Rebuilding Your Credit score: Harnessing the Energy of Private Loans

Associated Articles

- Unlocking Your Financial Potential: A Guide To Responsible Personal Loan Borrowing

- On-line Private Loans Vs. Conventional Banks: Which Is Higher?

- What Happens If You Default On A Personal Loan? A Guide To Avoiding The Fallout

- Are Personal Loans Tax Deductible? What You Need To Know

- Finding The Best Personal Loan Rates: A Guide For Every Credit Score

Introduction

On this article, we dive into Rebuilding Your Credit score: Harnessing the Energy of Private Loans, supplying you with a full overview of what’s to return

Video about

Rebuilding Your Credit score: Harnessing the Energy of Private Loans

Let’s face it, credit score scores are the gatekeepers to a number of life’s requirements. A great credit score rating opens doorways to decrease rates of interest on loans, higher rental phrases, and even higher job alternatives. However what in case your credit score rating has taken successful? Whether or not it is attributable to previous monetary missteps, a difficult financial interval, or just an absence of credit score historical past, rebuilding your credit score is a journey value taking.

This text will dive into the world of non-public loans as a robust device for credit score reconstruction. We’ll discover the intricacies of how private loans will help you rebuild your credit score, talk about the various kinds of private loans out there, and supply sensible ideas for navigating the method efficiently.

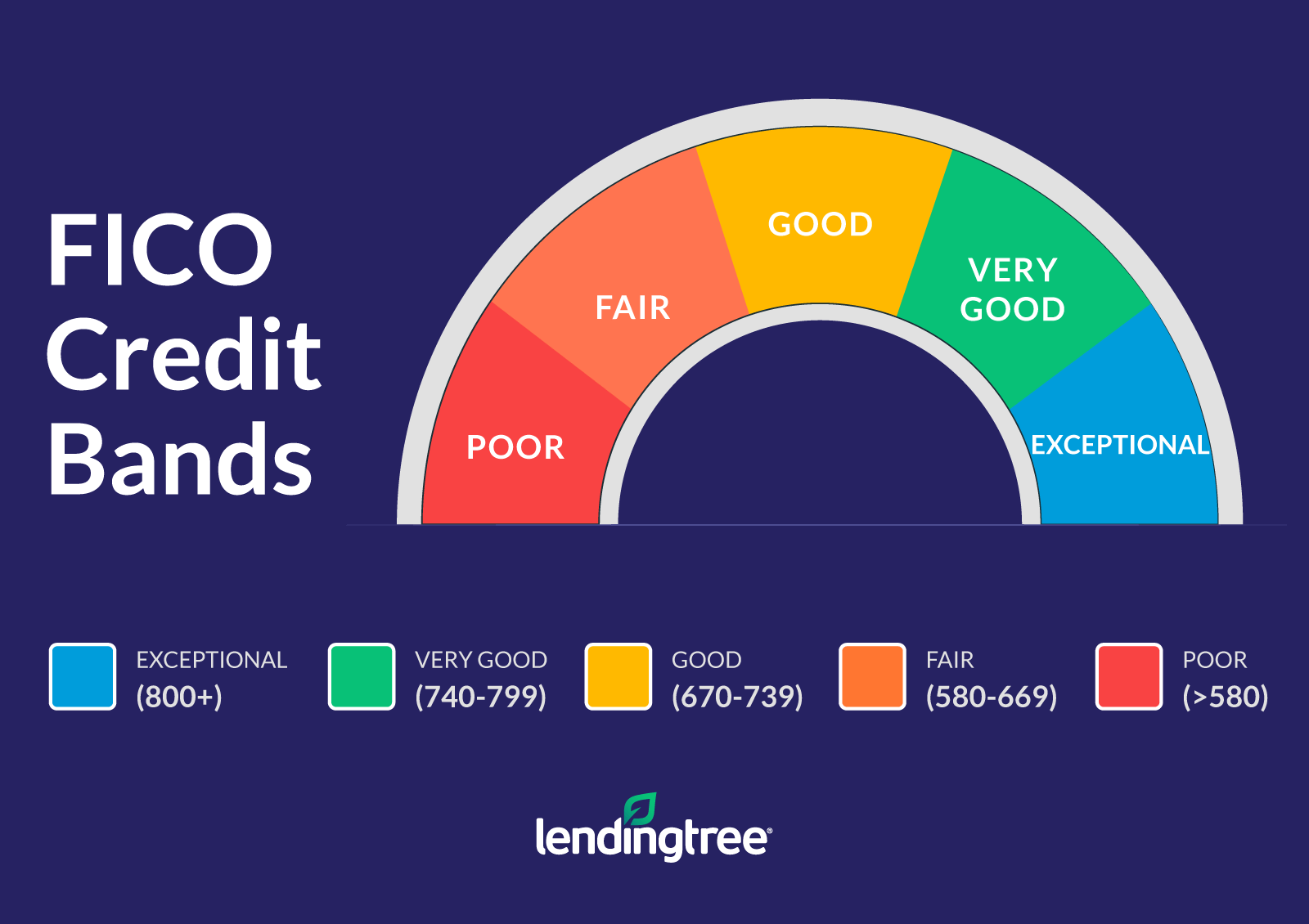

Understanding the Significance of Credit score

Your credit score rating is a numerical illustration of your creditworthiness. It is a snapshot of how accountable you’ve got been with managing debt prior to now. Lenders use this rating to evaluate your danger as a borrower. A better credit score rating means you are thought-about a decrease danger, main to raised mortgage phrases and rates of interest.

The Function of Private Loans in Credit score Rebuilding

Private loans is usually a priceless device for rebuilding your credit score. Here is why:

1. Constructing Constructive Cost Historical past:

The inspiration of a robust credit score rating is a constant monitor report of on-time funds. Private loans present a possibility to show your dedication to accountable reimbursement. By making common, well timed funds on a private mortgage, you’ll be able to set up a constructive fee historical past that may enhance your credit score rating over time.

2. Growing Your Credit score Utilization Ratio:

Credit score utilization ratio refers back to the quantity of obtainable credit score you are utilizing. A low credit score utilization ratio is usually favorable. Private loans will help you enhance your credit score utilization ratio by including extra credit score traces and growing your out there credit score, even for those who do not instantly improve your excellent debt.

3. Establishing a Credit score Historical past:

When you’ve got restricted or no credit score historical past, private loans is usually a good method to begin constructing a credit score profile. Having a private mortgage in your credit score report can present lenders that you’re able to managing credit score responsibly.

Varieties of Private Loans for Credit score Rebuilding

The private mortgage panorama is various, providing choices tailor-made to numerous credit score conditions:

1. Secured Private Loans:

Secured private loans are backed by collateral, reminiscent of a automotive or financial savings account. This collateral reduces the lender’s danger, typically resulting in decrease rates of interest and extra accessible phrases for debtors with less-than-perfect credit score.

2. Unsecured Private Loans:

Unsecured private loans are usually not backed by collateral. They sometimes include increased rates of interest than secured loans as a result of elevated danger for lenders. Nonetheless, they will nonetheless be a viable possibility for rebuilding credit score, particularly when you have a very good fee historical past with different credit score accounts.

3. Credit score Builder Loans:

Credit score builder loans are particularly designed to assist people with restricted or poor credit score construct a constructive credit score historical past. With these loans, you make common funds right into a financial savings account, and as soon as the mortgage is repaid, you obtain the amassed funds. The reimbursement historical past is reported to the credit score bureaus, serving to to enhance your credit score rating.

Selecting the Proper Private Mortgage for You

Deciding on the correct private mortgage is essential for a profitable credit score rebuilding journey. Here is a step-by-step information to creating an knowledgeable resolution:

1. Assess Your Credit score Scenario:

Earlier than making use of for a private mortgage, it is important to know your present credit score rating and credit score historical past. Verify your credit score report for any errors or inaccuracies and overview your credit score utilization ratio. This data will provide help to decide your eligibility for various mortgage choices.

2. Evaluate Mortgage Provides:

Store round for private loans from a number of lenders to check rates of interest, charges, and mortgage phrases. Take into account elements reminiscent of APR (Annual Proportion Fee), mortgage origination charges, and reimbursement phrases.

3. Perceive Mortgage Necessities:

Every lender has its personal set of necessities for private loans. Overview these necessities fastidiously to make sure you meet the eligibility standards. Elements like revenue, employment historical past, and credit score rating will play a job in mortgage approval.

4. Select a Mortgage That Suits Your Funds:

Choose a mortgage with a month-to-month fee which you can comfortably afford. Overstretching your funds can result in missed funds, which may negatively influence your credit score rating.

5. Take into account the Mortgage Time period:

The mortgage time period is the size of time it’s important to repay the mortgage. Shorter mortgage phrases usually include increased month-to-month funds however decrease general curiosity prices. Longer mortgage phrases supply decrease month-to-month funds however may end up in increased general curiosity prices.

Ideas for Maximizing the Impression of Private Loans on Your Credit score

1. Make On-Time Funds:

That is the only most necessary think about rebuilding your credit score. Arrange reminders or automated funds to make sure you by no means miss a fee.

2. Maintain Your Credit score Utilization Ratio Low:

Intention to maintain your credit score utilization ratio beneath 30%. This implies utilizing lower than 30% of your out there credit score.

3. Do not Shut Outdated Accounts:

Closing outdated credit score accounts, even when they’ve a low credit score restrict, can negatively influence your credit score rating. Older accounts contribute to an extended credit score historical past, which is a constructive think about credit score scoring.

4. Keep away from Opening Too Many New Accounts:

Every time you apply for brand new credit score, a tough inquiry is made in your credit score report. Too many exhausting inquiries can decrease your credit score rating. Deal with managing your present accounts responsibly.

5. Monitor Your Credit score Report Repeatedly:

Verify your credit score report not less than annually for errors or inaccuracies. You possibly can acquire a free copy of your credit score report from every of the three main credit score bureaus: Equifax, Experian, and TransUnion.

6. Construct a Constructive Cost Historical past:

Make well timed funds on all your credit score accounts, together with bank cards, loans, and utility payments.

7. Use a Credit score Monitoring Service:

Credit score monitoring providers can provide you with a warning to modifications in your credit score report and provide help to detect potential fraud.

8. Take into account a Secured Credit score Card:

Secured bank cards require a safety deposit, which reduces the lender’s danger. They could be a good possibility for people with restricted or poor credit score.

9. Be Affected person and Persistent:

Rebuilding credit score takes effort and time. Do not get discouraged for those who do not see speedy outcomes. Keep targeted on making accountable monetary selections, and your credit score rating will progressively enhance.

Conclusion

Private loans is usually a highly effective device for rebuilding your credit score. By understanding the various kinds of private loans out there, choosing the proper mortgage in your scenario, and following the ideas outlined on this article, you’ll be able to harness the ability of non-public loans to enhance your credit score rating and unlock a world of economic alternatives. Keep in mind, rebuilding credit score is a journey, not a vacation spot. With endurance, persistence, and accountable monetary habits, you’ll be able to obtain your credit score objectives and safe a brighter monetary future.

Closure

We hope this text has helped you perceive every thing about Rebuilding Your Credit score: Harnessing the Energy of Private Loans. Keep tuned for extra updates!

Don’t overlook to test again for the most recent information and updates on Rebuilding Your Credit score: Harnessing the Energy of Private Loans!

Be happy to share your expertise with Rebuilding Your Credit score: Harnessing the Energy of Private Loans within the remark part.

Maintain visiting our web site for the most recent tendencies and opinions.