep tuned for extra updates!

Make sure that to observe us for extra thrilling information and opinions.

Be at liberty to share your expertise with What You Must Know About FHA Mortgage Limits in 2024: Your Information to Reasonably priced Homeownership within the remark part.

Maintain visiting our web site for the newest tendencies and opinions.