Private Loans vs. Payday Loans: Key Variations

Associated Articles

- Unlocking Your Financial Potential: How To Get A Personal Loan With No Credit History

- Demystifying Personal Loans: Understanding APRs And Fees

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- Unlocking Your Financial Potential: A Guide To Responsible Personal Loan Borrowing

- What Happens If You Default On A Personal Loan? A Guide To Avoiding The Fallout

Introduction

Welcome to our in-depth have a look at Private Loans vs. Payday Loans: Key Variations

Video about

Private Loans vs. Payday Loans: Selecting the Proper Path for Your Monetary Wants

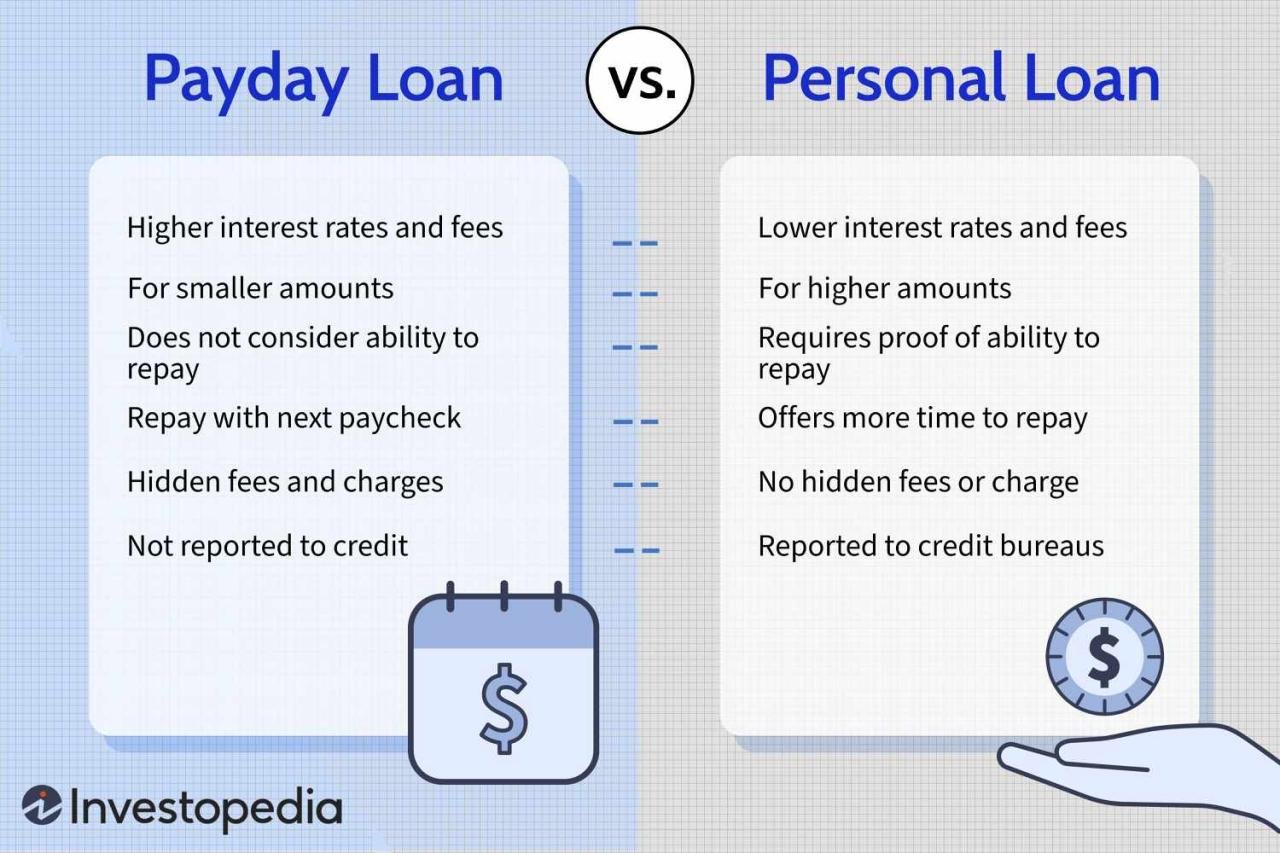

Life throws curveballs. Generally, surprising bills pop up, leaving you scrambling for fast money. In these moments, the attract of a fast mortgage will be tempting. However earlier than you bounce into the primary give you see, it is essential to know the stark variations between two well-liked mortgage choices: private loans and payday loans.

Whereas each can present short-term monetary reduction, the results of selecting one over the opposite can range drastically. This text will delve deep into the intricacies of every mortgage sort, equipping you with the information to make an knowledgeable resolution that aligns together with your monetary targets and circumstances.

Private Loans: A Dependable Path to Monetary Stability

Private loans are just like the dependable good friend you possibly can at all times depend on. They provide a structured and clear method to borrow cash for varied functions, from consolidating debt to protecting medical payments and even funding a dream trip. Here is a more in-depth have a look at their key options:

1. Purposeful Lending: In contrast to payday loans, private loans are designed for particular functions. Lenders sometimes ask for a transparent rationalization of how you plan to make use of the funds, guaranteeing the mortgage aligns together with your monetary wants.

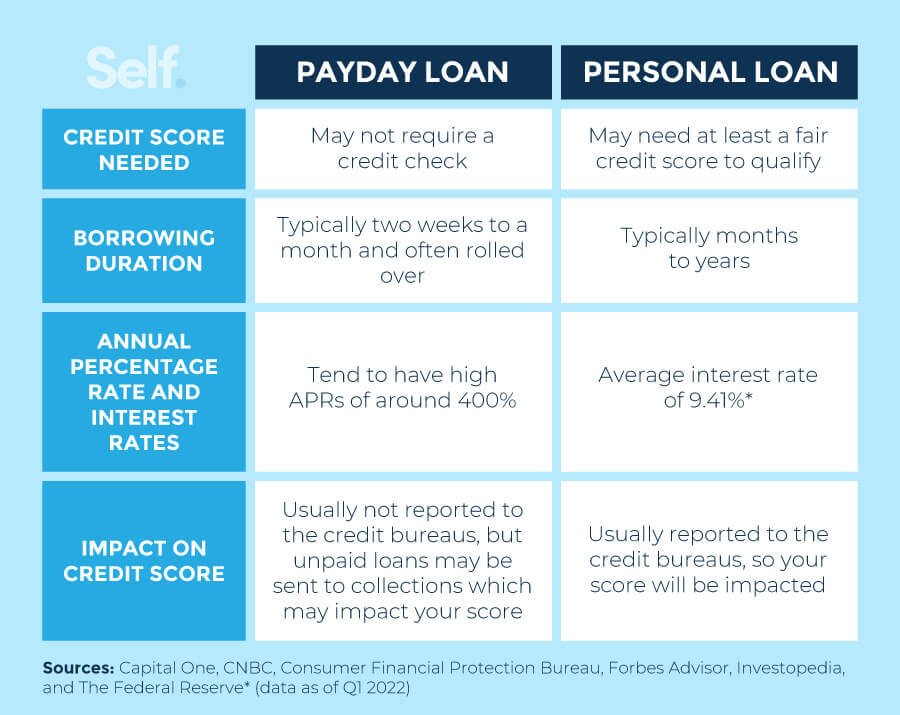

2. Aggressive Curiosity Charges: Private loans typically provide decrease rates of interest in comparison with payday loans. It is because lenders assess your creditworthiness and monetary historical past earlier than setting the rate of interest, making it a extra reasonably priced possibility for debtors with good credit score.

3. Versatile Reimbursement Phrases: Private loans include versatile reimbursement intervals, starting from months to years. This lets you select a schedule that matches your finances and monetary scenario, offering a snug reimbursement journey.

4. Mounted Curiosity Charges: Most private loans provide fastened rates of interest, which means your month-to-month funds will stay constant all through the mortgage time period. This predictability helps you finances successfully and keep away from any surprises.

5. Constructing Credit score: Making well timed funds on a private mortgage can positively impression your credit score rating, enhancing your monetary standing and opening doorways to higher monetary alternatives sooner or later.

Payday Loans: A Quick-Time period Resolution with Steep Prices

Payday loans, alternatively, are like the short repair that may go away you with a lingering headache. They provide a quick and straightforward method to entry money, however typically include exorbitant rates of interest and hidden charges that may rapidly spiral right into a debt lure.

1. Quick-Time period Aid: Payday loans are designed for rapid monetary wants, sometimes protecting a number of hundred {dollars} for a brief interval, often till your subsequent payday. They’re meant to be a brief answer, not a long-term monetary technique.

2. Excessive Curiosity Charges and Charges: The principle disadvantage of payday loans is their astronomical rates of interest, which may vary from 300% to 500% APR. This implies you may find yourself paying considerably greater than the quantity you borrowed, making them a really costly method to borrow cash.

3. Restricted Mortgage Quantities: Payday loans are sometimes capped at a number of hundred {dollars}, making them unsuitable for bigger monetary wants.

4. Threat of Debt Cycle: As a result of excessive rates of interest and quick reimbursement intervals, it is easy to fall right into a cycle of debt with payday loans. If you cannot repay the mortgage on time, you is likely to be pressured to take out one other mortgage to cowl the earlier one, resulting in a snowball impact of debt.

5. Damaging Influence on Credit score Rating: Whereas payday loans do not sometimes report back to credit score bureaus, lacking funds can negatively impression your credit score rating, hindering your future borrowing alternatives.

Selecting the Proper Path: A Complete Information

Now that you simply perceive the elemental variations between private loans and payday loans, let’s discover a complete information that will help you select the appropriate path in your particular monetary wants:

1. Assess Your Monetary State of affairs: Take a detailed have a look at your present earnings, bills, and present debt. Consider your potential to repay a mortgage on time and keep away from falling right into a debt lure.

2. Decide Your Mortgage Objective: What do you want the cash for? If it is a short-term emergency, a payday mortgage might sound interesting, however its excessive price would possibly go away you worse off. For bigger bills or long-term monetary wants, a private mortgage affords a extra sustainable and reasonably priced answer.

3. Evaluate Curiosity Charges and Charges: Do not simply deal with the marketed mortgage quantity. Fastidiously look at the rates of interest, charges, and reimbursement phrases of each private loans and payday loans. Evaluate affords from a number of lenders to search out probably the most aggressive phrases.

4. Contemplate Your Credit score Rating: Your credit score rating performs a major position in securing a private mortgage and getting a good rate of interest. In case your credit score rating is low, chances are you’ll battle to qualify for a private mortgage or face increased rates of interest. On this case, you would possibly must discover different choices like credit score counseling or debt consolidation applications.

5. Search Skilled Recommendation: If you happen to’re not sure about which kind of mortgage is best for you, it is at all times smart to hunt recommendation from a monetary advisor or credit score counselor. They will present customized steerage based mostly in your distinctive circumstances.

The Backside Line: Prioritize Monetary Effectively-being

Choosing the proper mortgage is an important resolution that may have a major impression in your monetary future. Whereas payday loans would possibly look like a fast repair, their excessive prices and potential for debt traps can go away you worse off. Private loans, alternatively, provide a extra structured and reasonably priced method to borrow cash, serving to you construct credit score and obtain your monetary targets.

Key phrases: Private loans, payday loans, mortgage comparability, rates of interest, charges, credit score rating, debt consolidation, monetary recommendation, monetary well-being, monetary literacy, accountable borrowing, short-term loans, long-term loans, borrowing choices, debt administration, monetary planning.

web optimization Optimization: This text is optimized for engines like google by incorporating related key phrases all through the textual content, utilizing headings and subheadings for readability, and offering a complete and informative information to private loans and payday loans.

Closure

Thanks for studying! Stick with us for extra insights on Private Loans vs. Payday Loans: Key Variations.

Don’t neglect to examine again for the newest information and updates on Private Loans vs. Payday Loans: Key Variations!

We’d love to listen to your ideas about Private Loans vs. Payday Loans: Key Variations—go away your feedback under!

Preserve visiting our web site for the newest traits and evaluations.