Unlocking Your Monetary Potential: A Complete Information to Private Mortgage Eligibility for Self-Employed People

Associated Articles

- House Renovation Goals: Ought to You Use A Private Mortgage?

- Unleashing The Power Of Personal Loans: Your Guide To Debt Consolidation And Financial Freedom

- How Do Personal Loans Affect Your Credit Score? A Comprehensive Guide

- Personal Loans Vs. Credit Cards: Which Is Better For You?

- What Happens If You Default On A Personal Loan? A Guide To Avoiding The Fallout

Introduction

Welcome to our in-depth take a look at Unlocking Your Monetary Potential: A Complete Information to Private Mortgage Eligibility for Self-Employed People

Video about

Unlocking Your Monetary Potential: A Complete Information to Private Mortgage Eligibility for Self-Employed People

Navigating the world of private loans could be a daunting job, particularly for self-employed people. In contrast to conventional workers with constant paychecks and available pay stubs, self-employed debtors face a singular set of challenges when making use of for private loans.

This complete information goals to equip you with the information and understanding wanted to efficiently navigate the non-public mortgage utility course of as a self-employed particular person. We’ll break down the eligibility necessities, discover methods for constructing a powerful utility, and supply useful ideas for securing the most effective mortgage phrases.

Understanding the Distinctive Challenges of Self-Employed Debtors

Lenders typically view self-employed people with a unique lens in comparison with salaried workers. This is why:

- Fluctuating Revenue: Revenue for self-employed people can differ considerably from month to month, making it tough for lenders to evaluate monetary stability.

- Restricted Credit score Historical past: Self-employed debtors could have much less established credit score historical past, as they sometimes haven’t got conventional employment data.

- Complicated Monetary Statements: Self-employed people want to supply extra detailed monetary info, together with tax returns and enterprise financial institution statements, which may be extra advanced to research.

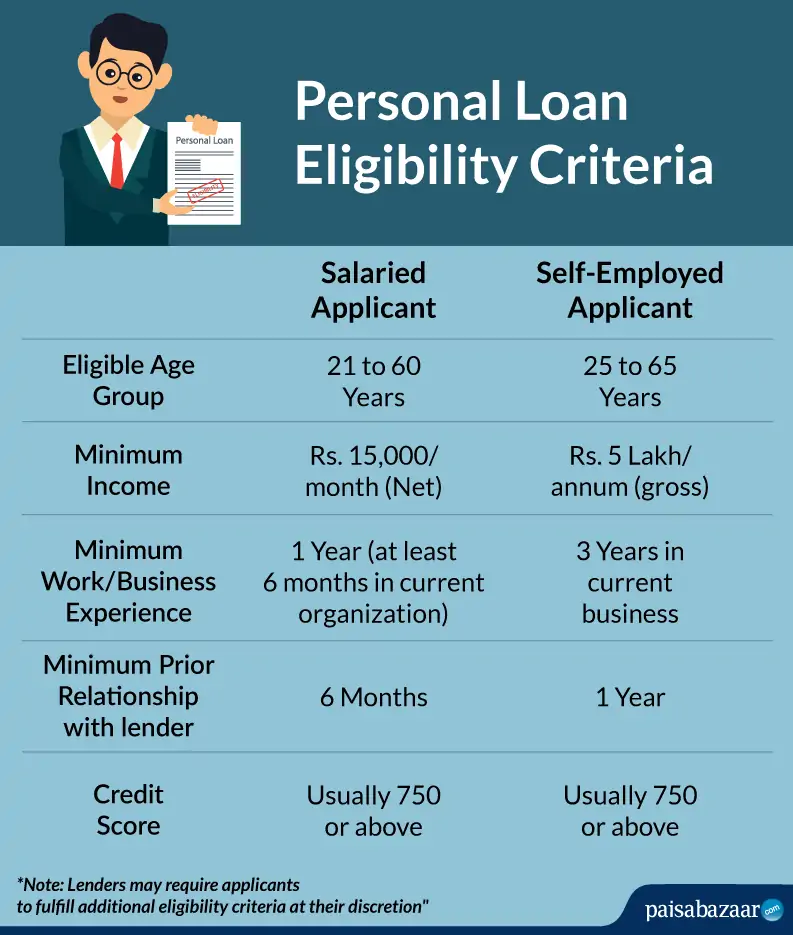

Key Eligibility Necessities for Self-Employed Private Loans

Whereas the particular necessities could differ throughout lenders, listed here are some frequent elements that lenders contemplate when assessing the eligibility of self-employed debtors:

1. Credit score Rating:

- Minimal Credit score Rating: Lenders sometimes have minimal credit score rating necessities for private loans, which may vary from 620 to 700 or larger.

- Credit score Historical past: A powerful credit score historical past, demonstrating accountable borrowing and reimbursement habits, is essential. This contains elements like on-time funds, credit score utilization, and the age of your credit score accounts.

2. Revenue:

- Self-Employment Revenue: Lenders will assess your revenue based mostly in your tax returns, financial institution statements, and doubtlessly different monetary paperwork.

- Revenue Verification: It’s possible you’ll be required to supply documentation corresponding to Schedule C of your tax return (Kind 1040), revenue and loss statements, and financial institution statements.

- Revenue Consistency: Lenders desire to see constant revenue over a time period, demonstrating monetary stability.

3. Debt-to-Revenue Ratio (DTI):

- DTI Calculation: Your DTI is calculated by dividing your month-to-month debt funds by your month-to-month gross revenue.

- Acceptable DTI: A decrease DTI usually signifies higher monetary well being. Lenders sometimes have a most DTI threshold, which may vary from 36% to 50% or larger.

4. Belongings:

- Liquid Belongings: Lenders could contemplate your liquid property, corresponding to financial savings accounts, checking accounts, and investments, as an indication of economic stability.

- Collateral: Some lenders could require collateral, corresponding to a automobile or property, for bigger mortgage quantities.

5. Enterprise Historical past:

- Years in Enterprise: Lenders could contemplate the size of time you have been in enterprise as an indicator of your expertise and monetary stability.

- Enterprise Income: They may assess your online business’s income and profitability to guage your revenue potential.

6. Different Elements:

- Mortgage Goal: Lenders could have particular mortgage functions for which they provide private loans, corresponding to debt consolidation, dwelling enchancment, or medical bills.

- Mortgage Quantity: The mortgage quantity you request will affect the eligibility necessities.

- Mortgage Time period: The mortgage time period can have an effect on your month-to-month funds and total curiosity price.

Methods for Constructing a Robust Software

Listed here are some efficient methods to enhance your possibilities of mortgage approval and safe favorable phrases:

1. Enhance Your Credit score Rating:

- Pay Payments on Time: Make all of your invoice funds on time to keep away from late charges and unfavourable marks in your credit score report.

- Scale back Credit score Utilization: Maintain your credit score utilization ratio low by conserving your bank card balances properly beneath your credit score limits.

- Monitor Your Credit score Report: Commonly evaluate your credit score report for any errors or inaccuracies that could possibly be affecting your rating.

- Take into account a Secured Credit score Card: A secured bank card can assist construct credit score historical past, particularly when you’ve got restricted credit score.

2. Doc Your Revenue:

- Keep Correct Information: Maintain detailed monetary data, together with revenue statements, expense studies, and financial institution statements.

- Put together Tax Returns: File your tax returns promptly and precisely, together with all related enterprise bills.

- Present Supporting Documentation: Be ready to supply supporting paperwork corresponding to financial institution statements, enterprise licenses, and revenue and loss statements.

3. Scale back Debt:

- Debt Consolidation: Take into account consolidating high-interest debt right into a lower-interest mortgage to scale back your month-to-month funds.

- Budgeting: Create a practical price range to trace your revenue and bills and determine areas the place you may in the reduction of on spending.

4. Store Round for Lenders:

- Examine Mortgage Provides: Get quotes from a number of lenders to check rates of interest, mortgage phrases, and costs.

- Take into account On-line Lenders: On-line lenders typically have extra versatile eligibility necessities and may supply aggressive charges.

- Test Credit score Unions: Credit score unions could supply extra customized service and doubtlessly decrease charges for members.

5. Leverage Your Belongings:

- Financial savings Accounts: Having a wholesome financial savings account can show monetary stability and doubtlessly qualify you for a bigger mortgage quantity.

- Actual Property: For those who personal actual property, you might be able to use it as collateral to safe a decrease rate of interest.

6. Be Clear and Sincere:

- Present Correct Data: Be truthful and correct when offering monetary info to lenders.

- Handle Any Credit score Points: In case you have any credit score points, be upfront with lenders and clarify the circumstances.

- Be Ready for Questions: Be able to reply questions on your online business, revenue, and monetary historical past.

Suggestions for Securing the Finest Mortgage Phrases

- Negotiate Curiosity Charges: Do not be afraid to barter rates of interest and mortgage phrases with lenders.

- Store Round for Decrease Charges: Examine mortgage origination charges, prepayment penalties, and different costs.

- Take into account a Shorter Mortgage Time period: A shorter mortgage time period may end up in decrease total curiosity prices, however it’ll additionally result in larger month-to-month funds.

- Discover Mortgage Options: For those who’re unable to qualify for a conventional private mortgage, contemplate various choices corresponding to enterprise loans, strains of credit score, or peer-to-peer lending.

Conclusion: Empowering Self-Employed Debtors

Whereas the non-public mortgage utility course of may be extra advanced for self-employed people, it is not insurmountable. By understanding the eligibility necessities, constructing a powerful utility, and leveraging out there assets, you may enhance your possibilities of securing the mortgage you have to obtain your monetary objectives. Keep in mind, your monetary success depends upon your skill to handle your funds successfully and make knowledgeable selections. By taking a proactive method to your credit score rating, revenue documentation, and debt administration, you may unlock your monetary potential and entry the assets you have to thrive as a self-employed particular person.

Closure

Thanks for studying! Stick with us for extra insights on Unlocking Your Monetary Potential: A Complete Information to Private Mortgage Eligibility for Self-Employed People.

Be sure to comply with us for extra thrilling information and evaluations.

Be at liberty to share your expertise with Unlocking Your Monetary Potential: A Complete Information to Private Mortgage Eligibility for Self-Employed People within the remark part.

Maintain visiting our web site for the most recent developments and evaluations.